Page 150 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 150

JSE – ITA Profile’s Stock Exchange Handbook: 2022 – Issue 1

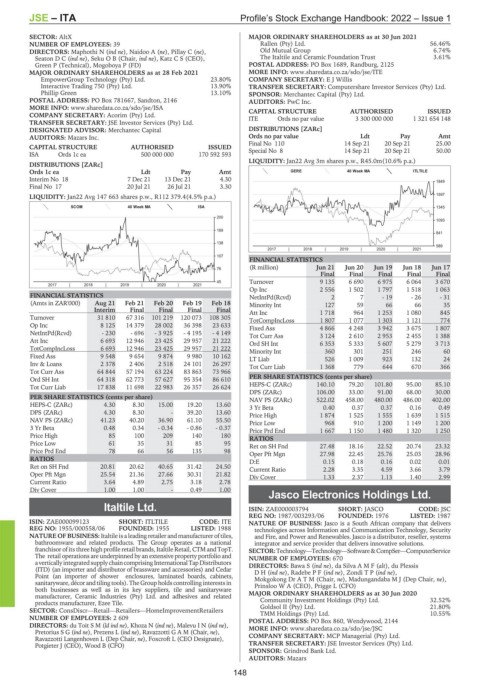

SECTOR: AltX MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021

NUMBER OF EMPLOYEES: 39 Rallen (Pty) Ltd. 56.46%

DIRECTORS: Maphothi N (ind ne), Naidoo A (ne), Pillay C (ne), Old Mutual Group 6.74%

SeatonDC(ind ne), Seku O B (Chair, ind ne), Katz C S (CEO), The Italtile and Ceramic Foundation Trust 3.61%

Green P (Technical), Mogoboya P (FD) POSTAL ADDRESS: PO Box 1689, Randburg, 2125

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021 MORE INFO: www.sharedata.co.za/sdo/jse/ITE

EmpowerGroup Technology (Pty) Ltd. 23.80% COMPANY SECRETARY: E J Willis

Interactive Trading 750 (Pty) Ltd. 13.90% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Phillip Green 13.10% SPONSOR: Merchantec Capital (Pty) Ltd.

POSTAL ADDRESS: PO Box 781667, Sandton, 2146 AUDITORS: PwC Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/ISA CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: Acorim (Pty) Ltd. ITE Ords no par value 3 300 000 000 1 321 654 148

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: Merchantec Capital DISTRIBUTIONS [ZARc]

AUDITORS: Mazars Inc. Ords no par value Ldt Pay Amt

Final No 110 14 Sep 21 20 Sep 21 25.00

CAPITAL STRUCTURE AUTHORISED ISSUED Special No 8 14 Sep 21 20 Sep 21 50.00

ISA Ords 1c ea 500 000 000 170 592 593

LIQUIDITY: Jan22 Avg 3m shares p.w., R45.0m(10.6% p.a.)

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt GERE 40 Week MA ITLTILE

Interim No 18 7 Dec 21 13 Dec 21 4.30

1849

Final No 17 20 Jul 21 26 Jul 21 3.30

LIQUIDITY: Jan22 Avg 147 663 shares p.w., R112 379.4(4.5% p.a.) 1597

SCOM 40 Week MA ISA 1345

200

1093

169

841

138

589

2017 | 2018 | 2019 | 2020 | 2021

107

FINANCIAL STATISTICS

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

76

Final Final Final Final Final

45 Turnover 9 135 6 690 6 975 6 064 3 670

2017 | 2018 | 2019 | 2020 | 2021

Op Inc 2 556 1 502 1 797 1 518 1 063

FINANCIAL STATISTICS NetIntPd(Rcvd) 2 7 - 19 - 26 - 31

(Amts in ZAR'000) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18 Minority Int 127 59 66 66 35

Interim Final Final Final Final Att Inc 1 718 964 1 253 1 080 845

Turnover 31 810 67 316 101 219 120 073 108 305 TotCompIncLoss 1 807 1 077 1 303 1 121 774

Op Inc 8 125 14 379 28 002 36 398 23 633 Fixed Ass 4 866 4 248 3 942 3 675 1 807

NetIntPd(Rcvd) - 230 - 696 - 3 925 - 4 195 - 4 149

Tot Curr Ass 3 124 2 610 2 953 2 455 1 388

Att Inc 6 693 12 946 23 425 29 957 21 222 Ord SH Int 6 353 5 333 5 607 5 279 3 713

TotCompIncLoss 6 693 12 946 23 425 29 957 21 222 Minority Int 360 301 251 246 60

Fixed Ass 9 548 9 654 9 874 9 980 10 162 LT Liab 526 1 009 923 132 24

Inv & Loans 2 378 2 406 2 518 24 101 26 297 Tot Curr Liab 1 368 779 644 670 366

Tot Curr Ass 64 844 57 194 63 224 83 863 73 966

Ord SH Int 64 318 62 773 57 627 95 354 86 610 PER SHARE STATISTICS (cents per share)

