Page 193 - SHB 2021 Issue 4

P. 193

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – RED

Redefine Properties Ltd. Reinet Investments SCA

RED REI

ISIN: ZAE000190252 ISIN: LU0383812293 SHORT: REINET CODE: RNI

SHORT: REDEFINE REG NO: B16576 FOUNDED: 2008 LISTED: 2008

CODE: RDF NATUREOF BUSINESS:Reinet wasestablished on21 October 2008 when

REG NO: 1999/018591/06

FOUNDED: 1999 the former Richemont SA changed its legal form to that of a partnership

LISTED: 2000 limited by shares and adopted the name Reinet Investments S.C.A.

NATURE OF BUSINESS: Redefine is a At the same time as it changed its legal status, Richemont SA redeemed its

South African-based Real Estate ordinary capital, which was held exclusively by Compagnie Financière

Investment Trust (REIT), with a sectoral and geographically diversified Richemont SA ("CFR"), by way of the distribution to CFR of its entire

property asset platform valued at R75.3 billion (FY20: R81.0 billion). luxury goods interests. In consequence, CFR became a specifically focused

Redefine’s portfolio is predominately anchored in local directly held retail, luxury goods company and Reinet was established as an investment

office and industrial properties, which is complemented by retail and vehicle, theprincipalassetofwhich wastheformerRichemont’sinterestin

logistics property assets in Poland. British American Tobacco.

SECTOR: RealEstate—RealEstate—REITS—Diversified SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs

NUMBER OF EMPLOYEES: 492 NUMBER OF EMPLOYEES: 12

DIRECTORS: Barkhuysen M (ind ne), DambuzaASP(ind ne), DIRECTORS: GrieveJA(ne, UK), Malherbe J (ne), Rupert J P (Chair),

Langa-RoydsNB(ind ne), Matthews B (ld ind ne), Naidoo D (ind ne),

Radley D (ind ne), SenneloLJ(ind ne), Pityana S M (Chair, ind ne), van Zyl W H (CEO)

Konig A J (CEO), Kok L C (COO), Nyawo N G (CFO) MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2020 Anton Rupert Trust 24.93%

Government Employees Pension Fund 13.29% Allan Gray Unit Trust Management (RF) (Pty) Ltd. 4.97%

Coronation Fund Managers 9.32% Prudential Investment Managers 3.80%

Ninety One Group 8.77% POSTAL ADDRESS: 35, Boulevard Prince Henri, L-1724 Luxembourg,

POSTAL ADDRESS:PostNetSuite264, PrivateBagX31,Saxonwold,2132 Grand Duchy of Luxembourg

EMAIL: investorenquiries@redefine.co.za MORE INFO: www.sharedata.co.za/sdo/jse/RNI

WEBSITE: www.redefine.co.za

TELEPHONE: 011-283-0000 COMPANY SECRETARY: S H Grundmann

COMPANY SECRETARY: Thembekile Dube (acting) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

SPONSOR: Java Capital AUDITORS: PwC Sàrl

AUDITORS: PwC Inc. CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED RNI Ords no par value - 195 941 286

RDF Ords no par 10 000 000 000 5 793 183 207 DISTRIBUTIONS [EURc]

DISTRIBUTIONS [ZARc] Dep Receipts Ldt Pay Amt

Ords no par Ldt Pay Amt Scr/100 Final No 4 5 Sep 17 15 Sep 17 1.65

Final No 61 19 Nov 19 25 Nov 19 48.13 - Final No 3 6 Sep 16 16 Sep 16 1.61

Interim No 60 21 May 19 27 May 19 49.19 5.18 LIQUIDITY: Oct21 Ave 2m shares p.w., R536.6m(49.2% p.a.)

