Page 236 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 236

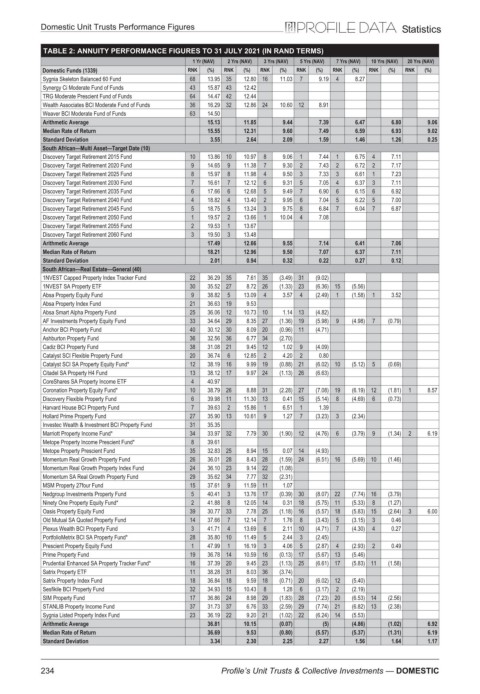

Domestic Unit Trusts Performance Figures Statistics

TABLE 2: ANNUITY PERFORMANCE FIGURES TO 31 JULY 2021 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1339) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Sygnia Skeleton Balanced 60 Fund 68 13.95 35 12.80 16 11.03 7 9.19 4 8.27

Synergy Ci Moderate Fund of Funds 43 15.87 43 12.42

TRG Moderate Prescient Fund of Funds 64 14.47 42 12.44

Wealth Associates BCI Moderate Fund of Funds 36 16.29 32 12.86 24 10.60 12 8.91

Weaver BCI Moderate Fund of Funds 63 14.50

Arithmetic Average 15.13 11.85 9.44 7.39 6.47 6.80 9.06

Median Rate of Return 15.55 12.31 9.60 7.49 6.59 6.93 9.02

Standard Deviation 3.55 2.64 2.09 1.59 1.46 1.26 0.25

South African—Multi Asset—Target Date (10)

Discovery Target Retirement 2015 Fund 10 13.86 10 10.97 8 9.06 1 7.44 1 6.75 4 7.11

Discovery Target Retirement 2020 Fund 9 14.65 9 11.38 7 9.30 2 7.43 2 6.72 2 7.17

Discovery Target Retirement 2025 Fund 8 15.97 8 11.98 4 9.50 3 7.33 3 6.61 1 7.23

Discovery Target Retirement 2030 Fund 7 16.61 7 12.12 6 9.31 5 7.05 4 6.37 3 7.11

Discovery Target Retirement 2035 Fund 6 17.66 6 12.68 5 9.49 7 6.90 6 6.15 6 6.92

Discovery Target Retirement 2040 Fund 4 18.82 4 13.40 2 9.95 6 7.04 5 6.22 5 7.00

Discovery Target Retirement 2045 Fund 5 18.75 5 13.24 3 9.75 8 6.84 7 6.04 7 6.87

Discovery Target Retirement 2050 Fund 1 19.57 2 13.66 1 10.04 4 7.08

Discovery Target Retirement 2055 Fund 2 19.53 1 13.67

Discovery Target Retirement 2060 Fund 3 19.50 3 13.48

Arithmetic Average 17.49 12.66 9.55 7.14 6.41 7.06

Median Rate of Return 18.21 12.96 9.50 7.07 6.37 7.11

Standard Deviation 2.01 0.94 0.32 0.22 0.27 0.12

South African—Real Estate—General (40)

1NVEST Capped Property Index Tracker Fund 22 36.29 35 7.61 35 (3.49) 31 (9.02)

1NVEST SA Property ETF 30 35.52 27 8.72 26 (1.33) 23 (6.36) 15 (5.56)

Absa Property Equity Fund 9 38.82 5 13.09 4 3.57 4 (2.49) 1 (1.58) 1 3.52

Absa Property Index Fund 21 36.63 19 9.53

Absa Smart Alpha Property Fund 25 36.06 12 10.73 10 1.14 13 (4.82)

AF Investments Property Equity Fund 33 34.64 29 8.35 27 (1.36) 19 (5.98) 9 (4.98) 7 (0.79)

