Page 233 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 233

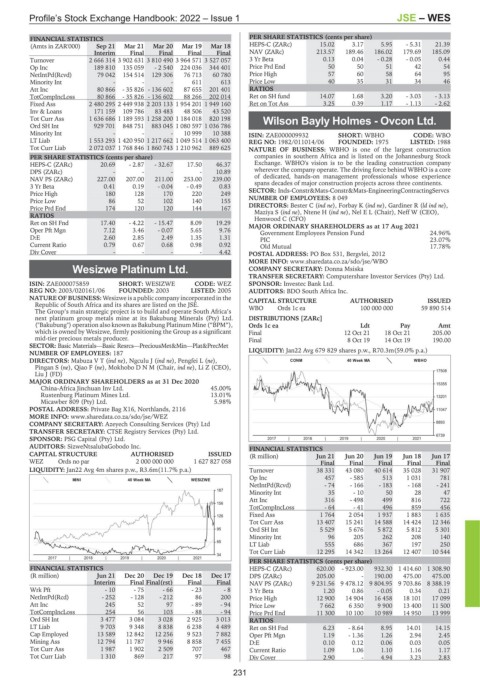

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – WES

FINANCIAL STATISTICS PER SHARE STATISTICS (cents per share)

(Amts in ZAR'000) Sep 21 Mar 21 Mar 20 Mar 19 Mar 18 HEPS-C (ZARc) 15.02 3.17 5.95 - 5.31 21.39

Interim Final Final Final Final NAV (ZARc) 213.57 189.46 186.02 179.69 185.09

Turnover 2 666 314 3 902 631 3 810 490 3 964 571 3 527 057 3 Yr Beta 0.13 0.04 - 0.28 - 0.05 0.44

Op Inc 189 810 135 059 - 2 540 224 036 344 401 Price Prd End 50 50 51 42 54

NetIntPd(Rcvd) 79 042 154 514 129 306 76 713 60 780 Price High 57 60 58 64 95

Minority Int - - - 611 613 Price Low 40 35 31 34 46

Att Inc 80 866 - 35 826 - 136 602 87 655 201 401 RATIOS

TotCompIncLoss 80 866 - 35 826 - 136 602 88 266 202 014 Ret on SH fund 14.07 1.68 3.20 - 3.03 - 3.13

Fixed Ass 2 480 295 2 449 938 2 203 133 1 954 201 1 949 160 Ret on Tot Ass 3.25 0.39 1.17 - 1.13 - 2.62

Inv & Loans 171 159 109 786 83 483 48 506 43 520

Tot Curr Ass 1 636 686 1 189 593 1 258 200 1 184 018 820 198 Wilson Bayly Holmes - Ovcon Ltd.

Ord SH Int 929 701 848 751 883 045 1 080 597 1 036 786

WIL

Minority Int - - - 10 999 10 388 ISIN: ZAE000009932 SHORT: WBHO CODE: WBO

LT Liab 1 553 293 1 420 950 1 217 662 1 049 514 1 063 400 REG NO: 1982/011014/06 FOUNDED: 1975 LISTED: 1988

Tot Curr Liab 2 072 037 1 768 846 1 860 743 1 210 962 889 625 NATURE OF BUSINESS: WBHO is one of the largest construction

PER SHARE STATISTICS (cents per share) companies in southern Africa and is listed on the Johannesburg Stock

HEPS-C (ZARc) 20.69 - 2.87 - 32.67 17.50 46.37 Exchange. WBHO's vision is to be the leading construction company

DPS (ZARc) - - - - 10.89 wherever the company operate. The driving force behind WBHO is a core

NAV PS (ZARc) 227.00 207.00 211.00 253.00 239.00 of dedicated, hands-on management professionals whose experience

3 Yr Beta 0.41 0.19 - 0.04 - 0.49 0.83 spans decades of major construction projects across three continents.

Price High 180 128 170 220 249 SECTOR: Inds-Constr&Mats-Constr&Mats-EngineeringContractingServcs

Price Low 86 52 102 140 155 NUMBER OF EMPLOYEES: 8 049

Price Prd End 174 120 120 144 167 DIRECTORS: Bester C (ind ne), Forbay K (ind ne), Gardiner R (ld ind ne),

Maziya S (ind ne), Ntene H (ind ne), Nel E L (Chair), Neff W (CEO),

RATIOS Henwood C (CFO)

Ret on SH Fnd 17.40 - 4.22 - 15.47 8.09 19.29 MAJOR ORDINARY SHAREHOLDERS as at 17 Aug 2021

Oper Pft Mgn 7.12 3.46 - 0.07 5.65 9.76 Government Employees Pension Fund 24.96%

D:E 2.60 2.85 2.49 1.35 1.31 PIC 23.07%

Current Ratio 0.79 0.67 0.68 0.98 0.92 Old Mutual 17.78%

Div Cover - - - - 4.42 POSTAL ADDRESS: PO Box 531, Bergvlei, 2012

MORE INFO: www.sharedata.co.za/sdo/jse/WBO

Wesizwe Platinum Ltd. COMPANY SECRETARY: Donna Msiska

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

WES

ISIN: ZAE000075859 SHORT: WESIZWE CODE: WEZ SPONSOR: Investec Bank Ltd.

