Page 87 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 87

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – ALV

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—Plat&PrecMet

Alviva Holdings Ltd. NUMBER OF EMPLOYEES: 21 681

ALV DIRECTORS: Cutifani M (ne, Aus), Dixon R (ind ne), Fakude N (ne),

ISIN: ZAE000227484 SHORT: ALVIVA CODE: AVV Leoka T (ind ne), MagezaNP(ind ne), MbazimaNB(ne), Michaud A

REG NO: 1986/000334/06 FOUNDED: 1986 LISTED: 1987 (ne), MoholiNT(ind ne), Naidoo D (ind ne), ViceJM(ind ne),

NATURE OF BUSINESS: Alviva is one of Africa's largest providers of WhitcuttPG(alt), Moosa M V (Chair, ind ne), Viljoen Ms N (CEO),

information and communication technology products and services. The Miller C (FD)

Group comprises focused operating subsidiaries who specialise in their MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

unique product and service offerings. Anglo American South Africa Investments (Pty) Ltd. 78.56%

SECTOR:Technology—Technology—Hardware&Equipment—Hardware POSTAL ADDRESS: Postnet Suite Number 153, Private Bag X31,

NUMBER OF EMPLOYEES: 3 597 Saxonwold, 2132

DIRECTORS: Chaba S (ind ne), MasemolaPN(ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/AMS

MokokaMG(ind ne), Natesan P (ld ind ne), Tugendhaft A (Chair, ne), COMPANY SECRETARY: Elizna Viljoen

Spies P (CEO), Lyon R D (CFO) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 23 Nov 2021 SPONSOR: Merrill Lynch SA (Pty) Ltd.

DY Investments 3 (Pty) Ltd. 11.67%

Fidelity Investments 10.21% AUDITORS: PwC Inc.

Invesco Canada Ltd. 8.77% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 483, Halfway House, Midrand, 1685 AMS Ords 10c ea 413 595 651 265 292 206

MORE INFO: www.sharedata.co.za/sdo/jse/AVV DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: S L Grobler Ords 10c ea Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Interim No 122 10 Aug 21 16 Aug 21 7000.00

SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd. Special 10 Aug 21 16 Aug 21 10500.00

AUDITORS: SizweNtsalubaGobodo Grant Thornton Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jan22 Avg 1m shares p.w., R2 174.2m(24.6% p.a.)

AVV Ords 1c ea 300 000 000 121 717 232 MINI 40 Week MA AMPLATS

DISTRIBUTIONS [ZARc]

224087

Ords 1c ea Ldt Pay Amt

Final No 15 9 Nov 21 15 Nov 21 29.00 184099

Final No 14 10 Nov 20 16 Nov 20 15.00

LIQUIDITY: Jan22 Avg 761 779 shares p.w., R8.1m(32.5% p.a.) 144111

TECH 40 Week MA ALVIVA 104123

2251

64135

1883

24146

2017 | 2018 | 2019 | 2020 | 2021

1515

FINANCIAL STATISTICS

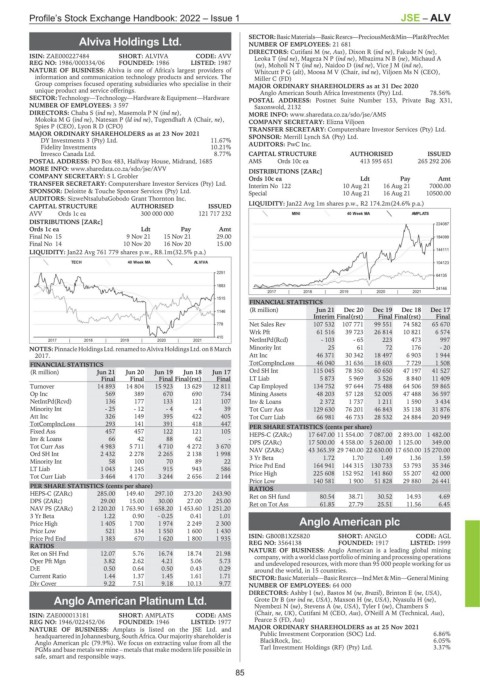

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

1146

Interim Final(rst) Final Final(rst) Final

778 Net Sales Rev 107 532 107 771 99 551 74 582 65 670

Wrk Pft 61 516 39 723 26 814 10 821 6 574

410

2017 | 2018 | 2019 | 2020 | 2021 NetIntPd(Rcd) - 103 - 65 223 473 997

NOTES: Pinnacle HoldingsLtd. renamed to Alviva HoldingsLtd. on8 March Minority Int 25 61 72 176 - 20