Tot Curr Liab 17 838 11 698 22 983 26 357 26 624 HEPS-C (ZARc) 140.10 79.20 101.80 95.00 85.10

DPS (ZARc) 106.00 33.00 91.00 68.00 30.00

PER SHARE STATISTICS (cents per share) NAV PS (ZARc) 522.02 458.00 480.00 486.00 402.00

HEPS-C (ZARc) 4.30 8.30 15.00 19.20 13.60 3 Yr Beta 0.40 0.37 0.37 0.16 0.49

DPS (ZARc) 4.30 8.30 - 39.20 13.60 Price High 1 874 1 525 1 555 1 639 1 515

NAV PS (ZARc) 41.23 40.20 36.90 61.10 55.50 Price Low 968 910 1 200 1 149 1 200

3 Yr Beta 0.48 0.34 - 0.34 - 0.86 - 0.37 Price Prd End 1 667 1 150 1 480 1 320 1 250

Price High 85 100 209 140 180 RATIOS

Price Low 61 35 31 85 95 Ret on SH Fnd 27.48 18.16 22.52 20.74 23.32

Price Prd End 78 66 56 135 98 Oper Pft Mgn 27.98 22.45 25.76 25.03 28.96

RATIOS D:E 0.15 0.18 0.16 0.02 0.01

Ret on SH Fnd 20.81 20.62 40.65 31.42 24.50 Current Ratio 2.28 3.35 4.59 3.66 3.79

Oper Pft Mgn 25.54 21.36 27.66 30.31 21.82 Div Cover 1.33 2.37 1.13 1.40 2.99

Current Ratio 3.64 4.89 2.75 3.18 2.78

Div Cover 1.00 1.00 - 0.49 1.00

Jasco Electronics Holdings Ltd.

Italtile Ltd. ISIN: ZAE000003794 SHORT: JASCO CODE: JSC

JAS

REG NO: 1987/003293/06 FOUNDED: 1976 LISTED: 1987

ITA

ISIN: ZAE000099123 SHORT: ITLTILE CODE: ITE NATURE OF BUSINESS: Jasco is a South African company that delivers

REG NO: 1955/000558/06 FOUNDED: 1955 LISTED: 1988 technologies across Information and Communication Technology, Security

NATURE OF BUSINESS: Italtile is a leading retailer and manufacturer of tiles, and Fire, and Power and Renewables. Jasco is a distributor, reseller, systems

bathroomware and related products. The Group operates as a national integrator and service provider that delivers innovative solutions.

franchisor of its three high profile retail brands, Italtile Retail, CTM and TopT. SECTOR:Technology—Technology—Software&CompSer—ComputerService

The retail operations are underpinned by an extensive property portfolio and NUMBER OF EMPLOYEES: 670

averticallyintegratedsupplychaincomprisingInternationalTapDistributors DIRECTORS: Bawa S (ind ne), da SilvaAMF(alt), du Plessis

(ITD) (an importer and distributor of brassware and accessories) and Cedar DH(ind ne), RadebePF(ind ne), ZondiTP(ind ne),

Point (an importer of shower enclosures, laminated boards, cabinets, Mokgokong DrATM (Chair, ne), Madungandaba M J (Dep Chair, ne),

sanitaryware, décor andtiling tools). The Group holdscontrolling interestsin Prinsloo W A (CEO), Prigge L (CFO)

both businessesaswellasinits key suppliers, tile and sanitaryware MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

manufacturer, Ceramic Industries (Pty) Ltd. and adhesives and related

products manufacturer, Ezee Tile. Community Investment Holdings (Pty) Ltd. 32.52%

SECTOR: ConsDiscr—Retail—Retailers—HomeImprovementRetailers Goldsol II (Pty) Ltd. 21.80%

TMM Holdings (Pty) Ltd.

10.55%

NUMBER OF EMPLOYEES: 2 609 POSTAL ADDRESS: PO Box 860, Wendywood, 2144

DIRECTORS: du ToitSM(ld ind ne), Khoza N (ind ne), Malevu I N (ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/JSC

Pretorius S G (ind ne), Prezens L (ind ne), Ravazzotti G A M (Chair, ne),

Ravazzotti Langenhoven L (Dep Chair, ne), Foxcroft L (CEO Designate), COMPANY SECRETARY: MCP Managerial (Pty) Ltd.

Potgieter J (CEO), Wood B (CFO) TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: Grindrod Bank Ltd.

AUDITORS: Mazars

148