Page 84 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 84

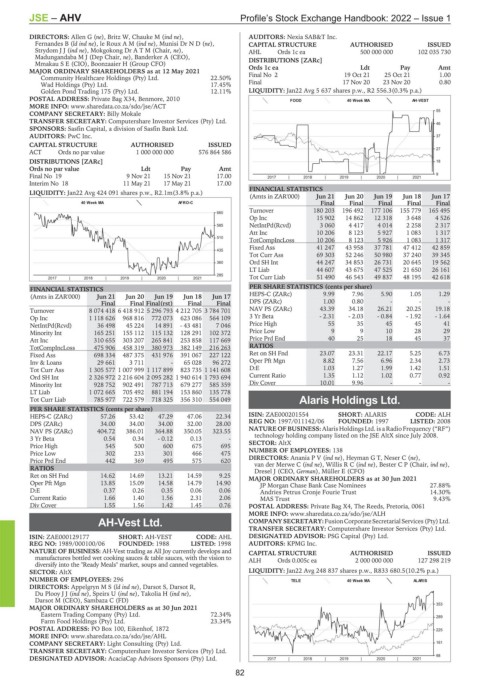

JSE – AHV Profile’s Stock Exchange Handbook: 2022 – Issue 1

DIRECTORS: Allen G (ne), Britz W, Chauke M (ind ne), AUDITORS: Nexia SAB&T Inc.

Fernandes B (ld ind ne), le RouxAM(ind ne), Munisi DrND(ne), CAPITAL STRUCTURE AUTHORISED ISSUED

StrydomJJ(ind ne), Mokgokong DrATM (Chair, ne), AHL Ords 1c ea 500 000 000 102 035 730

Madungandaba M J (Dep Chair, ne), Banderker A (CEO), DISTRIBUTIONS [ZARc]

Mmakau S E (CIO), Boonzaaier H (Group CFO) Ords 1c ea Ldt Pay Amt

MAJOR ORDINARY SHAREHOLDERS as at 12 May 2021

Community Healthcare Holdings (Pty) Ltd. 22.50% Final No 2 19 Oct 21 25 Oct 21 1.00

Wad Holdings (Pty) Ltd. 17.45% Final 17 Nov 20 23 Nov 20 0.80

Golden Pond Trading 175 (Pty) Ltd. 12.11% LIQUIDITY: Jan22 Avg 5 637 shares p.w., R2 556.3(0.3% p.a.)

POSTAL ADDRESS: Private Bag X34, Benmore, 2010 FOOD 40 Week MA AH-VEST

MORE INFO: www.sharedata.co.za/sdo/jse/ACT

55

COMPANY SECRETARY: Billy Mokale

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 46

SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd.

AUDITORS: PwC Inc. 37

CAPITAL STRUCTURE AUTHORISED ISSUED

ACT Ords no par value 1 000 000 000 576 864 586 27

DISTRIBUTIONS [ZARc] 18

Ords no par value Ldt Pay Amt

Final No 19 9 Nov 21 15 Nov 21 17.00 2017 | 2018 | 2019 | 2020 | 2021 9

Interim No 18 11 May 21 17 May 21 17.00

FINANCIAL STATISTICS

LIQUIDITY: Jan22 Avg 424 091 shares p.w., R2.1m(3.8% p.a.)

(Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

40 Week MA AFRO-C Final Final Final Final Final

Turnover 180 203 196 492 177 106 155 779 165 495

660

Op Inc 15 902 14 862 12 318 3 648 4 526

585 NetIntPd(Rcvd) 3 060 4 417 4 014 2 258 2 317

Att Inc 10 206 8 123 5 927 1 083 1 317

510

TotCompIncLoss 10 206 8 123 5 926 1 083 1 317

Fixed Ass 41 247 43 958 37 781 47 412 42 859

435

Tot Curr Ass 69 303 52 246 50 980 37 240 39 345

360 Ord SH Int 44 247 34 853 26 731 20 645 19 562

LT Liab 44 607 43 675 47 525 21 650 26 161

285 Tot Curr Liab 51 490 46 543 49 837 48 195 42 618

2017 | 2018 | 2019 | 2020 | 2021

PER SHARE STATISTICS (cents per share)

FINANCIAL STATISTICS

(Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 HEPS-C (ZARc) 9.99 7.96 5.90 1.05 1.29

Final Final Final(rst) Final Final DPS (ZARc) 1.00 0.80 - - -

Turnover 8 074 418 6 418 912 5 296 793 4 212 705 3 784 701 NAV PS (ZARc) 43.39 34.18 26.21 20.25 19.18

Op Inc 1 118 626 968 816 772 073 623 086 564 109 3 Yr Beta - 2.31 - 2.03 - 0.84 - 1.92 - 1.64

