Page 86 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 86

JSE – ALT Profile’s Stock Exchange Handbook: 2022 – Issue 1

POPULAR BRAND NAMES: Altron Security,

Altron Ltd. Altron TMT, Altron Nexus, Altron Systems

Integration, Altron Karabina, Netstar, Altron

ALT

Document Solutions, Altron Managed Solutions,

Altron People Solutions, Altron Arrow, Altron

HealthTech, Altron Fintech

POSTAL ADDRESS:POBox981, Houghton,2041

EMAIL: info@altron.com

WEBSITE: www.altron.com

Scan the QR code to TELEPHONE: 011-645-3600

visit our Investor COMPANY SECRETARY: Nicole Morgan

ISIN: ZAE000191342 SHORT: ALTRON CODE: AEL Centre

REG NO: 1947/024583/06 FOUNDED: 1965 LISTED: 1979 TRANSFER SECRETARY: Computershare

Investor Services (Pty) Ltd.

NATURE OF BUSINESS: SPONSOR: Investec Ltd.

Altron Ltd. (Altron) is domiciled in South Africa and listed on AUDITORS: PwC Inc.

BANKERS: Absa Bank Ltd., Investec Bank Ltd., Nedbank Ltd., a division of

the Johannesburg Stock Exchange (JSE). Altron is invested in Nedcor Bank Ltd., Rand Merchant Bank, a division of FirstRand Bank Ltd.,

the information and communications technology sector The Standard Bank of South Africa Ltd.

(ICT). Altron’s solutions and services are clustered into the SEGMENTAL REPORTING as at 31 Aug 20 (asa%of Revenue)

three segments of its ICT capabilities, namely Digital Trans- Digital Transformation 78.56%

9.15%

Smart IoT

formation, Managed Services and Own Platforms. Altron Managed Services 8.26%

creates value by providing highly differentiated end-to-end Healthtech/Fintech 6.56%

technology solutions to business enterprises. Altron’s growth Other -2.53%

areas are Security; Cloud; Data; and Automation. Altron has a

CALENDAR Expected Status

direct presence in the Middle East, Australia and the United Next Final Results May 2022 Unconfirmed

Kingdom. The Altron head office is located in Johannesburg,

South Africa. The Altron Group employs approximately 7 700 Annual General Meeting Jul 2022 Unconfirmed

employees globally. Next Interim Results Oct 2022 Unconfirmed

SECTOR:Technology—Technology—Software&CompSer—ComputerService CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021 AEL A ords no par value 500 000 000 405 635 971

Coronation Asset Management 25.14% DISTRIBUTIONS [ZARc]

Value Capital Partners 19.60%

Biltron 13.98% A ords no par value Ldt Pay Amt

NOTES: Allied Electronic Corporation Ltd. renamed to Altron Ltd. on 25 Interim No 74 9 Nov 21 15 Nov 21 7.00

August 2021. Final No 73 1 Jun 21 7 Jun 21 15.00

Special 11 May 21 17 May 21 96.00

FINANCIAL STATISTICS Interim No 72 10 Nov 20 16 Nov 20 33.00

(R million) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18

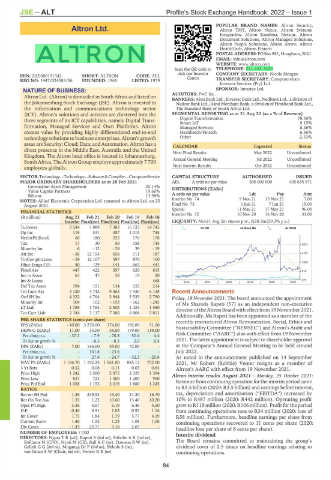

Interim Final(rst) Final(rst) Final(rst) Final(rst) LIQUIDITY: Nov21 Avg 2m shares p.w., R28.3m(29.3% p.a.)