REG NO: 2003/020161/06 FOUNDED: 2003 LISTED: 2005 AUDITORS: BDO South Africa Inc.

NATURE OF BUSINESS: Wesizwe is a public company incorporated in the CAPITAL STRUCTURE AUTHORISED ISSUED

Republic of South Africa and its shares are listed on the JSE. WBO Ords 1c ea 100 000 000 59 890 514

The Group’s main strategic project is to build and operate South Africa’s

next platinum group metals mine at its Bakubung Minerals (Pty) Ltd. DISTRIBUTIONS [ZARc]

("Bakubung") operation also known as Bakubung Platinum Mine (“BPM”), Ords 1c ea Ldt Pay Amt

which is owned by Wesizwe, firmly positioning the Group as a significant Final 12 Oct 21 18 Oct 21 205.00

mid-tier precious metals producer. Final 8 Oct 19 14 Oct 19 190.00

SECTOR: Basic Materials—Basic Resrcs—PreciousMet&Min—Plat&PrecMet

NUMBER OF EMPLOYEES: 187 LIQUIDITY: Jan22 Avg 679 829 shares p.w., R70.3m(59.0% p.a.)

DIRECTORS: MabuzaVT(ind ne), Ngculu J (ind ne), Pengfei L (ne), CONM 40 Week MA WBHO

Pingan S (ne), Qiao F (ne), MokhoboDNM (Chair, ind ne), Li Z (CEO),

Liu J (FD) 17508

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020 15355

China-Africa Jinchuan Inv Ltd. 45.00%

Rustenburg Platinum Mines Ltd. 13.01% 13201

Micawber 809 (Pty) Ltd. 5.98%

POSTAL ADDRESS: Private Bag X16, Northlands, 2116 11047

MORE INFO: www.sharedata.co.za/sdo/jse/WEZ

COMPANY SECRETARY: Azeyech Consulting Services (Pty) Ltd 8893

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

6739

SPONSOR: PSG Capital (Pty) Ltd. 2017 | 2018 | 2019 | 2020 | 2021

AUDITORS: SizweNtsalubaGobodo Inc. FINANCIAL STATISTICS

CAPITAL STRUCTURE AUTHORISED ISSUED (R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

WEZ Ords no par 2 000 000 000 1 627 827 058 Final Final Final Final Final

LIQUIDITY: Jan22 Avg 4m shares p.w., R3.6m(11.7% p.a.) Turnover 38 331 43 080 40 614 35 028 31 907

Op Inc 457 - 585 513 1 031 781

MINI 40 Week MA WESIZWE

NetIntPd(Rcvd) - 74 - 166 - 183 - 168 - 241

187

Minority Int 35 - 10 50 28 47

Att Inc 316 - 498 499 816 722

156

TotCompIncLoss - 64 - 41 496 859 456

126 Fixed Ass 1 764 2 054 1 937 1 883 1 635

Tot Curr Ass 13 407 15 241 14 588 14 424 12 346

95 Ord SH Int 5 529 5 676 5 872 5 812 5 301

Minority Int 96 205 262 208 140

65

LT Liab 555 686 367 197 250

Tot Curr Liab 12 295 14 342 13 264 12 407 10 544

34

2017 | 2018 | 2019 | 2020 | 2021

PER SHARE STATISTICS (cents per share)

FINANCIAL STATISTICS HEPS-C (ZARc) 620.00 - 923.00 932.30 1 414.60 1 308.90

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 DPS (ZARc) 205.00 - 190.00 475.00 475.00

Interim Final Final(rst) Final Final NAV PS (ZARc) 9 231.56 9 478.12 9 804.95 9 703.86 8 388.19

WrkPft -10 - 75 -66 - 23 -8 3 Yr Beta 1.20 0.86 - 0.05 0.34 0.21

NetIntPd(Rcd) - 252 - 128 - 212 86 200 Price High 12 900 14 904 16 458 18 101 17 099

Att Inc 245 52 97 - 89 - 94 Price Low 7 662 6 350 9 900 13 400 11 500

TotCompIncLoss 254 56 103 - 88 - 94 Price Prd End 11 300 10 100 10 989 14 950 13 999

Ord SH Int 3 477 3 084 3 028 2 925 3 013 RATIOS

LT Liab 9 703 9 348 8 838 6 238 4 489 Ret on SH Fnd 6.23 - 8.64 8.95 14.01 14.15

Cap Employed 13 589 12 842 12 256 9 523 7 882 Oper Pft Mgn 1.19 - 1.36 1.26 2.94 2.45

Mining Ass 12 794 11 787 9 946 8 858 7 455 D:E 0.10 0.12 0.06 0.03 0.05

Tot Curr Ass 1 987 1 902 2 509 707 467 Current Ratio 1.09 1.06 1.10 1.16 1.17

Tot Curr Liab 1 310 869 217 97 98 Div Cover 2.90 - 4.94 3.23 2.83

231