Page 250 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 250

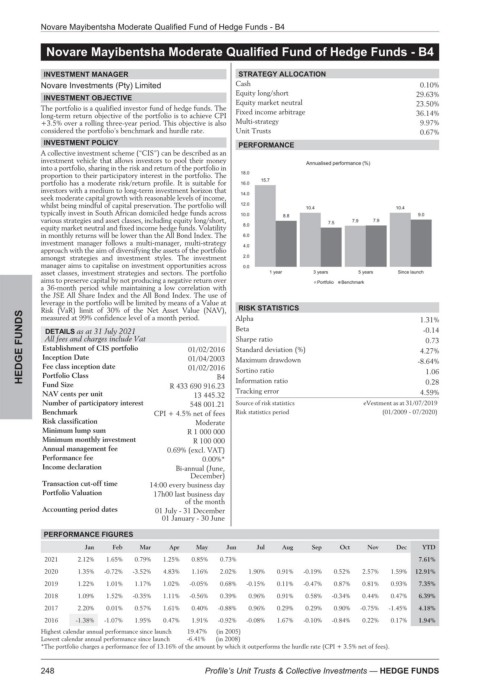

Novare Mayibentsha Moderate Qualified Fund of Hedge Funds - B4

Novare Mayibentsha Moderate Qualified Fund of Hedge Funds - B4

Novare Mayibentsha Moderate Qualified Fund of Hedge Funds - B4

INVESTMENT MANAGER STRATEGY ALLOCATION

Novare Investments (Pty) Limited Cash 0.10%

Equity long/short 29.63%

Equity market neutral 23.50%

INVESTMENT OBJECTIVE

The portfolio is a qualified investor fund of hedge funds. The

long-term return objective of the portfolio is to achieve CPI Fixed income arbitrage 36.14%

+3.5% over a rolling three-year period. This objective is also Multi-strategy 9.97%

considered the portfolio’s benchmark and hurdle rate. Unit Trusts 0.67%

INVESTMENT POLICY

PERFORMANCE

A collective investment scheme (“CIS”) can be described as an

investment vehicle that allows investors to pool their money

into a portfolio, sharing in the risk and return of the portfolio in

proportion to their participatory interest in the portfolio. The

portfolio has a moderate risk/return profile. It is suitable for

investors with a medium to long-term investment horizon that

seek moderate capital growth with reasonable levels of income,

whilst being mindful of capital preservation. The portfolio will

typically invest in South African domiciled hedge funds across

various strategies and asset classes, including equity long/short,

equity market neutral and fixed income hedge funds. Volatility

in monthly returns will be lower than the All Bond Index. The

investment manager follows a multi-manager, multi-strategy

approach with the aim of diversifying the assets of the portfolio

amongst strategies and investment styles. The investment

manager aims to capitalise on investment opportunities across

asset classes, investment strategies and sectors. The portfolio

aims to preserve capital by not producing a negative return over

a 36-month period while maintaining a low correlation with

the JSE All Share Index and the All Bond Index. The use of

leverage in the portfolio will be limited by means of a Value at

Risk (VaR) limit of 30% of the Net Asset Value (NAV), Alpha

FUNDS DETAILS as at 31 July 2021 Beta 1.31%

RISK STATISTICS

measured at 99% confidence level of a month period.

-0.14

All fees and charges include Vat

Sharpe ratio

0.73

HEDGE Establishment of CIS portfolio 01/02/2016 Standard deviation (%) -8.64%

4.27%

Inception Date

01/04/2003

Maximum drawdown

Fee class inception date

01/02/2016

Sortino ratio

1.06

Portfolio Class

B4

0.28

Fund Size

Tracking error

NAV cents per unit R 433 690 916.23 Information ratio 4.59%

13 445.32

Number of participatory interest 548 001.21 Source of risk statistics eVestment as at 31/07/2019

Benchmark CPI + 4.5% net of fees Risk statistics period (01/2009 - 07/2020)

Risk classification Moderate

Minimum lump sum R 1 000 000

Minimum monthly investment R 100 000

Annual management fee 0.69% (excl. VAT)

Performance fee 0.00%*

Income declaration Bi-annual (June,

December)

Transaction cut-off time 14:00 every business day

Portfolio Valuation 17h00 last business day

of the month

Accounting period dates 01 July - 31 December

01 January - 30 June

PERFORMANCE FIGURES

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec YTD

2021 2.12% 1.65% 0.79% 1.25% 0.85% 0.73% 7.61%

2020 1.35% -0.72% -3.52% 4.83% 1.16% 2.02% 1.90% 0.91% -0.19% 0.52% 2.57% 1.59% 12.91%

2019 1.22% 1.01% 1.17% 1.02% -0.05% 0.68% -0.15% 0.11% -0.47% 0.87% 0.81% 0.93% 7.35%

2018 1.09% 1.52% -0.35% 1.11% -0.56% 0.39% 0.96% 0.91% 0.58% -0.34% 0.44% 0.47% 6.39%

2017 2.20% 0.01% 0.57% 1.61% 0.40% -0.88% 0.96% 0.29% 0.29% 0.90% -0.75% -1.45% 4.18%

2016 -1.38% -1.07% 1.95% 0.47% 1.91% -0.92% -0.08% 1.67% -0.10% -0.84% 0.22% 0.17% 1.94%

Highest calendar annual performance since launch 19.47% (in 2005)

Lowest calendar annual performance since launch -6.41% (in 2008)

*The portfolio charges a performance fee of 13.16% of the amount by which it outperforms the hurdle rate (CPI + 3.5% net of fees).

248 Profile’s Unit Trusts & Collective Investments — HEDGE FUNDS