Page 191 - SHB 2021 Issue 4

P. 191

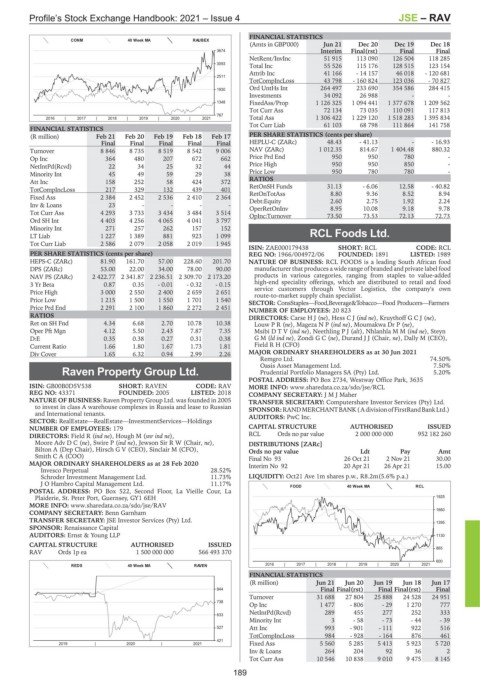

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – RAV

FINANCIAL STATISTICS

CONM 40 Week MA RAUBEX

(Amts in GBP'000) Jun 21 Dec 20 Dec 19 Dec 18

3674 Interim Final(rst) Final Final

NetRent/InvInc 51 915 113 090 126 504 118 285

3093

Total Inc 55 526 115 176 128 515 123 154

Attrib Inc 41 166 - 14 157 46 018 - 120 681

2511

TotCompIncLoss 43 798 - 160 824 123 036 - 70 827

Ord UntHs Int 264 497 233 690 354 586 284 415

1930

Investments 34 092 26 988 - -

1348 FixedAss/Prop 1 126 325 1 094 441 1 377 678 1 209 562

Tot Curr Ass 72 134 73 035 110 091 117 813

767

2016 | 2017 | 2018 | 2019 | 2020 | 2021 Total Ass 1 306 422 1 229 120 1 518 283 1 395 834

Tot Curr Liab 61 103 68 798 111 864 141 758

FINANCIAL STATISTICS

(R million) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17 PER SHARE STATISTICS (cents per share)

Final Final Final Final Final HEPLU-C (ZARc) 48.43 - 41.13 - - 16.93

Turnover 8 846 8 735 8 519 8 542 9 006 NAV (ZARc) 1 012.35 814.67 1 404.48 880.32

Op Inc 364 480 207 672 662 Price Prd End 950 950 780 -

NetIntPd(Rcvd) 22 34 25 32 44 Price High 950 950 850 -

Minority Int 45 49 59 29 38 Price Low 950 780 780 -

Att Inc 158 252 58 424 372 RATIOS

TotCompIncLoss 217 329 132 439 401 RetOnSH Funds 31.13 - 6.06 12.58 - 40.82

9.36

8.80

RetOnTotAss

8.94

8.52

Fixed Ass 2 384 2 452 2 536 2 410 2 364 Debt:Equity 2.60 2.75 1.92 2.24

Inv & Loans 23 - - - - OperRetOnInv 8.95 10.08 9.18 9.78

Tot Curr Ass 4 293 3 733 3 434 3 484 3 514 OpInc:Turnover 73.50 73.53 72.13 72.73

Ord SH Int 4 403 4 256 4 065 4 041 3 797

Minority Int 271 257 262 157 152

LT Liab 1 227 1 389 881 923 1 099 RCL Foods Ltd.

Tot Curr Liab 2 586 2 079 2 058 2 019 1 945 RCL

ISIN: ZAE000179438 SHORT: RCL CODE: RCL

PER SHARE STATISTICS (cents per share) REG NO: 1966/004972/06 FOUNDED: 1891 LISTED: 1989

HEPS-C (ZARc) 81.90 161.70 57.00 228.60 201.70 NATURE OF BUSINESS: RCL FOODS is a leading South African food

DPS (ZARc) 53.00 22.00 34.00 78.00 90.00 manufacturer that produces a wide range of branded and private label food

NAV PS (ZARc) 2 422.77 2 341.87 2 236.51 2 309.70 2 173.20 products in various categories, ranging from staples to value-added

3 Yr Beta 0.87 0.35 - 0.01 - 0.32 - 0.15 high-end speciality offerings, which are distributed to retail and food

service customers through Vector Logistics, the company's own

Price High 3 000 2 550 2 400 2 659 2 651 route-to-market supply chain specialist.