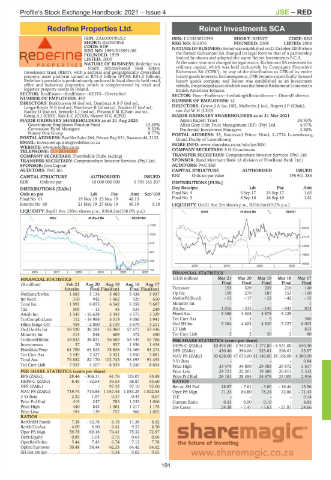

LIQUIDITY: Sep21 Ave 120m shares p.w., R364.2m(108.0% p.a.) GENF 40 Week MA REINET

REIV 40 Week MA REDEFINE

1229

30924

1022

27216

814

23508

607

19800

399

16093

2018 | 2019 | 2020 | 2021

192

2016 | 2017 | 2018 | 2019 | 2020 | 2021 FINANCIAL STATISTICS

FINANCIAL STATISTICS (EUR million) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17

(R million) Feb 21 Aug 20 Aug 19 Aug 18 Aug 17 Final Final Final Final Final

Interim Final Final(rst) Final Final(rst) Turnover 153 329 239 210 140

NetRent/InvInc 1 683 5 134 5 480 5 438 5 037 Op Inc 109 279 187 153 - 100

Int Recd 310 942 1 062 920 650 NetIntPd(Rcvd) - 13 - 17 - 22 - 42 - 15

Total Inc 1 993 6 075 6 542 6 358 5 687 Minority Int - - - - 1

Tax 505 - 13 43 533 240 Att Inc 1 016 - 335 - 145 - 843 813

Attrib Inc 1 545 - 16 628 3 342 6 575 3 329 Fixed Ass 5 386 4 404 4 875 5 129 -

TotCompIncLoss 112 - 14 988 3 519 8 086 1 941 Tot Curr Ass 1 1 5 - 386

Hline Erngs-CO 459 - 2 860 2 139 3 679 4 211 Ord SH Int 5 384 4 403 4 830 5 127 6 002

Ord UntHs Int 38 520 38 283 55 960 57 677 53 436 LT Liab - - - - 813

Minority Int 313 548 609 472 350 Tot Curr Liab 3 2 50 2 80

TotStockHldInt 38 833 38 831 56 569 58 149 53 786 PER SHARE STATISTICS (cents per share)

Investments 57 70 937 1 936 1 454 HEPS-C (ZARc) 10 494.00 - 2 942.00 - 1 177.00 - 6 531.00 640.40

FixedAss/Prop 61 790 63 523 78 836 74 469 63 274 DPS (ZARc) 430.40 394.06 323.81 298.61 25.97

Tot Curr Ass 5 449 7 327 3 321 2 850 3 881 NAV PS (ZARc) 50 628.00 47 073.00 41 146.00 38 166.00 4 380.90

Total Ass 76 882 82 170 102 743 98 693 91 493 3 Yr Beta - - - - 0.84

Tot Curr Liab 7 933 4 307 6 939 5 030 8 654 Price High 33 474 34 800 29 083 29 972 3 617

PER SHARE STATISTICS (cents per share) Price Low 24 721 22 301 19 308 20 813 2 532

EPS (ZARc) 28.44 - 306.11 61.76 123.07 65.88 Price Prd End 29 181 28 455 24 679 23 000 2 916

HEPS-C (ZARc) 8.45 - 52.64 39.53 68.87 83.60 RATIOS

DPS (ZARc) - - 97.32 97.10 92.00 Ret on SH Fnd 18.87 - 7.61 - 3.00 - 16.44 13.56

NAV PS (ZARc) 719.74 714.85 1 047.44 1 083.25 1 022.53 Oper Pft Mgn 71.24 84.80 78.24 72.86 - 71.43

3 Yr Beta 2.22 1.87 0.37 0.43 0.67 D:E - - - - 0.14

Price Prd End 415 247 785 1 035 1 066 Current Ratio 0.33 0.50 0.10 - 4.83

Price High 440 844 1 061 1 217 1 175 Div Cover 24.38 - 7.47 - 3.63 - 21.87 24.66

Price Low 194 139 757 966 1 005

RATIOS

RetOnSH Funds 7.38 - 42.78 6.18 11.38 6.32

RetOnTotAss 4.09 6.90 6.41 9.57 8.50

Oper Pft Mgn 59.78 69.16 74.41 75.32 72.97

Debt:Equity 0.89 1.04 0.76 0.64 0.66

OperRetOnInv 5.44 7.43 6.74 7.12 7.78

OpInc:Turnover 50.48 58.44 62.33 64.42 64.62

SH Ret On Inv - - 9.34 9.02 9.05

191