NetIntPd(Rcvd) 36 498 45 224 14 891 - 43 481 7 046 Price High 55 35 45 45 41

Minority Int 165 251 155 112 115 132 128 291 102 372 Price Low 9 9 10 28 29

Att Inc 310 655 303 207 265 841 253 858 117 669 Price Prd End 40 25 18 45 37

TotCompIncLoss 475 906 458 319 380 973 382 149 216 263 RATIOS

Fixed Ass 698 334 487 375 431 976 391 067 227 122 Ret on SH Fnd 23.07 23.31 22.17 5.25 6.73

Inv & Loans 29 661 3 711 - 65 028 96 272 Oper Pft Mgn 8.82 7.56 6.96 2.34 2.73

Tot Curr Ass 1 305 577 1 007 999 1 117 899 823 735 1 141 608 D:E 1.03 1.27 1.99 1.42 1.51

Ord SH Int 2 326 972 2 216 604 2 095 282 1 940 614 1 793 694 Current Ratio 1.35 1.12 1.02 0.77 0.92

Minority Int 928 752 902 491 787 713 679 277 585 359 Div Cover 10.01 9.96 - - -

LT Liab 1 072 665 705 492 881 194 153 860 135 778

Tot Curr Liab 785 977 722 579 718 325 356 310 554 049 Alaris Holdings Ltd.

PER SHARE STATISTICS (cents per share) ALA

HEPS-C (ZARc) 57.26 53.42 47.29 47.06 22.34 ISIN: ZAE000201554 SHORT: ALARIS CODE: ALH

DPS (ZARc) 34.00 34.00 34.00 32.00 28.00 REG NO: 1997/011142/06 FOUNDED: 1997 LISTED: 2008

NAV PS (ZARc) 404.72 386.01 364.88 350.05 323.55 NATURE OF BUSINESS: Alaris Holdings Ltd. is a Radio Frequency (“RF”)

technology holding company listed on the JSE AltX since July 2008.

3 Yr Beta 0.54 0.34 - 0.12 0.13 -

Price High 545 500 600 675 695 SECTOR: AltX

Price Low 302 233 301 466 475 NUMBER OF EMPLOYEES: 138

Price Prd End 442 369 495 575 620 DIRECTORS: AnaniaPV(ind ne), Heyman G T, Neser C (ne),

van der Merwe C (ind ne), WillisRC(ind ne), Bester C P (Chair, ind ne),

RATIOS Dresel J (CEO, German), Müller E (CFO)

Ret on SH Fnd 14.62 14.69 13.21 14.59 9.25 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021

Oper Pft Mgn 13.85 15.09 14.58 14.79 14.90 JP Morgan Chase Bank Case Nominees 27.88%

D:E 0.37 0.26 0.35 0.06 0.06 Andries Petrus Cronje Fourie Trust 14.30%

Current Ratio 1.66 1.40 1.56 2.31 2.06 MAS Trust 9.43%

Div Cover 1.55 1.56 1.42 1.45 0.76 POSTAL ADDRESS: Private Bag X4, The Reeds, Pretoria, 0061

MORE INFO: www.sharedata.co.za/sdo/jse/ALH

AH-Vest Ltd. COMPANY SECRETARY:FusionCorporateSecretarialServices(Pty)Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AHV

ISIN: ZAE000129177 SHORT: AH-VEST CODE: AHL DESIGNATED ADVISOR: PSG Capital (Pty) Ltd.

REG NO: 1989/000100/06 FOUNDED: 1988 LISTED: 1998 AUDITORS: KPMG Inc.

NATURE OF BUSINESS: AH-Vest trading as All Joy currently develops and CAPITAL STRUCTURE AUTHORISED ISSUED

manufactures bottled wet cooking sauces & table sauces, with the vision to ALH Ords 0.005c ea 2 000 000 000 127 298 219

diversify into the "Ready Meals" market, soups and canned vegetables.

SECTOR: AltX LIQUIDITY: Jan22 Avg 248 837 shares p.w., R833 680.5(10.2% p.a.)

NUMBER OF EMPLOYEES: 296 TELE 40 Week MA ALARIS

DIRECTORS: AppelgrynMS(ld ind ne), Darsot S, Darsot R,

Du PlooyJJ(ind ne), Speirs U (ind ne), Takolia H (ind ne),

Darsot M (CEO), Sambaza C (FD)

353

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021

Eastern Trading Company (Pty) Ltd. 72.34% 289

Farm Food Holdings (Pty) Ltd. 23.34%

POSTAL ADDRESS: PO Box 100, Eikenhof, 1872 225

MORE INFO: www.sharedata.co.za/sdo/jse/AHL

COMPANY SECRETARY: Light Consulting (Pty) Ltd. 161

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: AcaciaCap Advisors Sponsors (Pty) Ltd. 2017 | 2018 | 2019 | 2020 | 2021 98

82