Page 207 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 207

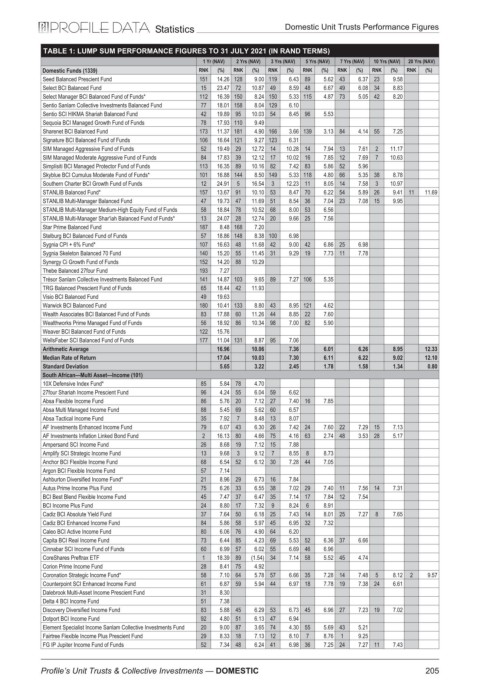

Statistics Domestic Unit Trusts Performance Figures

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JULY 2021 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1339) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Seed Balanced Prescient Fund 151 14.26 128 9.00 119 6.43 89 5.62 43 6.37 23 9.58

Select BCI Balanced Fund 15 23.47 72 10.87 49 8.59 48 6.67 49 6.08 34 8.83

Select Manager BCI Balanced Fund of Funds* 112 16.39 150 8.24 150 5.33 115 4.87 73 5.05 42 8.20

Sentio Sanlam Collective Investments Balanced Fund 77 18.01 158 8.04 129 6.10

Sentio SCI HIKMA Shariah Balanced Fund 42 19.89 95 10.03 54 8.45 96 5.53

Sequoia BCI Managed Growth Fund of Funds 78 17.93 110 9.49

Sharenet BCI Balanced Fund 173 11.37 181 4.90 166 3.66 139 3.13 84 4.14 55 7.25

Signature BCI Balanced Fund of Funds 106 16.64 121 9.27 123 6.31

SIM Managed Aggressive Fund of Funds 52 19.49 29 12.72 14 10.28 14 7.94 13 7.61 2 11.17

SIM Managed Moderate Aggressive Fund of Funds 84 17.83 39 12.12 17 10.02 16 7.85 12 7.69 7 10.63

Simplisiti BCI Managed Protector Fund of Funds 113 16.35 89 10.16 82 7.42 83 5.86 52 5.96

Skyblue BCI Cumulus Moderate Fund of Funds* 101 16.88 144 8.50 149 5.33 118 4.80 66 5.35 38 8.78

Southern Charter BCI Growth Fund of Funds 12 24.91 5 16.54 3 12.23 11 8.05 14 7.58 3 10.97

STANLIB Balanced Fund* 157 13.67 91 10.10 53 8.47 70 6.22 54 5.89 26 9.41 11 11.69

STANLIB Multi-Manager Balanced Fund 47 19.73 47 11.69 51 8.54 36 7.04 23 7.08 15 9.95

STANLIB Multi-Manager Medium-High Equity Fund of Funds 58 18.84 78 10.52 68 8.00 53 6.56

STANLIB Multi-Manager Shar'iah Balanced Fund of Funds* 13 24.07 28 12.74 20 9.66 25 7.56

Star Prime Balanced Fund 187 8.48 168 7.20

Stelburg BCI Balanced Fund of Funds 57 18.86 148 8.38 100 6.98

Sygnia CPI + 6% Fund* 107 16.63 48 11.68 42 9.00 42 6.86 25 6.98

Sygnia Skeleton Balanced 70 Fund 140 15.20 55 11.45 31 9.29 19 7.73 11 7.78

Synergy Ci Growth Fund of Funds 152 14.20 88 10.29

Thebe Balanced 27four Fund 193 7.27

Trésor Sanlam Collective Investments Balanced Fund 141 14.87 103 9.65 89 7.27 106 5.35

