Page 190 - SHB 2021 Issue 4

P. 190

JSE – RAN Profile’s Stock Exchange Handbook: 2021 – Issue 4

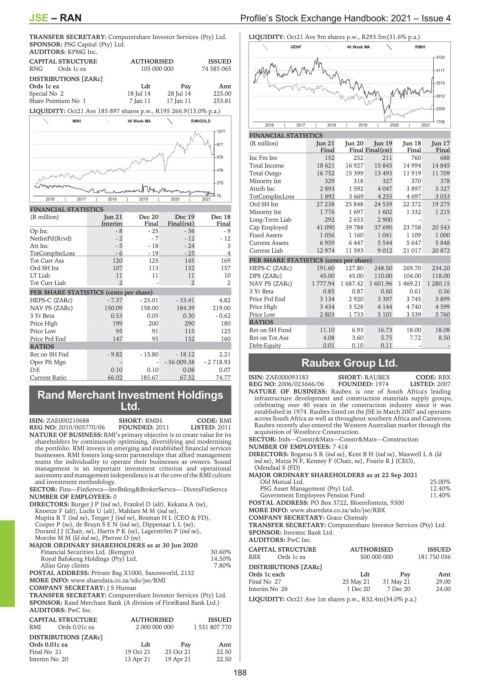

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Oct21 Ave 9m shares p.w., R293.5m(31.6% p.a.)

SPONSOR: PSG Capital (Pty) Ltd.

GENF 40 Week MA RMIH

AUDITORS: KPMG Inc.

4720

CAPITAL STRUCTURE AUTHORISED ISSUED

RNG Ords 1c ea 105 000 000 74 585 065 4117

DISTRIBUTIONS [ZARc]

3515

Ords 1c ea Ldt Pay Amt

Special No 2 18 Jul 14 28 Jul 14 225.00

2912

Share Premium No 1 7 Jan 11 17 Jan 11 253.81

LIQUIDITY: Oct21 Ave 185 897 shares p.w., R195 266.9(13.0% p.a.) 2309

MINI 40 Week MA RANGOLD 1706

2016 | 2017 | 2018 | 2019 | 2020 | 2021

1077

FINANCIAL STATISTICS

877 (R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final(rst) Final Final

676 Inc Fm Inv 152 252 211 760 688

Total Income 18 621 16 927 15 845 14 994 14 845

476

Total Outgo 16 752 15 399 13 493 11 919 11 709

Minority Int 329 318 327 370 378

275

Attrib Inc 2 893 1 592 4 047 3 897 3 327

75 TotCompIncLoss 1 892 3 669 4 255 4 697 3 033

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Ord SH Int 27 238 25 848 24 539 22 372 19 275

FINANCIAL STATISTICS Minority Int 1 776 1 697 1 602 1 332 1 215

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Long-Term Liab 292 2 653 2 900 - -

Interim Final Final(rst) Final

Op Inc - 8 - 25 - 36 - 9 Cap Employed 41 090 39 788 37 690 23 758 20 543

NetIntPd(Rcvd) - 2 - 7 - 12 - 12 Fixed Assets 1 056 1 160 1 041 1 109 1 000

AttInc -5 -18 - 24 3 Current Assets 6 959 6 447 5 544 5 647 5 848

TotCompIncLoss - 6 - 19 - 25 4 Current Liab 12 974 11 593 9 012 21 017 20 872

Tot Curr Ass 120 125 145 169 PER SHARE STATISTICS (cents per share)

Ord SH Int 107 113 132 157 HEPS-C (ZARc) 191.60 127.80 248.50 269.70 234.20

LT Liab 11 11 11 10 DPS (ZARc) 45.00 45.00 110.00 104.00 118.00

Tot Curr Liab 2 - 2 2 NAV PS (ZARc) 1 777.94 1 687.42 1 601.96 1 469.21 1 280.15

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.85 0.87 0.60 0.61 0.56

HEPS-C (ZARc) - 7.37 - 25.01 - 33.41 4.82 Price Prd End 3 134 2 920 3 397 3 745 3 899

NAV PS (ZARc) 150.09 158.00 184.39 219.00 Price High 3 434 3 528 4 144 4 740 4 599