2017. Att Inc 46 371 30 342 18 497 6 903 1 944

FINANCIAL STATISTICS TotCompIncLoss 46 040 31 636 18 603 7 729 1 508

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 Ord SH Int 115 045 78 350 60 650 47 197 41 527

Final Final Final Final(rst) Final LT Liab 5 873 5 969 3 526 8 840 11 409

Turnover 14 893 14 804 15 923 13 629 12 811 Cap Employed 134 752 97 644 75 488 64 506 59 865

Op Inc 569 389 670 690 734 Mining Assets 48 203 57 128 52 005 47 488 36 597

NetIntPd(Rcvd) 136 177 133 121 107 Inv & Loans 2 372 1 737 1 211 1 590 3 434

Minority Int - 25 - 12 - 4 - 4 39 Tot Curr Ass 129 630 76 201 46 843 35 138 31 876

Att Inc 326 149 395 422 405 Tot Curr Liab 66 981 46 733 28 532 24 884 20 949

TotCompIncLoss 293 141 391 418 447 PER SHARE STATISTICS (cents per share)

Fixed Ass 457 457 122 121 105 HEPS-C (ZARc) 17 647.00 11 554.00 7 087.00 2 893.00 1 482.00

Inv & Loans 66 42 88 62 - DPS (ZARc) 17 500.00 4 558.00 5 260.00 1 125.00 349.00

Tot Curr Ass 4 983 5 711 4 710 4 272 3 670 NAV (ZARc) 43 365.39 29 740.00 22 630.00 17 650.00 15 270.00

Ord SH Int 2 432 2 278 2 265 2 138 1 998 3 Yr Beta 1.72 1.70 1.49 1.36 1.59

Minority Int 58 100 70 89 22

LT Liab 1 043 1 245 915 943 586 Price Prd End 164 941 144 315 130 733 53 793 35 346

Tot Curr Liab 3 464 4 170 3 244 2 656 2 144 Price High 225 608 152 952 141 860 55 207 42 000

Price Low 140 581 1 900 51 828 29 880 26 441

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 285.00 149.40 297.10 273.20 243.90 Ret on SH fund 80.54 38.71 30.52 14.93 4.69

DPS (ZARc) 29.00 15.00 30.00 27.00 25.00 Ret on Tot Ass 61.85 27.79 25.51 11.56 6.45

NAV PS (ZARc) 2 120.20 1 763.90 1 658.20 1 453.60 1 251.20

3 Yr Beta 1.22 0.90 - 0.25 0.41 1.01

Price High 1 405 1 700 1 974 2 249 2 300 Anglo American plc

Price Low 521 334 1 550 1 600 1 430 ANG

Price Prd End 1 383 670 1 620 1 800 1 935 ISIN: GB00B1XZS820 SHORT: ANGLO CODE: AGL

RATIOS REG NO: 3564138 FOUNDED: 1917 LISTED: 1999

Ret on SH Fnd 12.07 5.76 16.74 18.74 21.98 NATURE OF BUSINESS: Anglo American is a leading global mining

company, with a world class portfolio of mining and processing operations

Oper Pft Mgn 3.82 2.62 4.21 5.06 5.73 and undeveloped resources, with more than 95 000 people working for us

D:E 0.50 0.64 0.50 0.43 0.29 around the world, in 15 countries.

Current Ratio 1.44 1.37 1.45 1.61 1.71 SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining

Div Cover 9.22 7.51 9.18 10.13 9.77 NUMBER OF EMPLOYEES: 64 000

DIRECTORS: Ashby I (ne), Bastos M (ne, Brazil), Brinton E (ne, USA),

Anglo American Platinum Ltd. Grote Dr B (snr ind ne, USA), Maxson H (ne, USA), Nyasulu H (ne),

Nyembezi N (ne), Stevens A (ne, USA), Tyler I (ne), Chambers S

ANG

ISIN: ZAE000013181 SHORT: AMPLATS CODE: AMS (Chair, ne, UK), Cutifani M (CEO, Aus), O'Neill A M (Technical, Aus),

REG NO: 1946/022452/06 FOUNDED: 1946 LISTED: 1977 Pearce S (FD, Aus)

NATURE OF BUSINESS: Amplats is listed on the JSE Ltd. and MAJOR ORDINARY SHAREHOLDERS as at 25 Nov 2021

headquartered in Johannesburg, South Africa. Our majority shareholder is Public Investment Corporation (SOC) Ltd. 6.86%

Anglo American plc (79.9%). We focus on extracting value from all the BlackRock, Inc. 6.05%

PGMs and base metals we mine – metals that make modern life possible in Tarl Investment Holdings (RF) (Pty) Ltd. 3.37%

safe, smart and responsible ways.

85