Page 128 - SHB 2021 Issue 4

P. 128

JSE – GOL Profile’s Stock Exchange Handbook: 2021 – Issue 4

Gold Fields Ltd. TELEPHONE: 011-562-9700

COMPANY SECRETARY: Anré Weststrate

GOL

ISIN: ZAE000018123 TRANSFER SECRETARY: Computershare

SHORT: GFIELDS Investor Services (Pty) Ltd.

CODE: GFI SPONSOR: JP Morgan Equities South Africa Ltd.

REG NO: 1968/004880/06 AUDITORS: PwC Inc.

FOUNDED: 1998 BANKERS: Standard Bank of SA Ltd.

LISTED: 1998

Scan the QR code to

NATURE OF BUSINESS: visit our website

Gold Fields Ltd. is a globally

diversified gold producer SEGMENTAL REPORTING as at 31 Dec 20 (asa%of Revenue)

43.99%

Australia

with nine operating mines Ghana 37.17%

and one project in Australia, Chile, Ghana (including our South Africa 9.81%

AsankoJointVenture), PeruandSouth Africa, with totalattrib- Peru 9.03%

utable annual gold-equivalent production of 2.24Moz. It has at- CALENDAR Expected Status

tributable gold-equivalent Mineral Reserves of 52.1Moz and Next Final Results 17 Feb 2022 Confirmed

gold Mineral Resources of 116.0Moz. Gold Fields has a primary Annual General Meeting 1 Jun 2022 Confirmed

listing on the Johannesburg Stock Exchange (JSE) Ltd., and an

additional listing on the New York Stock Exchange (NYSE). Next Interim Results 18 Aug 2022 Confirmed

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 27 Aug 2021 GFI Ords 50c ea 1 000 000 000 887 717 348

Public Investment Corporation (Pretoria) 8.36% DISTRIBUTIONS [ZARc]

VanEck Global (New York) 5.50% Ords 50c ea Ldt Pay Amt

BlackRock Investment Mgt-Index (San Francisco) 4.04%

Interim No 94 7 Sep 21 13 Sep 21 210.00

FINANCIAL STATISTICS Final No 93 9 Mar 21 15 Mar 21 320.00

(USD million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 Interim No 92 8 Sep 20 14 Sep 20 160.00

Interim Final Final Final(rst) Final Final No 91 10 Mar 20 16 Mar 20 100.00

Wrk Revenue 1 984 3 892 2 967 2 578 2 762

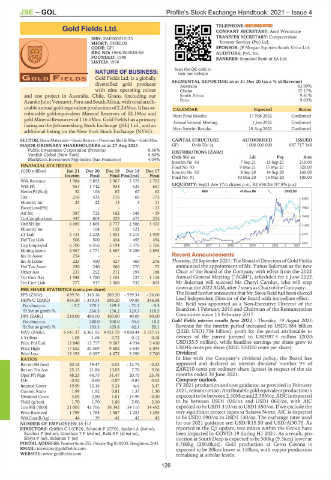

LIQUIDITY: Sep21 Ave 17m shares p.w., R2 656.2m(97.8% p.a.)

Wrk Pft 957 1 742 934 535 657

NetIntPd(Rcd) 32 106 82 67 62 MINI 40 Week MA GFIELDS

Tax 216 433 176 - 66 173

23551

Minority Int 23 22 13 3 11

ExordLoss(Pft) - - - - - 13 19521

Att Inc 387 723 162 - 348 - 19

15492

TotCompIncLoss 447 804 229 675 255

Ord SH Int 4 069 3 665 2 777 2 586 3 403

11462

Minority Int - 164 132 121 -

LT Liab 2 131 2 228 1 851 2 216 1 909 7433

Def Tax Liab 506 500 434 455 454

3403

Cap Employed 6 706 6 556 5 194 5 378 5 766 2016 | 2017 | 2018 | 2019 | 2020 | 2021

Mining assets 4 967 4 771 4 657 4 259 4 893

Inv In Assoc 254 - - - - Recent Announcements

Inv & Loans 223 450 327 460 276 Thursday, 02 September 2021: The Board of Directors of Gold Fields

Def Tax Asset 230 240 266 270 72 announced the appointment of Mr. Yunus Suleman as the new

Other Ass 233 252 211 194 188 Chair of the Board of the Company with effect from the 2022

Tot Curr Ass 1 548 1 760 1 101 727 1 114 Annual General Meeting (“AGM”), scheduled for 1 June 2022.

