Page 241 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 241

Edge RCIS Matador Retail Hedge Fund

Edge RCIS Matador Retail Hedge Fund

Edge RCIS Matador Retail Hedge Fund

Sector: South African—Equity—

Unclassified

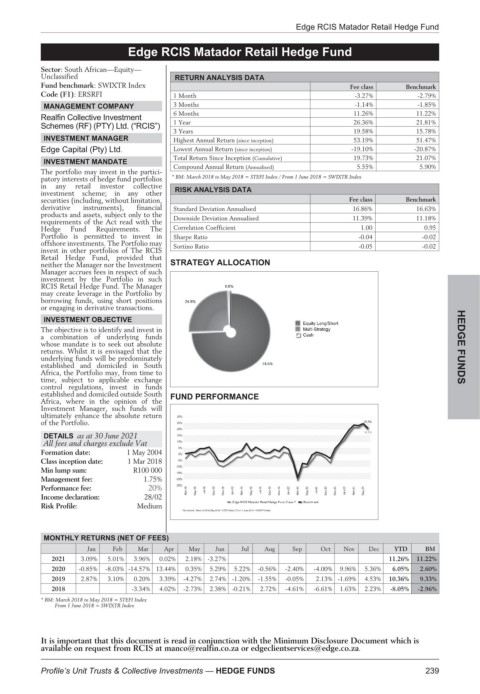

RETURN ANALYSIS DATA

Fund benchmark: SWIXTR Index Fee class Benchmark

Code (F1): ERSRFI 1 Month -3.27% -2.79%

3 Months -1.14% -1.85%

MANAGEMENT COMPANY

6 Months 11.26% 11.22%

Realfin Collective Investment

Schemes (RF) (PTY) Ltd. (“RCIS”) 1 Year 26.36% 21.81%

3 Years 19.58% 15.78%

INVESTMENT MANAGER Highest Annual Return (since inception) 53.19% 51.47%

Edge Capital (Pty) Ltd. Lowest Annual Return (since inception) -19.10% -20.87%

Total Return Since Inception (Cumulative) 19.73% 21.07%

INVESTMENT MANDATE

Compound Annual Return (Annualised) 5.55% 5.90%

The portfolio may invest in the partici-

patory interests of hedge fund portfolios * BM: March 2018 to May 2018 = STEFI Index / From 1 June 2018 = SWIXTR Index

in any retail investor collective

investment scheme; in any other RISK ANALYSIS DATA

securities (including, without limitation, Fee class Benchmark

derivative instruments), financial Standard Deviation Annualised 16.86% 16.63%

products and assets, subject only to the Downside Deviation Annualised 11.39% 11.18%

requirements of the Act read with the

Hedge Fund Requirements. The Correlation Coefficient 1.00 0.95

Portfolio is permitted to invest in Sharpe Ratio -0.04 -0.02

offshore investments. The Portfolio may Sortino Ratio -0.05 -0.02

invest in other portfolios of The RCIS

Retail Hedge Fund, provided that

neither the Manager nor the Investment STRATEGY ALLOCATION

Manager accrues fees in respect of such

investment by the Portfolio in such

RCIS Retail Hedge Fund. The Manager

may create leverage in the Portfolio by

borrowing funds, using short positions

or engaging in derivative transactions.

INVESTMENT OBJECTIVE

The objective is to identify and invest in HEDGE

a combination of underlying funds

whose mandate is to seek out absolute

returns. Whilst it is envisaged that the

underlying funds will be predominately

established and domiciled in South FUNDS

Africa, the Portfolio may, from time to

time, subject to applicable exchange

control regulations, invest in funds

established and domiciled outside South

Africa, where in the opinion of the FUND PERFORMANCE

Investment Manager, such funds will

ultimately enhance the absolute return

of the Portfolio.

DETAILS as at 30 June 2021

All fees and charges exclude Vat

Formation date: 1 May 2004

Class inception date: 1 Mar 2018

Min lump sum: R100 000

Management fee: 1.75%

Performance fee: 20%

Income declaration: 28/02

Risk Profile: Medium

MONTHLY RETURNS (NET OF FEES)

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec YTD BM

2021 3.09% 5.01% 3.96% 0.02% 2.18% -3.27% 11.26% 11.22%

2020 -0.85% -8.03% -14.57% 13.44% 0.35% 5.29% 5.22% -0.56% -2.40% -4.00% 9.96% 5.36% 6.05% 2.60%

2019 2.87% 3.10% 0.20% 3.39% -4.27% 2.74% -1.20% -1.55% -0.05% 2.13% -1.69% 4.53% 10.36% 9.33%

2018 -3.34% 4.02% -2.73% 2.38% -0.21% 2.72% -4.61% -6.61% 1.63% 2.23% -8.05% -2.96%

* BM: March 2018 to May 2018 = STEFI Index

From 1 June 2018 = SWIXTR Index

It is important that this document is read in conjunction with the Minimum Disclosure Document which is

available on request from RCIS at manco@realfin.co.za or edgeclientservices@edge.co.za.

239

Profile’s Unit Trusts & Collective Investments — HEDGE FUNDS