Page 198 - SHB 2021 Issue 4

P. 198

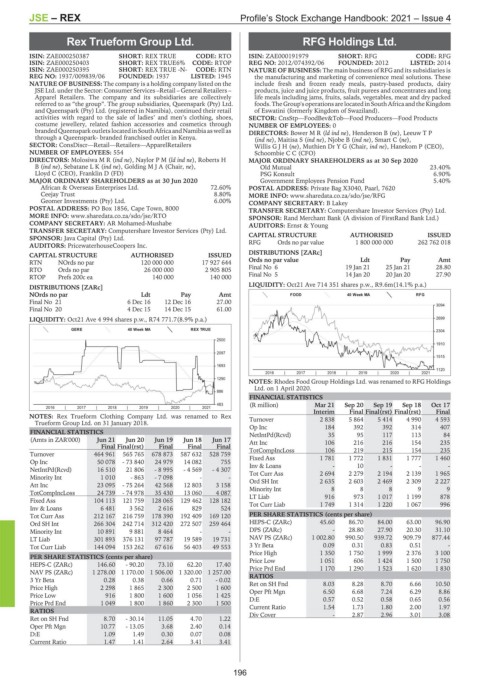

JSE – REX Profile’s Stock Exchange Handbook: 2021 – Issue 4

Rex Trueform Group Ltd. RFG Holdings Ltd.

REX RFG

ISIN: ZAE000250387 SHORT: REX TRUE CODE: RTO ISIN: ZAE000191979 SHORT: RFG CODE: RFG

ISIN: ZAE000250403 SHORT: REX TRUE6% CODE: RTOP REG NO: 2012/074392/06 FOUNDED: 2012 LISTED: 2014

ISIN: ZAE000250395 SHORT: REX TRUE -N- CODE: RTN NATURE OF BUSINESS: The main business of RFG and its subsidiaries is

REG NO: 1937/009839/06 FOUNDED: 1937 LISTED: 1945 the manufacturing and marketing of convenience meal solutions. These

NATURE OF BUSINESS: The company is a holding company listed on the include fresh and frozen ready meals, pastry-based products, dairy

JSE Ltd. under the Sector: Consumer Services –Retail – General Retailers – products, juice and juice products, fruit purees and concentrates and long

Apparel Retailers. The company and its subsidiaries are collectively life meals including jams, fruits, salads, vegetables, meat and dry packed

referred to as “the group”. The group subsidiaries, Queenspark (Pty) Ltd. foods. The Group's operations are located in South Africa and the Kingdom

and Queenspark (Pty) Ltd. (registered in Namibia), continued their retail of Eswatini (formerly Kingdom of Swaziland).

activities with regard to the sale of ladies’ and men’s clothing, shoes, SECTOR: CnsStp—FoodBev&Tob—Food Producers—Food Products

costume jewellery, related fashion accessories and cosmetics through NUMBER OF EMPLOYEES: 0

brandedQueensparkoutletslocatedinSouthAfricaandNamibia aswellas DIRECTORS: BowerMR(ld ind ne), Henderson B (ne), Leeuw T P

through a Queenspark- branded franchised outlet in Kenya. (ind ne), Maitisa S (ind ne), Njobe B (ind ne), Smart C (ne),

SECTOR: ConsDiscr—Retail—Retailers—ApparelRetailers WillisGJH(ne), Muthien Dr Y G (Chair, ind ne), Hanekom P (CEO),

NUMBER OF EMPLOYEES: 554 Schoombie C C (CFO)

DIRECTORS: MolosiwaMR(ind ne), NaylorPM(ld ind ne), Roberts H MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020

B(ind ne), SebataneLK(ind ne), GoldingMJA (Chair, ne), Old Mutual 23.40%

Lloyd C (CEO), Franklin D (FD) PSG Konsult 6.90%

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 Government Employees Pension Fund 5.40%

African & Overseas Enterprises Ltd. 72.60% POSTAL ADDRESS: Private Bag X3040, Paarl, 7620

Ceejay Trust 8.80% MORE INFO: www.sharedata.co.za/sdo/jse/RFG

Geomer Investments (Pty) Ltd. 6.00% COMPANY SECRETARY: B Lakey

POSTAL ADDRESS: PO Box 1856, Cape Town, 8000 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/RTO SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

COMPANY SECRETARY: AR Mohamed-Mushabe AUDITORS: Ernst & Young

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Java Capital (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: PricewaterhouseCoopers Inc. RFG Ords no par value 1 800 000 000 262 762 018

DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED

RTN NOrds no par 120 000 000 17 927 644 Ords no par value Ldt Pay Amt

RTO Ords no par 26 000 000 2 905 805 Final No 6 19 Jan 21 25 Jan 21 28.80

RTOP Prefs 200c ea 140 000 140 000 Final No 5 14 Jan 20 20 Jan 20 27.90

LIQUIDITY: Oct21 Ave 714 351 shares p.w., R9.6m(14.1% p.a.)