Tot Curr Liab 777 917 1 368 532 854 Mr Suleman will succeed Ms Cheryl Carolus, who will step

downatthe2022AGM,after7yearsasChair oftheCompany.

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 639.76 1 343.16 289.20 - 599.34 - 26.66 The Board further announces that Mr. Steve Reid had been elected

HEPS-C (ZARc) 654.30 1 359.54 289.20 99.89 346.58 Lead Independent Director of the Board with immediate effect.

Pct chng p.a. - 3.7 370.1 189.5 - 71.2 - 9.3 Mr. Reid was appointed as a Non-Executive Director of the

Tr 5yr av grwth % - 256.5 138.2 129.3 118.5 Board on 1 February 2016 and Chairman of the Remuneration

DPS (ZARc) 210.00 480.00 160.00 40.00 90.00 Committee since 13 February 2017.

Pct chng p.a. - 200.0 300.0 - 55.6 - 18.2 Gold Fields interim results June 2021 - Thursday, 19 August 2021:

Tr 5yr av grwth % - 153.3 105.8 62.1 55.1 Revenuefor theinterim period increased to USD1.984 billion

NAV (ZARc) 6 541.37 6 361.95 4 921.70 4 820.44 5 127.13 (2020: USD1.754 billion), profit for the period attributable to

3 Yr Beta 1.05 1.06 0.72 0.12 0.18 owners of the parent jumped to USD387.4 million (2020:

Price Prd End 12 840 13 757 9 587 4 934 5 410 USD155.5 million), while headline earnings per share grew to

Price High 17 652 25 569 9 602 5 649 6 094 USD45 cents per share (2020: USD20 cents per share).

Price Low 12 193 6 397 4 672 3 290 3 760 Dividend

RATIOS In line with the Company’s dividend policy, the Board has

Ret on SH fund 20.16 19.47 6.01 - 12.74 - 0.23 approved and declared an interim dividend number 94 of

Ret on Tot Ass 25.15 21.86 13.03 7.70 9.06 ZAR210 cents per ordinary share (gross) in respect of the six

Oper Pft Mgn 48.23 44.75 31.47 20.75 23.78 months ended 30 June 2021.

D:E 0.52 0.60 0.87 0.85 0.62 Company outlook

Interest Cover 19.99 12.16 5.24 n/a 3.47 FY 2021 production and cost guidance, as provided in February

Current Ratio 1.99 1.92 0.81 1.37 1.30 2021, remains intact.Attributablegoldequivalentproduction is

Dividend Cover 3.05 2.80 1.81 - 14.98 - 0.30 expectedtobebetween2.30Mozand2.35Moz.AISCisexpected

Yield (g/ton) 1.70 1.70 1.80 2.00 2.10 to be between USD1 020/oz and USD1 060/oz, with AIC

Ton Mll (‘000) 21 005 42 706 38 342 34 110 34 492 expected to be USD1 310/oz to USD1 350/oz. If we exclude the

Price Received 1 799 1 765 1 387 1 251 1 255 very significant project capex at Salares Norte, AIC is expected

WrkCost(R/kg) 44 39 41 42 43 to be USD1 090/oz to USD1 130/oz. The exchange rates used

NUMBER OF EMPLOYEES: 18 412 for our 2021 guidance are: USD/R15.50 and USD/AD0.75. As

DIRECTORS: Griffith C I (CEO), Schmidt P (CFO), Andani A (ind ne), reported in the Q1 update, two mines within the Group have

Bacchus P (ind ne), GoodlaceTP(ind ne), ReidSP(ld ind ne), been impacted by COVID-19 during H1 2021. As a result, pro-

Sibiya P (ne), Suleman Y (ne) duction at South Deep is expected to be 300kg (9.3koz) lower at

POSTALADDRESS:PostnetSuite252,PrivateBagX30500,Houghton,2041 8,700kg (280.0koz). Gold production at Cerro Corona is

EMAIL: investors@goldfields.com expected to be 20koz lower at 110koz, with copper production

WEBSITE: www.goldfields.com remaining at similar levels.

126