Turnover 3 544 7 089 7 383 15 723 14 743 SCOM 40 Week MA ALTRON

Op Inc 119 331 457 1 015 745

NetIntPd(Rcvd) 68 180 255 176 178

Tax 17 30 50 158 145 2823

Minority Int 6 - 12 - 28 39 - 19

Att Inc - 36 12 154 656 711 187 2187

TotCompIncLoss - 59 12 107 597 870 100

1550

Hline Erngs-CO 40 129 141 663 441

Fixed Ass 447 422 597 620 615 914

Inv in Assoc 65 47 58 19 20

Inv & Loans - - - - 468 2016 | 2017 | 2018 | 2019 | 2020 | 2021 277

Def Tax Asset 194 151 134 155 214

Tot Curr Ass 3 120 4 742 9 063 7 430 6 138 Recent Announcements

Ord SH Int 4 322 4 764 3 944 3 535 2 790 Friday, 19 November 2021: The board announced the appointment

Minority Int 104 102 - 193 - 162 - 245 of Ms Sharoda Rapeti (57) as an independent non-executive

LT Liab 1 768 1 764 2 502 1 424 1 580 director of the Altron Board with effect from 19 November 2021.

Tot Curr Liab 2 144 3 117 7 360 6 804 5 811

Additionally, Ms Rapeti has been appointed as a member of the

PER SHARE STATISTICS (cents per share) recently restructured Altron Remuneration, Social, Ethics and

EPS (ZARc) - 10.00 3 270.00 174.00 192.00 51.00 Sustainability Committee (“REMSEC”) and Altron’s Audit and

HEPS-C (ZARc) 11.00 35.00 38.00 179.00 119.00

Pct chng p.a. - 37.1 - 7.9 - 78.8 50.4 4.4 Risk Committee (“AARC”) also with effect from 19 November

Tr 5yr av grwth % - - 8.3 - 8.3 2.0 0.4 2021. The latter appointment is subject to shareholder approval

DPS (ZARc) 7.00 144.00 55.00 72.00 - at the Company’s Annual General Meeting to be held around

Pct chng p.a. - 161.8 - 23.6 - - July 2022.

Tr 5yr av grwth % - 27.6 - 24.7 - 32.3 - 25.6 As noted in the announcement published on 14 September

NAV PS (ZARc) 1 166.70 1 192.25 1 061.00 885.12 752.00 2021, Mr Robert (Robbie) Venter resigns as a member of

3 Yr Beta 0.32 0.08 0.11 - 0.03 0.64 Altron’s AARC with effect from 19 November 2021.

Price High 1 242 3 500 2 875 2 029 1 394 Altron interim results August 2021 - Monday, 25 October 2021:

Price Low 837 723 1 400 1 200 950 Revenue from continuing operation for the interim period came

Price Prd End 1 038 1 153 2 019 1 880 1 245

RATIOS to R3.5 billion (2020: R3.5 billion) and earnings before interest,

Ret on SH Fnd - 1.36 249.53 19.40 21.30 16.70 tax, depreciation and amortisation (“EBITDA”) increased by

Ret On Tot Ass 1.33 1.22 10.60 13.40 10.20 10% to R487 million (2020: R442 million). Operating profit

Oper Pft Mgn 3.36 4.67 6.19 6.46 4.50 grew to R119 million (2020: R106 million). Profit for the period

D:E 0.46 0.51 1.03 0.92 1.16 from continuing operations rose to R34 million (2020: loss of

Int Cover 1.75 1.84 1.79 5.77 4.19 R58 million). Furthermore, headline earnings per share from

Current Ratio 1.46 1.52 1.23 1.09 1.06 continuing operations recovered to 11 cents per share (2020:

Div Cover - 1.43 22.71 3.16 2.67 - headline loss per share of 8 cents per share).

NUMBER OF EMPLOYEES: 7 700 Interim dividend

DIRECTORS: NgaraTR(alt), Rapeti S (ind ne), SithebeAK(ind ne),

Bofilatos N (CFO), Nyati M (CE), BallAC(ne), DawsonBW(ne), The Board remains committed to maintaining the group’s

GelinkGG(ind ne), Mnganga Dr P (ind ne), Sithole S (ne), dividend cover of 2.5 times on headline earnings relating to

van Graan S W (Chair, ind ne), VenterRE(ne) continuing operations.

84