Page 148 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 148

JSE – INV Profile’s Stock Exchange Handbook: 2022 – Issue 1

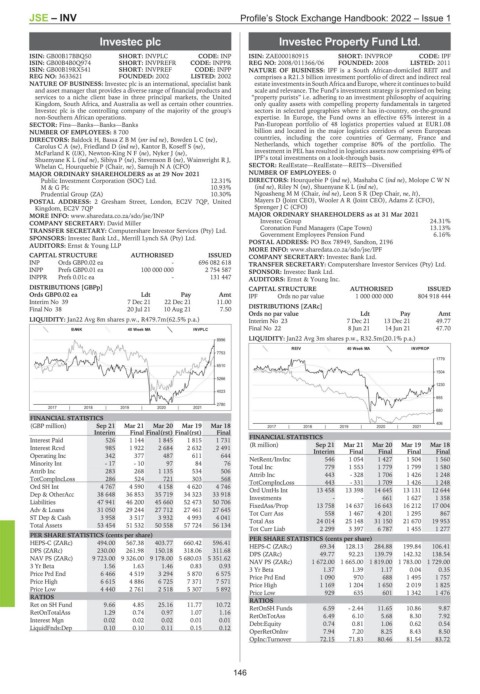

Investec plc Investec Property Fund Ltd.

INV INV

ISIN: GB00B17BBQ50 SHORT: INVPLC CODE: INP ISIN: ZAE000180915 SHORT: INVPROP CODE: IPF

ISIN: GB00B4B0Q974 SHORT: INVPREFR CODE: INPPR REG NO: 2008/011366/06 FOUNDED: 2008 LISTED: 2011

ISIN: GB00B19RX541 SHORT: INVPREF CODE: INPP NATURE OF BUSINESS: IPF is a South African-domiciled REIT and

REG NO: 3633621 FOUNDED: 2002 LISTED: 2002 comprises a R21.3 billion investment portfolio of direct and indirect real

NATURE OF BUSINESS: Investec plc is an international, specialist bank estate investments in South Africa and Europe, where it continues to build

and asset manager that provides a diverse range of financial products and scale and relevance. The Fund’s investment strategy is premised on being

services to a niche client base in three principal markets, the United “property purists” i.e. adhering to an investment philosophy of acquiring

Kingdom, South Africa, and Australia as well as certain other countries. only quality assets with compelling property fundamentals in targeted

Investec plc is the controlling company of the majority of the group's sectors in selected geographies where it has in-country, on-the-ground

non-Southern African operations. expertise. In Europe, the Fund owns an effective 65% interest in a

SECTOR: Fins—Banks—Banks—Banks Pan-European portfolio of 48 logistics properties valued at EUR1.08

NUMBER OF EMPLOYEES: 8 700 billion and located in the major logistics corridors of seven European

DIRECTORS: Baldock H, BassaZBM(snr ind ne), BowdenLC(ne), countries, including the core countries of Germany, France and

CarolusCA(ne), Friedland D (ind ne), Kantor B, Koseff S (ne), Netherlands, which together comprise 80% of the portfolio. The

McFarland K (UK), Newton-KingNF(ne), Nyker J (ne), investment in PEL has resulted in logistics assets now comprising 49% of

ShuenyaneKL(ind ne), Sibiya P (ne), Stevenson B (ne), Wainwright R J, IPF’s total investments on a look-through basis.

Whelan C, Hourquebie P (Chair, ne), Samujh N A (CFO) SECTOR: RealEstate—RealEstate—REITS—Diversified

MAJOR ORDINARY SHAREHOLDERS as at 29 Nov 2021 NUMBER OF EMPLOYEES: 0

Public Investment Corporation (SOC) Ltd. 12.31% DIRECTORS: Hourquebie P (ind ne), Mashaba C (ind ne), MolopeCWN

M & G Plc 10.93% (ind ne), Riley N (ne), ShuenyaneKL(ind ne),

Prudential Group (ZA) 10.30% Ngoasheng M M (Chair, ind ne), Leon S R (Dep Chair, ne, It),

POSTAL ADDRESS: 2 Gresham Street, London, EC2V 7QP, United Mayers D (Joint CEO), Wooler A R (Joint CEO), Adams Z (CFO),

Kingdom, EC2V 7QP Sprenger J C (CFO)

MORE INFO: www.sharedata.co.za/sdo/jse/INP MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021

COMPANY SECRETARY: David Miller Investec Group 24.31%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Coronation Fund Managers (Cape Town) 13.13%

6.16%

Government Employees Pension Fund

SPONSORS: Investec Bank Ltd., Merrill Lynch SA (Pty) Ltd.

AUDITORS: Ernst & Young LLP POSTAL ADDRESS: PO Box 78949, Sandton, 2196

MORE INFO: www.sharedata.co.za/sdo/jse/IPF

CAPITAL STRUCTURE AUTHORISED ISSUED COMPANY SECRETARY: Investec Bank Ltd.