Anchor BCI Property Fund 40 30.12 30 8.09 20 (0.96) 11 (4.71)

Ashburton Property Fund 36 32.56 36 6.77 34 (2.70)

Cadiz BCI Property Fund 38 31.08 21 9.45 12 1.02 9 (4.09)

Catalyst SCI Flexible Property Fund 20 36.74 6 12.85 2 4.20 2 0.80

Catalyst SCI SA Property Equity Fund* 12 38.19 16 9.99 19 (0.88) 21 (6.02) 10 (5.12) 5 (0.69)

Citadel SA Property H4 Fund 13 38.12 17 9.97 24 (1.13) 26 (6.63)

CoreShares SA Property Income ETF 4 40.97

Coronation Property Equity Fund* 10 38.79 26 8.88 31 (2.28) 27 (7.08) 19 (6.19) 12 (1.81) 1 8.57

Discovery Flexible Property Fund 6 39.98 11 11.30 13 0.41 15 (5.14) 8 (4.69) 6 (0.73)

Harvard House BCI Property Fund 7 39.63 2 15.86 1 6.51 1 1.39

Hollard Prime Property Fund 27 35.90 13 10.61 9 1.27 7 (3.23) 3 (2.34)

Investec Wealth & Investment BCI Property Fund 31 35.35

Marriott Property Income Fund* 34 33.97 32 7.79 30 (1.90) 12 (4.76) 6 (3.79) 9 (1.34) 2 6.19

Metope Property Income Prescient Fund* 8 39.61

Metope Property Prescient Fund 35 32.83 25 8.94 15 0.07 14 (4.93)

Momentum Real Growth Property Fund 26 36.01 28 8.43 28 (1.59) 24 (6.51) 16 (5.69) 10 (1.46)

Momentum Real Growth Property Index Fund 24 36.10 23 9.14 22 (1.08)

Momentum SA Real Growth Property Fund 29 35.62 34 7.77 32 (2.31)

MSM Property 27four Fund 15 37.61 9 11.59 11 1.07

Nedgroup Investments Property Fund 5 40.41 3 13.76 17 (0.39) 30 (8.07) 22 (7.74) 16 (3.79)

Ninety One Property Equity Fund* 2 41.88 8 12.05 14 0.31 18 (5.75) 11 (5.33) 8 (1.27)

Oasis Property Equity Fund 39 30.77 33 7.78 25 (1.18) 16 (5.57) 18 (5.83) 15 (2.64) 3 6.00

Old Mutual SA Quoted Property Fund 14 37.66 7 12.14 7 1.76 8 (3.43) 5 (3.15) 3 0.46

Plexus Wealth BCI Property Fund 3 41.71 4 13.69 6 2.11 10 (4.71) 7 (4.30) 4 0.27

PortfolioMetrix BCI SA Property Fund* 28 35.80 10 11.49 5 2.44 3 (2.45)

Prescient Property Equity Fund 1 47.99 1 16.19 3 4.06 5 (2.87) 4 (2.93) 2 0.49

Prime Property Fund 19 36.78 14 10.59 16 (0.13) 17 (5.67) 13 (5.46)

Prudential Enhanced SA Property Tracker Fund* 16 37.39 20 9.45 23 (1.13) 25 (6.61) 17 (5.83) 11 (1.58)

Satrix Property ETF 11 38.28 31 8.03 36 (3.74)

Satrix Property Index Fund 18 36.84 18 9.59 18 (0.71) 20 (6.02) 12 (5.40)

Sesfikile BCI Property Fund 32 34.93 15 10.43 8 1.28 6 (3.17) 2 (2.19)

SIM Property Fund 17 36.86 24 8.98 29 (1.83) 28 (7.23) 20 (6.53) 14 (2.56)

STANLIB Property Income Fund 37 31.73 37 6.76 33 (2.59) 29 (7.74) 21 (6.82) 13 (2.38)

Sygnia Listed Property Index Fund 23 36.19 22 9.20 21 (1.02) 22 (6.24) 14 (5.53)

Arithmetic Average 36.81 10.15 (0.07) (5) (4.86) (1.02) 6.92

Median Rate of Return 36.69 9.53 (0.80) (5.57) (5.37) (1.31) 6.19

Standard Deviation 3.34 2.30 2.25 2.27 1.56 1.64 1.17

234 Profile’s Unit Trusts & Collective Investments — DOMESTIC