Page 159 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 159

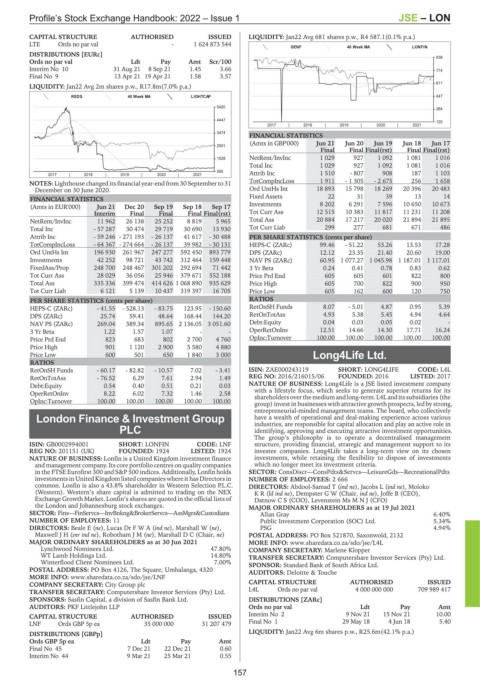

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – LON

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jan22 Avg 681 shares p.w., R4 587.1(0.1% p.a.)

LTE Ords no par val - 1 624 873 544

GENF 40 Week MA LONFIN

DISTRIBUTIONS [EURc]

938

Ords no par val Ldt Pay Amt Scr/100

Interim No 10 31 Aug 21 8 Sep 21 1.45 3.66 774

Final No 9 13 Apr 21 19 Apr 21 1.58 3.57

611

LIQUIDITY: Jan22 Avg 2m shares p.w., R17.8m(7.0% p.a.)

REDS 40 Week MA LIGHTCAP 447

5420

284

4447 120

2017 | 2018 | 2019 | 2020 | 2021

3474

FINANCIAL STATISTICS

(Amts in GBP'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

2501

Final Final Final(rst) Final Final(rst)

1528 NetRent/InvInc 1 029 927 1 092 1 081 1 016

Total Inc 1 029 927 1 092 1 081 1 016

555 Attrib Inc 1 510 - 807 908 187 1 103

2017 | 2018 | 2019 | 2020 | 2021

NOTES: Lighthouse changed its financial year-end from 30 September to 31 TotCompIncLoss 1 911 - 1 305 - 2 675 256 1 658

December on 30 June 2020. Ord UntHs Int 18 893 15 798 18 269 20 396 20 483

FINANCIAL STATISTICS Fixed Assets 22 31 39 13 14

(Amts in EUR'000) Jun 21 Dec 20 Sep 19 Sep 18 Sep 17 Investments 8 202 6 291 7 596 10 650 10 673

Interim Final Final Final Final(rst) Tot Curr Ass 12 515 10 383 11 817 11 231 11 208

NetRent/InvInc 11 962 26 138 25 252 8 819 5 965 Total Ass 20 884 17 217 20 020 21 894 21 895

Total Inc - 57 287 30 474 29 719 30 690 13 930 Tot Curr Liab 299 277 681 671 486

Attrib Inc - 59 246 - 271 193 - 26 137 41 617 - 30 488 PER SHARE STATISTICS (cents per share)

TotCompIncLoss - 64 367 - 274 664 - 26 137 39 982 - 30 131 HEPS-C (ZARc) 99.46 - 51.22 53.26 13.53 17.28

Ord UntHs Int 196 930 261 967 247 277 592 450 893 779 DPS (ZARc) 12.12 23.35 21.40 20.60 19.00

Investments 42 252 98 721 43 742 312 464 159 448 NAV PS (ZARc) 60.95 1 077.27 1 045.98 1 187.01 1 117.01

FixedAss/Prop 248 700 248 467 301 202 292 694 71 442 3 Yr Beta 0.24 0.41 0.78 0.83 0.62

Tot Curr Ass 28 029 36 056 25 946 379 671 552 188 Price Prd End 605 605 601 822 800

Total Ass 335 336 399 474 414 626 1 068 890 935 629 Price High 605 700 822 900 950

Tot Curr Liab 6 121 5 139 10 437 319 397 16 705 Price Low 605 162 600 120 750

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) - 41.55 - 528.13 - 83.75 123.95 - 150.60 RetOnSH Funds 8.07 - 5.01 4.87 0.95 5.39

DPS (ZARc) 25.74 59.41 48.64 168.44 144.20 RetOnTotAss 4.93 5.38 5.45 4.94 4.64

NAV PS (ZARc) 269.04 389.34 895.65 2 136.05 3 051.60 Debt:Equity 0.04 0.03 0.05 0.02 -

3 Yr Beta 1.22 1.57 1.07 - - OperRetOnInv 12.51 14.66 14.30 17.71 16.24

Price Prd End 823 683 802 2 700 4 760 OpInc:Turnover 100.00 100.00 100.00 100.00 100.00

Price High 901 1 120 2 900 5 580 4 880

Price Low 600 501 650 1 840 3 000 Long4Life Ltd.

