Page 220 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 220

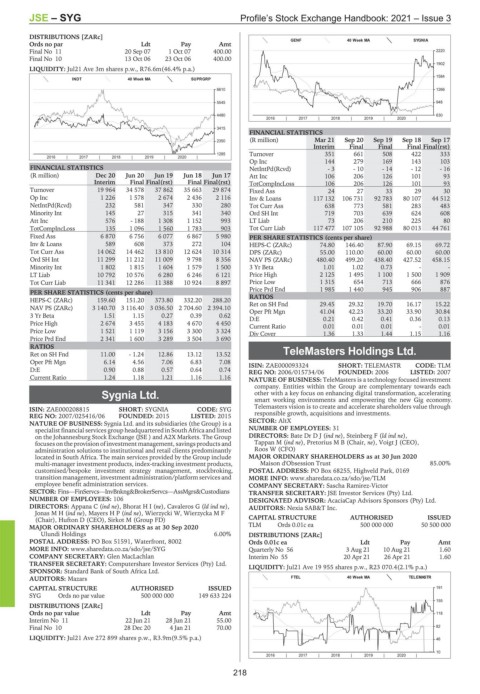

JSE – SYG Profile’s Stock Exchange Handbook: 2021 – Issue 3

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt GENF 40 Week MA SYGNIA

Final No 11 20 Sep 07 1 Oct 07 400.00 2220

Final No 10 13 Oct 06 23 Oct 06 400.00

1902

LIQUIDITY: Jul21 Ave 3m shares p.w., R76.6m(46.4% p.a.)

1584

INDT 40 Week MA SUPRGRP

6610 1266

5545 948

4480 630

2016 | 2017 | 2018 | 2019 | 2020 |

3415

FINANCIAL STATISTICS

2350 (R million) Mar 21 Sep 20 Sep 19 Sep 18 Sep 17

Interim Final Final Final Final(rst)

1285 Turnover 351 661 508 422 333

2016 | 2017 | 2018 | 2019 | 2020 |

Op Inc 144 279 169 143 103

FINANCIAL STATISTICS NetIntPd(Rcvd) - 3 - 10 - 14 - 12 - 16

(R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17 Att Inc 106 206 126 101 93

Interim Final Final(rst) Final Final(rst) TotCompIncLoss 106 206 126 101 93

Turnover 19 964 34 578 37 862 35 663 29 874 Fixed Ass 24 27 33 29 30

Op Inc 1 226 1 578 2 674 2 436 2 116 Inv & Loans 117 132 106 731 92 783 80 107 44 512

NetIntPd(Rcvd) 232 581 347 330 280 Tot Curr Ass 638 773 581 283 483

Minority Int 145 27 315 341 340 Ord SH Int 719 703 639 624 608

Att Inc 576 - 188 1 308 1 152 993 LT Liab 73 206 210 225 80

TotCompIncLoss 135 1 096 1 560 1 783 903 Tot Curr Liab 117 477 107 105 92 988 80 013 44 761

Fixed Ass 6 870 6 756 6 077 6 867 5 980 PER SHARE STATISTICS (cents per share)

Inv & Loans 589 608 373 272 104 HEPS-C (ZARc) 74.80 146.40 87.90 69.15 69.72

Tot Curr Ass 14 062 14 462 13 810 12 624 10 314 DPS (ZARc) 55.00 110.00 60.00 60.00 60.00

Ord SH Int 11 299 11 212 11 009 9 798 8 356 NAV PS (ZARc) 480.40 499.20 438.40 427.52 458.15

Minority Int 1 802 1 815 1 604 1 579 1 500 3 Yr Beta 1.01 1.02 0.73 - -

LT Liab 10 792 10 576 6 280 6 246 6 121 Price High 2 125 1 495 1 100 1 500 1 909

Tot Curr Liab 11 341 12 286 11 388 10 924 8 897 Price Low 1 315 654 713 666 876

Price Prd End 1 985 1 440 945 906 887

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 159.60 151.20 373.80 332.20 288.20

NAV PS (ZARc) 3 140.70 3 116.40 3 036.50 2 704.60 2 394.10 Ret on SH Fnd 29.45 29.32 19.70 16.17 15.22

