Page 156 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 156

JSE – LEW Profile’s Stock Exchange Handbook: 2022 – Issue 1

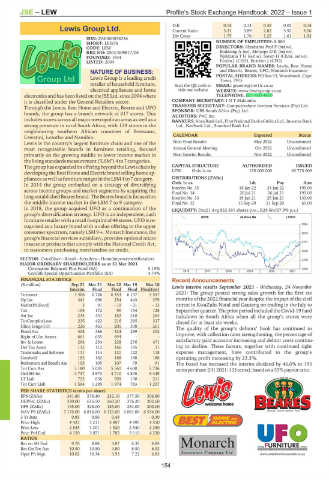

D:E 0.15 0.13 0.35 0.03 0.14

Lewis Group Ltd. Current Ratio 3.31 3.89 2.82 5.92 4.56

LEW Div Cover 1.75 1.76 1.25 1.61 1.53

ISIN: ZAE000058236

SHORT: LEWIS NUMBER OF EMPLOYEES: 8 880

CODE: LEW DIRECTORS: Abrahams Prof F (ind ne),

REG NO: 2004/009817/06 Bodasing A (ne), MotsepeDR(ind ne),

FOUNDED: 1934 NjikizanaTH(ind ne), Saven H (Chair, ind ne),

LISTED: 2004 Enslin J (CEO), Bestbier J (CFO)

POPULAR BRAND NAMES: Lewis, Best Home

NATURE OF BUSINESS: and Electric, Beares, UFO, Monarch Insurance

Lewis Group is a leading credit POSTAL ADDRESS: PO Box 43, Woodstock, Cape

Town, 7915

retailer of household furniture, Scan the QR code to EMAIL: graeme@tier1ir.co.za

electrical appliances and home visit our website WEBSITE: www.lewisgroup.co.za

electronicsandhasbeenlisted ontheJSELtd. since2004where TELEPHONE: 021-460-4400

it is classified under the General Retailers sector. COMPANY SECRETARY: I N T Makomba

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Through the Lewis, Best Home and Electric, Beares and UFO SPONSOR: UBS South Africa (Pty) Ltd.

brands, the group has a branch network of 817 stores. This AUDITORS: PwC Inc.

includes stores across all major metropolitan areas as well as a BANKERS:AbsaBankLtd.,FirstNationalBankofAfricaLtd.,InvestecBank

strong presence in rural South Africa, with 129 stores in the Ltd., Nedbank Ltd., Standard Bank Ltd.

neighbouring southern African countries of Botswana,

CALENDAR Expected Status

Eswatini, Lesotho and Namibia.

Lewis is the country's largest furniture chain and one of the Next Final Results May 2022 Unconfirmed

most recognisable brands in furniture retailing, focused Annual General Meeting Oct 2022 Unconfirmed

primarily on the growing middle to lower income market in Next Interim Results Nov 2022 Unconfirmed

thelivingstandardsmeasurement("LSM")4to7categories.

ThegrouphasexpandeditsofferingbeyondtheLewischainby CAPITAL STRUCTURE AUTHORISED ISSUED

developing the Best Home and Electric brand selling home ap- LEW Ords 1c ea 150 000 000 63 775 009

pliancesaswellasfurniturerangesintheLSM4to7category. DISTRIBUTIONS [ZARc]

In 2014 the group embarked on a strategy of diversifying Ords 1c ea Ldt Pay Amt

across income groups and market segments by acquiring the Interim No 35 18 Jan 22 24 Jan 22 195.00

Final No 34 20 Jul 21 26 Jul 21 195.00

long-establishedBeares brand. The Beares brand is focusedon Interim No 33 19 Jan 21 25 Jan 21 133.00

the middle-income market in the LSM 7 to 9 category. Final No 32 15 Sep 20 21 Sep 20 65.00

In 2018, the group acquired UFO as a continuation of the LIQUIDITY: Dec21 Avg 832 391 shares p.w., R29.6m(67.9% p.a.)

group’s diversification strategy. UFO is an independent, cash

GERE 40 Week MA LEWIS

furniture retailer with a retail footprintof44 stores. UFOis re-

7084

cognised as a luxury brand with a value offering to the upper

consumerspectrum, namelyLSM9+.MonarchInsurance,the 5915

group's financial services subsidiary, provides optional micro

4747

insurance products that comply with the National Credit Act,

to customers purchasing merchandise on credit. 3578

SECTOR: ConsDiscr—Retail—Retailers—HomeImprovementRetailers 2409

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021

Coronation Balanced Plus Fund (SA) 5.15% 1240

Corolife Special Opportunities Portfolio (SA) 4.74% 2016 | 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS Recent Announcements

(R million) Sep 21 Mar 21 Mar 20 Mar 19 Mar 18 Lewis interim results September 2021 - Wednesday, 24 November

Interim Final Final Final Final(rst)

Turnover 3 406 6 726 6 453 6 137 5 557 2021: The group posted strong sales growth for the first six

Op Inc 341 696 254 443 379 months of the 2022 financial year despite the impact of the civil

NetIntPd(Rcvd) 3 91 - 19 - 21 - 13 unrest in KwaZulu-Natal and Gauteng on trading in the July to

Tax 104 172 90 154 128 Septemberquarter.Theprior period includedtheCovid-19hard

Att Inc 234 433 182 310 264 lockdown in South Africa when all the group’s stores were

TotCompIncLoss 235 422 216 295 317 closed for at least six weeks.

Hline Erngs-CO 226 463 205 308 261 The quality of the group’s debtors’ book has continued to

Fixed Ass 408 386 324 299 302 improve, with collection rates strengthening, the percentage of

Right of Use Assets 661 635 694 - -

Inv & Loans 264 254 228 276 471 satisfactory paid accounts increasing and debtor costs continu-

Def Tax Asset 115 112 166 195 11 ing to decline. These factors, together with continued tight

Trademarks and Software 111 114 121 122 118 expense management, have contributed to the group’s

Goodwill 182 182 188 188 188 operating profit increasing by 23.3%.

Retirement and Benefit Ass 105 105 107 79 91 The board has increased the interim dividend by 46.6% to 195

Tot Curr Ass 5 180 5 035 5 561 4 630 5 736 centspershare(H12021:133cents),basedona55%payoutratio.

Ord SH Int 4 737 4 873 4 710 4 876 5 449

LT Liab 725 656 705 130 211

Tot Curr Liab 1 564 1 295 1 974 783 1 257

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 341.80 576.40 232.10 377.50 306.80

HEPS-C (ZARc) 330.00 616.50 260.20 376.20 302.60

DPS (ZARc) 195.00 328.00 185.00 234.00 200.00

NAV PS (ZARc) 7 176.00 6 814.00 6 126.00 6 081.00 6 534.00

3 Yr Beta 0.85 0.86 0.48 - - 0.30

Price High 4 423 3 211 3 897 4 995 4 550

Price Low 2 835 1 201 1 520 2 540 2 250

Price Prd End 4 150 3 071 1 782 3 110 4 220

RATIOS

Ret on SH Fnd 9.70 8.88 3.87 6.35 4.85

Ret On Tot Ass 10.50 10.50 4.80 8.50 6.92

Oper Pft Mgn 10.02 10.34 3.93 7.22 6.83

154