Page 197 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 197

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – REM

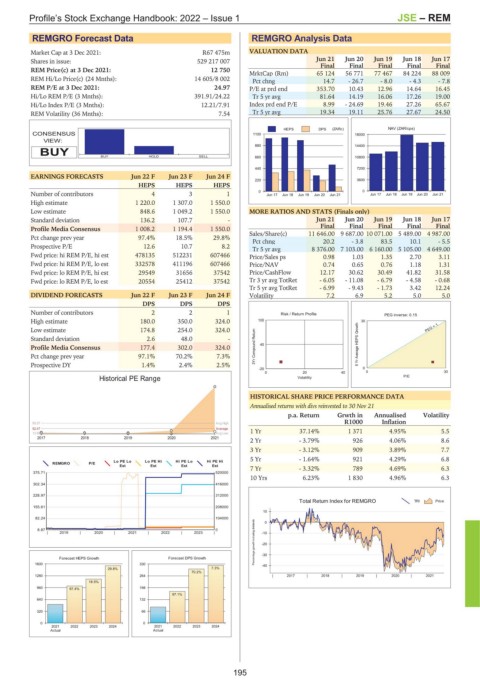

REMGRO Forecast Data REMGRO Analysis Data

Market Cap at 3 Dec 2021: R67 475m VALUATION DATA

Shares in issue: 529 217 007 Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final Final Final

REM Price(c) at 3 Dec 2021: 12 750

MrktCap (Rm) 65 124 56 771 77 467 84 224 88 009

REM Hi/Lo Price(c) (24 Mnths): 14 605/8 002 Pct chng 14.7 - 26.7 - 8.0 - 4.3 - 7.8

REM P/E at 3 Dec 2021: 24.97 P/E at prd end 353.70 10.43 12.96 14.64 16.45

Hi/Lo REM P/E (3 Mnths): 391.91/24.22 Tr 5 yr avg 81.64 14.19 16.06 17.26 19.00

Hi/Lo Index P/E (3 Mnths): 12.21/7.91 Index prd end P/E 8.99 - 24.69 19.46 27.26 65.67

REM Volatility (36 Mnths): 7.54 Tr 5 yr avg 19.34 19.11 25.76 27.67 24.50

HEPS DPS (ZARc) NAV (ZAR/cps)

CONSENSUS 1100 18000

VIEW:

880 14400

BUY

BUY HOLD SELL 660 10800

440 7200

EARNINGS FORECASTS Jun 22 F Jun 23 F Jun 24 F

220 3600

HEPS HEPS HEPS

Number of contributors 4 3 1 0 Jun 17 Jun 18 Jun 19 Jun 20 Jun 21 0 Jun 17 Jun 18 Jun 19 Jun 20 Jun 21

High estimate 1 220.0 1 307.0 1 550.0

Low estimate 848.6 1 049.2 1 550.0 MORE RATIOS AND STATS (Finals only)

Standard deviation 136.2 107.7 - Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final Final Final

Profile Media Consensus 1 008.2 1 194.4 1 550.0

Sales/Share(c) 11 646.00 9 687.00 10 071.00 5 489.00 4 987.00

Pct change prev year 97.4% 18.5% 29.8%

Pct chng 20.2 - 3.8 83.5 10.1 - 5.5

Prospective P/E 12.6 10.7 8.2

Tr 5 yr avg 8 376.00 7 103.00 6 160.00 5 105.00 4 649.00

Fwd price: hi REM P/E, hi est 478135 512231 607466 Price/Sales ps 0.98 1.03 1.35 2.70 3.11

Fwd price: hi REM P/E, lo est 332578 411196 607466 Price/NAV 0.74 0.65 0.76 1.18 1.31

Fwd price: lo REM P/E, hi est 29549 31656 37542 Price/CashFlow 12.17 30.62 30.49 41.82 31.58

Fwd price: lo REM P/E, lo est 20554 25412 37542 Tr 3 yr avg TotRet - 6.05 - 11.08 - 6.79 - 4.58 - 0.68

Tr 5 yr avg TotRet - 6.99 - 9.43 - 1.73 3.42 12.24

DIVIDEND FORECASTS Jun 22 F Jun 23 F Jun 24 F Volatility 7.2 6.9 5.2 5.0 5.0

DPS DPS DPS

Number of contributors 2 2 1 Risk / Return Profile PEG inverse: 0.15

High estimate 180.0 350.0 324.0 100 30

Low estimate 174.8 254.0 324.0 PEG = 1

Standard deviation 2.6 48.0 -

Profile Media Consensus 177.4 302.0 324.0 3Yr Compound Return 40 5 Yr Average HEPS Growth

Pct change prev year 97.1% 70.2% 7.3%

Prospective DY 1.4% 2.4% 2.5%

-20 0

0 20 40 0 30

Historical PE Range Volatility P/E

HISTORICAL SHARE PRICE PERFORMANCE DATA

Annualised returns with divs reinvested to 30 Nov 21

p.a. Return Grwth in Annualised Volatility

R1000 Inflation

95.57 Avg High

52.47 Average 1 Yr 37.14% 1 371 4.95% 5.5

13.89 Avg Low

2017 2018 2019 2020 2021

2 Yr - 3.79% 926 4.06% 8.6

3 Yr - 3.12% 909 3.89% 7.7

5 Yr - 1.64% 921 4.29% 6.8

Lo PE Lo Lo PE Hi Hi PE Lo Hi PE Hi

REMGRO P/E

Est Est Est Est

7 Yr - 3.32% 789 4.69% 6.3

375.71 520000

10 Yrs 6.23% 1 830 4.96% 6.3

302.34 416000

228.97 312000

Total Return Index for REMGRO TRI Price

155.61 208000

10

82.24 104000 0

Percentage growthincluding dividends -20

8.87 0

| 2019 | 2020 | 2021 | 2022 | 2023 | -10

Forecast HEPS Growth Forecast DPS Growth -30

1600 330 -40

29.8% 7.3%

70.2%

1280 264 | 2017 | 2018 | 2019 | 2020 | 2021

18.5%

960 97.4% 198

97.1%

640 132

320 66

0 0

2021 2022 2023 2024 2021 2022 2023 2024

Actual Actual

195