41.04

33.20

30.84

42.23

Oper Pft Mgn

33.90

3 Yr Beta 1.51 1.15 0.27 0.39 0.62 D:E 0.21 0.42 0.41 0.36 0.13

Price High 2 674 3 455 4 183 4 670 4 450 Current Ratio 0.01 0.01 0.01 - 0.01

Price Low 1 521 1 119 3 156 3 300 3 324 Div Cover 1.36 1.33 1.44 1.15 1.16

Price Prd End 2 341 1 600 3 289 3 504 3 690

RATIOS

Ret on SH Fnd 11.00 - 1.24 12.86 13.12 13.52 TeleMasters Holdings Ltd.

Oper Pft Mgn 6.14 4.56 7.06 6.83 7.08 ISIN: ZAE000093324 SHORT: TELEMASTR CODE: TLM

TEL

D:E 0.90 0.88 0.57 0.64 0.74 REG NO: 2006/015734/06 FOUNDED: 2006 LISTED: 2007

Current Ratio 1.24 1.18 1.21 1.16 1.16 NATURE OF BUSINESS: TeleMasters is a technology focused investment

company. Entities within the Group are complementary towards each

Sygnia Ltd. other with a key focus on enhancing digital transformation, accelerating

smart working environments and empowering the new Gig economy.

SYG Telemasters vision is to create and accelerate shareholders value through

ISIN: ZAE000208815 SHORT: SYGNIA CODE: SYG

REG NO: 2007/025416/06 FOUNDED: 2015 LISTED: 2015 responsible growth, acquisitions and investments.

NATURE OF BUSINESS: Sygnia Ltd. and its subsidiaries (the Group) is a SECTOR: AltX

specialist financial services group headquartered in South Africa and listed NUMBER OF EMPLOYEES: 31

on the Johannesburg Stock Exchange (JSE ) and A2X Markets. The Group DIRECTORS: Bate DrDJ(ind ne), Steinberg F (ld ind ne),

focuses on the provision of investment management, savings products and Tappan M (ind ne), Pretorius M B (Chair, ne), Voigt J (CEO),

administration solutions to institutional and retail clients predominantly Roos W (CFO)

located in South Africa. The main services provided by the Group include MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

multi-manager investment products, index-tracking investment products, Maison d'Obsession Trust 85.00%

customised/bespoke investment strategy management, stockbroking, POSTAL ADDRESS: PO Box 68255, Highveld Park, 0169

transition management, investment administration/platform services and MORE INFO: www.sharedata.co.za/sdo/jse/TLM

employee benefit administration services. COMPANY SECRETARY: Sascha Ramirez-Victor

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 106 DESIGNATED ADVISOR: AcaciaCap Advisors Sponsors (Pty) Ltd.

DIRECTORS: Appana C (ind ne), BhoratHI(ne), Cavaleros G (ld ind ne), AUDITORS: Nexia SAB&T Inc.

JonasMH(ind ne), MayersHP(ind ne), Wierzycki W, Wierzycka M F

(Chair), Hufton D (CEO), Sirkot M (Group FD) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020 TLM Ords 0.01c ea 500 000 000 50 500 000

Ulundi Holdings 6.00% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: PO Box 51591, Waterfront, 8002 Ords 0.01c ea Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/SYG QuarterlyNo 56 3 Aug21 10Aug 21 1.60

COMPANY SECRETARY: Glen MacLachlan Interim No 55 20 Apr 21 26 Apr 21 1.60

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jul21 Ave 19 955 shares p.w., R23 070.4(2.1% p.a.)

SPONSOR: Standard Bank of South Africa Ltd.

AUDITORS: Mazars FTEL 40 Week MA TELEMASTR

CAPITAL STRUCTURE AUTHORISED ISSUED 191

SYG Ords no par value 500 000 000 149 633 224

155

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 118

Interim No 11 22 Jun 21 28 Jun 21 55.00

Final No 10 28 Dec 20 4 Jan 21 70.00 82

LIQUIDITY: Jul21 Ave 272 899 shares p.w., R3.9m(9.5% p.a.) 46

10

2016 | 2017 | 2018 | 2019 | 2020 |

218