TRG Balanced Prescient Fund of Funds 65 18.44 42 11.93

Visio BCI Balanced Fund 49 19.63

Warwick BCI Balanced Fund 180 10.41 133 8.80 43 8.95 121 4.62

Wealth Associates BCI Balanced Fund of Funds 83 17.88 60 11.26 44 8.85 22 7.60

Wealthworks Prime Managed Fund of Funds 56 18.92 86 10.34 98 7.00 82 5.90

Weaver BCI Balanced Fund of Funds 122 15.76

WellsFaber SCI Balanced Fund of Funds 177 11.04 131 8.87 95 7.06

Arithmetic Average 16.96 10.06 7.36 6.01 6.26 8.95 12.33

Median Rate of Return 17.04 10.03 7.30 6.11 6.22 9.02 12.10

Standard Deviation 5.65 3.22 2.45 1.78 1.58 1.34 0.80

South African—Multi Asset—Income (101)

10X Defensive Index Fund* 85 5.84 78 4.70

27four Shariah Income Prescient Fund 96 4.24 55 6.04 59 6.62

Absa Flexible Income Fund 86 5.76 20 7.12 27 7.40 16 7.85

Absa Multi Managed Income Fund 88 5.45 69 5.62 60 6.57

Absa Tactical Income Fund 35 7.92 7 8.48 13 8.07

AF Investments Enhanced Income Fund 79 6.07 43 6.30 26 7.42 24 7.60 22 7.29 15 7.13

AF Investments Inflation Linked Bond Fund 2 16.13 80 4.66 75 4.16 63 2.74 48 3.53 28 5.17

Ampersand SCI Income Fund 26 8.68 19 7.12 15 7.88

Amplify SCI Strategic Income Fund 13 9.68 3 9.12 7 8.55 8 8.73

Anchor BCI Flexible Income Fund 68 6.54 52 6.12 30 7.28 44 7.05

Argon BCI Flexible Income Fund 57 7.14

Ashburton Diversified Income Fund* 21 8.96 29 6.73 16 7.84

Autus Prime Income Plus Fund 75 6.26 33 6.55 38 7.02 29 7.40 11 7.56 14 7.31

BCI Best Blend Flexible Income Fund 45 7.47 37 6.47 35 7.14 17 7.84 12 7.54

BCI Income Plus Fund 24 8.80 17 7.32 9 8.24 6 8.91

Cadiz BCI Absolute Yield Fund 37 7.64 50 6.18 25 7.43 14 8.01 25 7.27 8 7.65

Cadiz BCI Enhanced Income Fund 84 5.86 58 5.97 45 6.95 32 7.32

Caleo BCI Active Income Fund 80 6.06 76 4.90 64 6.20

Capita BCI Real Income Fund 73 6.44 85 4.23 69 5.53 52 6.36 37 6.66

Cinnabar SCI Income Fund of Funds 60 6.99 57 6.02 55 6.69 46 6.96

CoreShares Preftrax ETF 1 18.39 89 (1.54) 34 7.14 58 5.52 45 4.74

Corion Prime Income Fund 28 8.41 75 4.92

Coronation Strategic Income Fund* 58 7.10 64 5.78 57 6.66 35 7.28 14 7.48 5 8.12 2 9.57

Counterpoint SCI Enhanced Income Fund 61 6.87 59 5.94 44 6.97 18 7.78 19 7.38 24 6.61

Dalebrook Multi-Asset Income Prescient Fund 31 8.30

Delta 4 BCI Income Fund 51 7.38

Discovery Diversified Income Fund 83 5.88 45 6.29 53 6.73 45 6.96 27 7.23 19 7.02

Dotport BCI Income Fund 92 4.80 51 6.13 47 6.94

Element Specialist Income Sanlam Collective Investments Fund 20 9.00 87 3.65 74 4.30 55 5.69 43 5.21

Fairtree Flexible Income Plus Prescient Fund 29 8.33 18 7.13 12 8.10 7 8.76 1 9.25

FG IP Jupiter Income Fund of Funds 52 7.34 48 6.24 41 6.98 36 7.25 24 7.27 11 7.43

205

Profile’s Unit Trusts & Collective Investments — DOMESTIC