DISTRIBUTIONS [ZARc]

NOrds no par Ldt Pay Amt FOOD 40 Week MA RFG

Final No 21 6 Dec 16 12 Dec 16 27.00

3094

Final No 20 4 Dec 15 14 Dec 15 61.00

LIQUIDITY: Oct21 Ave 4 994 shares p.w., R74 771.7(8.9% p.a.) 2699

GERE 40 Week MA REX TRUE

2304

2500

1910

2097

1515

1693

1120

2016 | 2017 | 2018 | 2019 | 2020 | 2021

1290

NOTES: Rhodes Food Group Holdings Ltd. was renamed to RFG Holdings

Ltd. on 1 April 2020.

886

FINANCIAL STATISTICS

483 (R million) Mar 21 Sep 20 Sep 19 Sep 18 Oct 17

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Interim Final Final(rst) Final(rst) Final

NOTES: Rex Trueform Clothing Company Ltd. was renamed to Rex Turnover 2 838 5 864 5 414 4 990 4 593

Trueform Group Ltd. on 31 January 2018.

Op Inc 184 392 392 314 407

FINANCIAL STATISTICS NetIntPd(Rcvd) 35 95 117 113 84

(Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 Att Inc 106 216 216 154 235

Final Final(rst) Final Final Final

Turnover 464 961 565 765 678 873 587 632 528 759 TotCompIncLoss 106 219 215 154 235

Op Inc 50 078 - 73 840 24 979 14 082 755 Fixed Ass 1 781 - 1 772 1 831 - 1 777 - 1 460 -

Inv & Loans

10

NetIntPd(Rcvd) 16 510 21 806 - 8 995 - 4 569 - 4 307 Tot Curr Ass 2 694 2 279 2 194 2 139 1 965

Minority Int 1 010 - 863 - 7 098 - - Ord SH Int 2 635 2 603 2 469 2 309 2 227

Att Inc 23 095 - 75 264 42 568 12 803 3 158 Minority Int 8 8 8 9 9

TotCompIncLoss 24 739 - 74 978 35 430 13 060 4 087

973

916

Fixed Ass 104 113 121 759 128 065 129 462 128 182 LT Liab 1 749 1 314 1 017 1 199 878

1 220

Tot Curr Liab

996

1 067

Inv & Loans 6 481 3 562 2 616 829 524

Tot Curr Ass 212 167 216 759 178 390 192 409 169 120 PER SHARE STATISTICS (cents per share)

Ord SH Int 266 304 242 714 312 420 272 507 259 464 HEPS-C (ZARc) 45.60 86.70 84.00 63.00 96.90

Minority Int 10 891 9 881 8 464 - - DPS (ZARc) - 28.80 27.90 20.30 31.10

LT Liab 301 893 376 131 97 787 19 589 19 731 NAV PS (ZARc) 1 002.80 990.50 939.72 909.79 877.44

Tot Curr Liab 144 094 153 262 67 616 56 403 49 553 3 Yr Beta 0.09 0.31 0.83 0.51 -

Price High 1 350 1 750 1 999 2 376 3 100

PER SHARE STATISTICS (cents per share) Price Low 1 051 606 1 424 1 500 1 750

HEPS-C (ZARc) 146.60 - 90.20 73.10 62.20 17.40 Price Prd End 1 170 1 290 1 523 1 620 1 830

NAV PS (ZARc) 1 278.00 1 170.00 1 506.00 1 320.00 1 257.00

3 Yr Beta 0.28 0.38 0.66 0.71 - 0.02 RATIOS 8.03 8.28 8.70 6.66 10.50

Ret on SH Fnd

Price High 2 298 1 865 2 300 2 500 1 600

Oper Pft Mgn 6.50 6.68 7.24 6.29 8.86

Price Low 916 1 800 1 600 1 056 1 425 D:E 0.57 0.52 0.58 0.65 0.56

Price Prd End 1 049 1 800 1 860 2 300 1 500 Current Ratio 1.54 1.73 1.80 2.00 1.97

RATIOS

Ret on SH Fnd 8.70 - 30.14 11.05 4.70 1.22 Div Cover - 2.87 2.96 3.01 3.08

Oper Pft Mgn 10.77 - 13.05 3.68 2.40 0.14

D:E 1.09 1.49 0.30 0.07 0.08

Current Ratio 1.47 1.41 2.64 3.41 3.41

196