INP Ords GBP0.02 ea - 696 082 618 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

INPP Prefs GBP0.01 ea 100 000 000 2 754 587 SPONSOR: Investec Bank Ltd.

INPPR Prefs 0.01c ea - 131 447 AUDITORS: Ernst & Young Inc.

DISTRIBUTIONS [GBPp] CAPITAL STRUCTURE AUTHORISED ISSUED

Ords GBP0.02 ea Ldt Pay Amt IPF Ords no par value 1 000 000 000 804 918 444

Interim No 39 7 Dec 21 22 Dec 21 11.00

Final No 38 20 Jul 21 10 Aug 21 7.50 DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

LIQUIDITY: Jan22 Avg 8m shares p.w., R479.7m(62.5% p.a.) Interim No 23 7 Dec 21 13 Dec 21 49.77

BANK 40 Week MA INVPLC Final No 22 8 Jun 21 14 Jun 21 47.70

LIQUIDITY: Jan22 Avg 3m shares p.w., R32.5m(20.1% p.a.)

8996

REIV 40 Week MA INVPROP

7753

1779

6510

1504

5266

1230

4023

955

2780

2017 | 2018 | 2019 | 2020 | 2021

680

FINANCIAL STATISTICS

(GBP million) Sep 21 Mar 21 Mar 20 Mar 19 Mar 18 2017 | 2018 | 2019 | 2020 | 2021 406

Interim Final Final(rst) Final(rst) Final

Interest Paid 526 1 144 1 845 1 815 1 731 FINANCIAL STATISTICS

Sep 21

Interest Rcvd 985 1 922 2 684 2 632 2 491 (R million) Interim Mar 21 Mar 20 Mar 19 Mar 18

Final

Final

Final

Final

Operating Inc 342 377 487 611 644 NetRent/InvInc 546 1 054 1 427 1 504 1 560

Minority Int - 17 - 10 97 84 76

Total Inc 779 1 553 1 779 1 799 1 580

Attrib Inc 283 268 1 135 534 506 Attrib Inc 443 - 328 1 706 1 426 1 248

TotCompIncLoss 286 524 721 303 568 TotCompIncLoss 443 - 331 1 709 1 426 1 248

Ord SH Int 4 767 4 590 4 158 4 620 4 746 Ord UntHs Int 13 458 13 398 14 645 13 131 12 644

Dep & OtherAcc 38 648 36 853 35 719 34 323 33 918 Investments - - 661 1 627 1 358

Liabilities 47 941 46 200 45 660 52 473 50 706 FixedAss/Prop 13 758 14 637 16 643 16 212 17 004

Adv & Loans 31 050 29 244 27 712 27 461 27 645 Tot Curr Ass 558 1 467 4 201 1 295 867

ST Dep & Cash 3 958 3 517 3 932 4 993 4 041 Total Ass 24 014 25 148 31 150 21 670 19 953

Total Assets 53 454 51 532 50 558 57 724 56 134

Tot Curr Liab 2 299 3 397 6 787 1 455 1 277

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 494.00 567.38 403.77 660.42 596.41 HEPS-C (ZARc) 69.34 128.13 284.88 199.84 106.41

DPS (ZARc) 230.00 261.98 150.18 318.06 311.68 DPS (ZARc) 49.77 92.23 139.79 142.32 138.54

NAV PS (ZARc) 9 723.00 9 326.00 9 178.00 5 680.03 5 351.62 NAV PS (ZARc) 1 672.00 1 665.00 1 819.00 1 783.00 1 729.00

3 Yr Beta 1.56 1.63 1.46 0.83 0.93 3 Yr Beta 1.37 1.39 1.17 0.04 0.35

Price Prd End 6 466 4 519 3 294 5 870 6 575 Price Prd End 1 090 970 688 1 495 1 757

Price High 6 615 4 886 6 725 7 371 7 571 Price High 1 169 1 204 1 650 2 019 1 825

Price Low 4 440 2 761 2 518 5 307 5 892 Price Low 929 635 601 1 342 1 476

RATIOS RATIOS

Ret on SH Fund 9.66 4.85 25.16 11.77 10.72 RetOnSH Funds 6.59 - 2.44 11.65 10.86 9.87

RetOnTotalAss 1.29 0.74 0.97 1.07 1.16 RetOnTotAss 6.49 6.10 5.68 8.30 7.92

Interest Mgn 0.02 0.02 0.02 0.01 0.01 Debt:Equity 0.74 0.81 1.06 0.62 0.54

LiquidFnds:Dep 0.10 0.10 0.11 0.15 0.12

OperRetOnInv 7.94 7.20 8.25 8.43 8.50

OpInc:Turnover 72.15 71.83 80.46 81.54 83.72

146