Price Low 1 215 1 500 1 550 1 701 1 540 SECTOR: ConsStaples—Food,Beverage&Tobacco—Food Producers—Farmers

Price Prd End 2 291 2 100 1 860 2 272 2 451 NUMBER OF EMPLOYEES: 20 823

RATIOS DIRECTORS: CarseHJ(ne), HessCJ(ind ne), KruythoffGCJ(ne),

Ret on SH Fnd 4.34 6.68 2.70 10.78 10.38 LouwPR(ne), MagezaNP(ind ne), Moumakwa Dr P (ne),

Oper Pft Mgn 4.12 5.50 2.43 7.87 7.35 MsibiDTV(ind ne), NeethlingPJ(alt), NhlanhlaMM(ind ne), Steyn

D:E 0.35 0.38 0.27 0.31 0.38 GM(ld ind ne), ZondiGC(ne), Durand J J (Chair, ne), Dally M (CEO),

Current Ratio 1.66 1.80 1.67 1.73 1.81 Field R H (CFO)

Div Cover 1.65 6.32 0.94 2.99 2.26 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021

Remgro Ltd. 74.50%

Oasis Asset Management Ltd. 7.50%

Raven Property Group Ltd. Prudential Portfolio Managers SA (Pty) Ltd. 5.20%

POSTAL ADDRESS: PO Box 2734, Westway Office Park, 3635

RAV

ISIN: GB00B0D5V538 SHORT: RAVEN CODE: RAV MORE INFO: www.sharedata.co.za/sdo/jse/RCL

REG NO: 43371 FOUNDED: 2005 LISTED: 2018 COMPANY SECRETARY: J M J Maher

NATURE OF BUSINESS: Raven Property Group Ltd. was founded in 2005 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

to invest in class A warehouse complexes in Russia and lease to Russian SPONSOR:RANDMERCHANTBANK(AdivisionofFirstRandBankLtd.)

and International tenants. AUDITORS: PwC Inc.

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

NUMBER OF EMPLOYEES: 179 CAPITAL STRUCTURE AUTHORISED ISSUED

DIRECTORS: Field R (ind ne), Hough M (snr ind ne), RCL Ords no par value 2 000 000 000 952 182 260

Moore AdvDC(ne), Swire P (ind ne), Jewson Sir R W (Chair, ne), DISTRIBUTIONS [ZARc]

Bilton A (Dep Chair), Hirsch G V (CEO), Sinclair M (CFO), Ords no par value Ldt Pay Amt

Smith C A (COO) Final No 93 26 Oct 21 2 Nov 21 30.00

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2020 Interim No 92 20 Apr 21 26 Apr 21 15.00

Invesco Perpetual 28.52%

Schroder Investment Management Ltd. 11.73% LIQUIDITY: Oct21 Ave 1m shares p.w., R8.2m(5.6% p.a.)

J O Hambro Capital Management Ltd. 11.17%

FOOD 40 Week MA RCL

POSTAL ADDRESS: PO Box 522, Second Floor, La Vieille Cour, La

Plaiderie, St. Peter Port, Guernsey, GY1 6EH 1925

MORE INFO: www.sharedata.co.za/sdo/jse/RAV

COMPANY SECRETARY: Benn Garnham 1660

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

1395

SPONSOR: Renaissance Capital

AUDITORS: Ernst & Young LLP 1130

CAPITAL STRUCTURE AUTHORISED ISSUED

865

RAV Ords 1p ea 1 500 000 000 566 493 370

600

REDS 40 Week MA RAVEN 2016 | 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

844 Final Final(rst) Final Final(rst) Final

Turnover 31 688 27 804 25 888 24 528 24 951

738

Op Inc 1 477 - 806 - 29 1 270 777

NetIntPd(Rcvd) 289 455 277 252 333

633

Minority Int 3 - 58 - 73 - 44 - 39

527 Att Inc 993 - 901 - 111 922 516

TotCompIncLoss 984 - 928 - 164 876 461

421

2019 | 2020 | 2021 Fixed Ass 5 560 5 285 5 413 5 923 5 720

Inv & Loans 264 204 92 36 2

Tot Curr Ass 10 546 10 838 9 010 9 475 8 145

189