Page 155 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 155

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – LAB

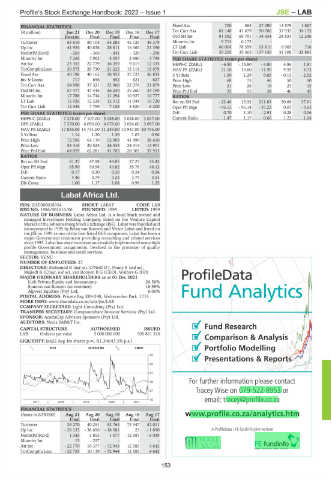

FINANCIAL STATISTICS Fixed Ass 700 583 27 090 13 579 1 867

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 Tot Curr Ass 81 148 41 479 90 706 37 932 34 175

Interim Final Final Final Final Ord SH Int 91 592 69 791 - 34 434 24 831 12 246

Turnover 63 616 80 104 64 285 45 725 46 379 Minority Int 9 713 6 172 - - -

Op Inc 41 924 40 838 28 811 16 360 21 390 LT Liab 66 004 78 559 93 810 6 965 716

NetIntPd(Rcvd) - 264 - 366 - 441 - 320 - 298 Tot Curr Liab 55 255 35 365 137 156 31 108 32 891

Minority Int 7 268 7 062 5 057 2 980 3 798 PER SHARE STATISTICS (cents per share)

Att Inc 23 353 22 779 16 259 9 615 12 335 HEPS-C (ZARc) - 6.50 - 15.80 - 4.80 4.86 1.81

TotCompIncLoss 30 575 29 730 21 225 13 118 15 679 NAV PS (ZARc) 21.10 19.60 - 11.90 9.59 4.73

Fixed Ass 40 198 40 165 38 953 37 723 36 833 3 Yr Beta 1.50 1.29 0.85 - 0.13 - 2.52

Inv & Loans 717 656 652 621 627 Price High 68 75 46 50 50

Tot Curr Ass 54 998 37 321 22 960 22 078 21 879 Price Low 21 26 16 23 15

Ord SH Int 57 477 47 446 36 230 35 260 34 769 Price Prd End 23 55 38 46 45

Minority Int 17 788 14 744 11 294 10 927 10 777 RATIOS

LT Liab 12 926 12 528 12 312 11 044 10 720 Ret on SH Fnd - 22.46 13.32 211.83 50.68 37.91

Tot Curr Liab 12 336 7 799 7 105 5 820 6 200 Oper Pft Mgn - 96.12 - 96.14 - 35.22 0.03 - 3.63

PER SHARE STATISTICS (cents per share) D:E 0.70 1.10 - 2.91 0.28 0.06

HEPS-C (ZARc) 7 278.00 7 107.00 5 088.00 3 028.00 3 047.00 Current Ratio 1.47 1.17 0.66 1.22 1.04

DPS (ZARc) 7 270.00 6 090.00 4 678.00 3 024.00 3 097.00

NAV PS (ZARc) 17 845.00 14 731.00 11 249.00 10 947.00 10 795.00

3 Yr Beta 1.14 1.20 1.36 1.03 0.96

Price High 72 596 64 119 52 903 41 490 38 610

Price Low 54 418 20 525 26 535 24 414 13 901

Price Prd End 64 059 62 281 41 705 28 305 37 913

RATIOS

Ret on SH Fnd 81.37 47.98 44.85 27.27 35.42

Oper Pft Mgn 65.90 50.98 44.82 35.78 46.12

D:E 0.17 0.20 0.26 0.24 0.24

Current Ratio 4.46 4.79 3.23 3.79 3.53

Div Cover 1.00 1.17 1.08 0.99 1.25

Labat Africa Ltd.

LAB

ISIN: ZAE000018354 SHORT: LABAT CODE: LAB

REG NO: 1986/001616/06 FOUNDED: 1995 LISTED: 1999

NATURE OF BUSINESS: Labat Africa Ltd. is a local black owned and

managed Investment Holding Company, listed on the Venture Capital

Market of the Johannesburg Stock Exchange (JSE). Labat was founded and

incorporated in 1995 by Brian van Rooyen and Victor Labat and listed on

the JSE in 1999 as one of the first listed BEE companies. Labat has been a

major Government contractor providing consulting and related services

since 1995. Labat has since inception successfully implemented manyhigh

profile Government assignments. Involved in the provision of quality

management, business and retail services.

SECTOR: VENC

NUMBER OF EMPLOYEES: 27

DIRECTORS: Mohamed R (ind ne), O'Neill D J, Penny B (ind ne),

Majiedt R (Chair, ind ne), van Rooyen B G (CEO), Walters G (FD)

MAJOR ORDINARY SHAREHOLDERS as at 01 Dec 2021

Link Private Equity and Investments 26.58%

Stanton van Rooyen (as nominee) 18.98%

Alpvest Equities (Pty) Ltd. 6.00%

POSTAL ADDRESS: Private Bag X09-248, Weltevreden Park, 1715

MORE INFO: www.sharedata.co.za/sdo/jse/LAB

COMPANY SECRETARY: Light Consulting (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: AcaciaCap Advisors Sponsors (Pty) Ltd.

AUDITORS: Nexia SAB&T Inc.

Fund Research

CAPITAL STRUCTURE AUTHORISED ISSUED

LAB Ords no par value 5 000 000 000 505 821 316

Comparison & Analysis

LIQUIDITY: Jan22 Avg 4m shares p.w., R1.3m(43.3% p.a.)

Portfolio Modelling

INDT 40 Week MA LABAT

75

Presentations & Reports

63

51

For further information please contact

39

Tracey Wise on 079-522-8953 or

27

15 email: tracey@profile.co.za

2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS

(Amts in ZAR'000) Aug 21 Aug 20 Aug 19 Aug 18 Aug 17 www.profile.co.za/analytics.htm

Final Final Final Final Final

Turnover 29 270 40 251 52 764 73 347 52 011

Op Inc - 28 135 - 38 696 - 18 581 23 - 1 890 A ProfileData / FE fundinfo joint venture

NetIntPd(Rcvd) 1 343 1 853 1 077 - 12 587 - 6 039

Minority Int 15 - 257 - - -

Att Inc - 22 770 10 377 - 72 943 12 585 4 642

TotCompIncLoss - 22 755 10 119 - 72 944 12 585 4 642

153