RATIOS

LON

RetOnSH Funds - 60.17 - 82.82 - 10.57 7.02 - 3.41 ISIN: ZAE000243119 SHORT: LONG4LIFE CODE: L4L

RetOnTotAss - 76.52 6.29 7.61 2.94 1.49 REG NO: 2016/216015/06 FOUNDED: 2016 LISTED: 2017

Debt:Equity 0.54 0.40 0.51 0.21 0.03 NATURE OF BUSINESS: Long4Life is a JSE listed investment company

OperRetOnInv 8.22 6.02 7.32 1.46 2.58 with a lifestyle focus, which seeks to generate superior returns for its

shareholdersoverthe medium andlong-term. L4Landitssubsidiaries (the

OpInc:Turnover 100.00 100.00 100.00 100.00 100.00

group) invest in businesses with attractive growth prospects, led by strong,

entrepreneurial-minded management teams. The board, who collectively

London Finance & Investment Group have a wealth of operational and deal-making experience across various

industries, are responsible for capital allocation and play an active role in

PLC identifying, approving and executing attractive investment opportunities.

The group’s philosophy is to operate a decentralised management

LON

ISIN: GB0002994001 SHORT: LONFIN CODE: LNF structure, providing financial, strategic and management support to its

REG NO: 201151 (UK) FOUNDED: 1924 LISTED: 1924 investee companies. Long4Life takes a long-term view on its chosen

NATURE OF BUSINESS: Lonfin is a United Kingdom investment finance investments, while retaining the flexibility to dispose of investments

and management company. Its core portfolio centres on quality companies which no longer meet its investment criteria.

in the FTSE Eurofirst 300 and S&P 500 indices. Additionally, Lonfin holds SECTOR: ConsDiscr—ConsPdts&Servcs—LeisureGds—RecreationalPdts

investments in United Kingdom listed companies where it has Directors in NUMBER OF EMPLOYEES: 2 666

common. Lonfin is also a 43.8% shareholder in Western Selection P.L.C. DIRECTORS: Abdool-Samad T (ind ne), Jacobs L (ind ne), Moloko

(Western). Western’s share capital is admitted to trading on the NEX KR(ld ind ne), Dempster G W (Chair, ind ne), Joffe B (CEO),

Exchange Growth Market. Lonfin’s shares are quoted in the official lists of Datnow C S (COO), Levenstein MsMNJ (CFO)

the London and Johannesburg stock exchanges. MAJOR ORDINARY SHAREHOLDERS as at 19 Jul 2021

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians Allan Gray 6.40%

NUMBER OF EMPLOYEES: 11 Public Investment Corporation (SOC) Ltd. 5.34%

DIRECTORS: Beale E (ne), Lucas DrFWA(ind ne), Marshall W (ne), PSG 4.94%

MaxwellJH(snr ind ne), RobothamJM(ne), Marshall D C (Chair, ne) POSTAL ADDRESS: PO Box 521870, Saxonwold, 2132

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021 MORE INFO: www.sharedata.co.za/sdo/jse/L4L

Lynchwood Nominees Ltd. 47.80% COMPANY SECRETARY: Marlene Klopper

WT Lamb Holdings Ltd. 14.80% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Winterflood Client Nominees Ltd. 7.00% SPONSOR: Standard Bank of South Africa Ltd.

POSTAL ADDRESS: PO Box 4126, The Square, Umhalanga, 4320 AUDITORS: Deloitte & Touche

MORE INFO: www.sharedata.co.za/sdo/jse/LNF

COMPANY SECRETARY: City Group plc CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. L4L Ords no par val 4 000 000 000 709 989 417

SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd. DISTRIBUTIONS [ZARc]

AUDITORS: PKF Littlejohn LLP Ords no par val Ldt Pay Amt

CAPITAL STRUCTURE AUTHORISED ISSUED Interim No 2 9 Nov 21 15 Nov 21 10.00

LNF Ords GBP 5p ea 35 000 000 31 207 479 Final No 1 29 May 18 4 Jun 18 5.40

DISTRIBUTIONS [GBPp] LIQUIDITY: Jan22 Avg 6m shares p.w., R25.6m(42.1% p.a.)

Ords GBP 5p ea Ldt Pay Amt

Final No 45 7 Dec 21 22 Dec 21 0.60

Interim No 44 9 Mar 21 25 Mar 21 0.55

157