3 Yr Beta 0.53 0.05 0.30 - 0.62 Price Low 2 803 1 733 3 101 3 539 3 760

Price High 199 200 290 180 RATIOS

Price Low 95 91 115 125 Ret on SH Fund 11.10 6.93 16.73 18.00 18.08

Price Prd End 147 95 132 160 Ret on Tot Ass 4.08 3.60 5.75 7.72 8.50

RATIOS Debt:Equity 0.01 0.10 0.11 - -

Ret on SH Fnd - 9.82 - 15.80 - 18.12 2.21

Oper Pft Mgn - - - 56 009.38 - 2 718.93 Raubex Group Ltd.

D:E 0.10 0.10 0.08 0.07 RAU

Current Ratio 66.02 185.67 67.32 74.77 ISIN: ZAE000093183 SHORT: RAUBEX CODE: RBX

REG NO: 2006/023666/06 FOUNDED: 1974 LISTED: 2007

Rand Merchant Investment Holdings NATURE OF BUSINESS: Raubex is one of South Africa's leading

infrastructure development and construction materials supply groups,

Ltd. celebrating over 40 years in the construction industry since it was

established in 1974. Raubex listed on the JSE in March 2007 and operates

RAN

ISIN: ZAE000210688 SHORT: RMIH CODE: RMI across South Africa as well as throughout southern Africa and Cameroon.

REG NO: 2010/005770/06 FOUNDED: 2011 LISTED: 2011 Raubex recently also entered the Western Australian market through the

NATURE OF BUSINESS: RMI’s primary objective is to create value for its acquisition of Westforce Construction.

shareholders by continuously optimising, diversifying and modernising SECTOR: Inds—Constr&Mats—Constr&Mats—Construction

the portfolio. RMI invests in emerging and established financial services NUMBER OF EMPLOYEES: 7 418

businesses. RMI fosters long-term partnerships that afford management DIRECTORS: BogatsuSR(ind ne), KentBH(ind ne), MaxwellLA(ld

teams the individuality to operate their businesses as owners. Sound ind ne), Msiza N F, Kenney F (Chair, ne), Fourie R J (CEO),

management is an important investment criterion and operational Odendaal S (FD)

autonomy and management independence is at the core of the RMI culture MAJOR ORDINARY SHAREHOLDERS as at 22 Sep 2021

and investment methodology. Old Mutual Ltd. 25.00%

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs PSG Asset Management (Pty) Ltd. 12.40%

NUMBER OF EMPLOYEES: 0 Government Employees Pension Fund 11.40%

DIRECTORS: BurgerJP(ind ne), Frankel D (alt), Kekana A (ne), POSTAL ADDRESS: PO Box 3722, Bloemfontein, 9300

Knoetze F (alt), Lucht U (alt), MahlareMM(ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/RBX

MupitaRT(ind ne), Teeger J (ind ne), Bosman H L (CEO & FD), COMPANY SECRETARY: Grace Chemaly

Cooper P (ne), de BruynSEN(ind ne), DippenaarLL(ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Durand J J (Chair, ne), HarrisPK(ne), Lagerström P (ind ne), SPONSOR: Investec Bank Ltd.

MorobeMM(ld ind ne), Phetwe O (ne) AUDITORS: PwC Inc.

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

Financial Securities Ltd. (Remgro) 30.60% CAPITAL STRUCTURE AUTHORISED ISSUED

Royal Bafokeng Holdings (Pty) Ltd. 14.50% RBX Ords 1c ea 500 000 000 181 750 036

Allan Gray clients 7.80% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: Private Bag X1000, Saxonworld, 2132 Ords 1c each Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/RMI Final No 27 25 May 21 31 May 21 29.00

COMPANY SECRETARY: J S Human Interim No 26 1 Dec 20 7 Dec 20 24.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Oct21 Ave 1m shares p.w., R32.4m(34.0% p.a.)

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

RMI Ords 0.01c ea 2 000 000 000 1 531 807 770

DISTRIBUTIONS [ZARc]

Ords 0.01c ea Ldt Pay Amt

Final No 21 19 Oct 21 25 Oct 21 22.50

Interim No 20 13 Apr 21 19 Apr 21 22.50

188