Page 243 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 243

Edge RCIS Multi Managed Alternative Equity Retail Hedge Fund

Edge RCIS Multi Managed Alternative Equity Retail Hedge Fund

Edge RCIS Multi Managed Alternative Equity Retail Hedge Fund

Sector: South African—Equity—

Unclassified

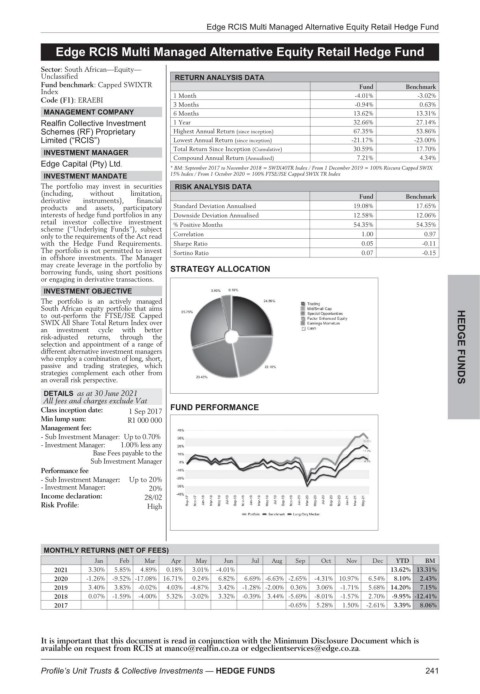

RETURN ANALYSIS DATA

Fund benchmark: Capped SWIXTR Fund Benchmark

Index 1 Month -4.01% -3.02%

Code (F1): ERAEBI

3 Months -0.94% 0.63%

6 Months 13.62% 13.31%

MANAGEMENT COMPANY

Realfin Collective Investment 1 Year 32.66% 27.14%

Schemes (RF) Proprietary Highest Annual Return (since inception) 67.35% 53.86%

Limited (“RCIS”) Lowest Annual Return (since inception) -21.17% -23.00%

Total Return Since Inception (Cumulative) 30.59% 17.70%

INVESTMENT MANAGER

Compound Annual Return (Annualised) 7.21% 4.34%

Edge Capital (Pty) Ltd.

* BM: September 2017 to November 2018 = SWIX40TR Index / From 1 December 2019 = 100% Riscura Capped SWIX

15% Index / From 1 October 2020 = 100% FTSE/JSE Capped SWIX TR Index

INVESTMENT MANDATE

The portfolio may invest in securities RISK ANALYSIS DATA

(including, without limitation, Fund Benchmark

derivative instruments), financial

products and assets, participatory Standard Deviation Annualised 19.08% 17.65%

interests of hedge fund portfolios in any Downside Deviation Annualised 12.58% 12.06%

retail investor collective investment % Positive Months 54.35% 54.35%

scheme (“Underlying Funds”), subject

only to the requirements of the Act read Correlation 1.00 0.97

with the Hedge Fund Requirements. Sharpe Ratio 0.05 -0.11

The portfolio is not permitted to invest Sortino Ratio 0.07 -0.15

in offshore investments. The Manager

may create leverage in the portfolio by

borrowing funds, using short positions STRATEGY ALLOCATION

or engaging in derivative transactions.

INVESTMENT OBJECTIVE

The portfolio is an actively managed

South African equity portfolio that aims

to out-perform the FTSE/JSE Capped

SWIX All Share Total Return Index over

an investment cycle with better HEDGE

risk-adjusted returns, through the

selection and appointment of a range of

different alternative investment managers

who employ a combination of long, short,

passive and trading strategies, which FUNDS

strategies complement each other from

an overall risk perspective.

DETAILS as at 30 June 2021

All fees and charges exclude Vat

Class inception date: 1 Sep 2017 FUND PERFORMANCE

Min lump sum: R1 000 000

Management fee:

- Sub Investment Manager: Up to 0.70%

- Investment Manager: 1.00% less any

Base Fees payable to the

Sub Investment Manager

Performance fee

- Sub Investment Manager: Up to 20%

- Investment Manager: 20%

Income declaration: 28/02

Risk Profile: High

MONTHLY RETURNS (NET OF FEES)

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec YTD BM

2021 3.30% 5.85% 4.89% 0.18% 3.01% -4.01% 13.62% 13.31%

2020 -1.26% -9.52% -17.08% 16.71% 0.24% 6.82% 6.69% -6.63% -2.65% -4.31% 10.97% 6.54% 8.10% 2.43%

2019 3.40% 3.83% -0.02% 4.03% -4.87% 3.42% -1.28% -2.00% 0.36% 3.06% -1.71% 5.68% 14.20% 7.15%

2018 0.07% -1.59% -4.00% 5.32% -3.02% 3.32% -0.39% 3.44% -5.69% -8.01% -1.57% 2.70% -9.95% -12.41%

2017 -0.65% 5.28% 1.50% -2.61% 3.39% 8.06%

It is important that this document is read in conjunction with the Minimum Disclosure Document which is

available on request from RCIS at manco@realfin.co.za or edgeclientservices@edge.co.za.

241

Profile’s Unit Trusts & Collective Investments — HEDGE FUNDS