Page 218 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 218

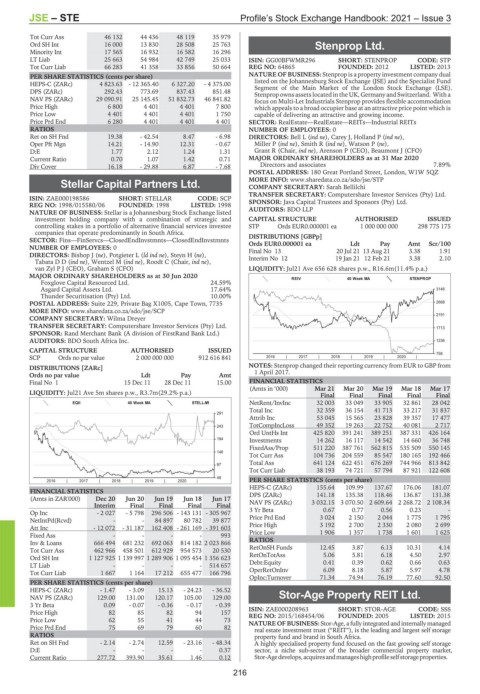

JSE – STE Profile’s Stock Exchange Handbook: 2021 – Issue 3

Tot Curr Ass 46 132 44 436 48 119 35 979

Ord SH Int 16 000 13 830 28 508 25 763 Stenprop Ltd.

Minority Int 17 565 16 932 16 582 16 296

STE

LT Liab 25 663 54 984 42 749 25 033 ISIN: GG00BFWMR296 SHORT: STENPROP CODE: STP

Tot Curr Liab 66 283 41 358 33 856 50 664 REG NO: 64865 FOUNDED: 2012 LISTED: 2013

PER SHARE STATISTICS (cents per share) NATURE OF BUSINESS: Stenprop is a property investment company dual

HEPS-C (ZARc) 4 823.63 - 12 365.40 6 327.20 - 4 375.00 listed on the Johannesburg Stock Exchange (JSE) and the Specialist Fund

Segment of the Main Market of the London Stock Exchange (LSE).

DPS (ZARc) 292.43 773.69 837.43 851.48 Stenprop ownsassets located in the UK, Germany and Switzerland. With a

NAV PS (ZARc) 29 090.91 25 145.45 51 832.73 46 841.82 focus on Multi-Let Industrials Stenprop provides flexible accommodation

Price High 6 800 4 401 4 401 7 800 which appeals to a broad occupier base at an attractive price point which is

Price Low 4 401 4 401 4 401 1 750 capable of delivering an attractive and growing income.

Price Prd End 6 280 4 401 4 401 4 401 SECTOR: RealEstate—RealEstate—REITs—Industrial REITs

RATIOS NUMBER OF EMPLOYEES: 0

Ret on SH Fnd 19.38 - 42.54 8.47 - 6.98 DIRECTORS: Bell L (ind ne), Carey J, Holland P (ind ne),

Oper Pft Mgn 14.21 - 14.90 12.31 - 0.67 Miller P (ind ne), Smith R (ind ne), Watson P (ne),

D:E 1.77 2.12 1.24 1.31 Grant R (Chair, ind ne), Arenson P (CEO), Beaumont J (CFO)

Current Ratio 0.70 1.07 1.42 0.71 MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

Div Cover 16.18 - 29.88 6.87 - 7.68 Directors and associates 7.89%

POSTAL ADDRESS: 180 Great Portland Street, London, W1W 5QZ

MORE INFO: www.sharedata.co.za/sdo/jse/STP

Stellar Capital Partners Ltd. COMPANY SECRETARY: Sarah Bellilchi

STE TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ISIN: ZAE000198586 SHORT: STELLAR CODE: SCP SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

REG NO: 1998/015580/06 FOUNDED: 1998 LISTED: 1998

NATURE OF BUSINESS: Stellar is a Johannesburg Stock Exchange listed AUDITORS: BDO LLP

investment holding company with a combination of strategic and CAPITAL STRUCTURE AUTHORISED ISSUED

controlling stakes in a portfolio of alternative financial services investee STP Ords EUR0.000001 ea 1 000 000 000 298 775 175

companies that operate predominantly in South Africa.

SECTOR: Fins—FinServcs—ClosedEndInvstmnts—ClosedEndInvstmnts DISTRIBUTIONS [GBPp] Ldt Pay Amt Scr/100

Ords EUR0.000001 ea

NUMBER OF EMPLOYEES: 0 Final No 13 20 Jul 21 13 Aug 21 3.38 1.91

DIRECTORS: Bishop J (ne), Potgieter L (ld ind ne), Steyn H (ne),

TabataDD(ind ne), Wentzel M (ind ne), Roodt C (Chair, ind ne), Interim No 12 19 Jan 21 12 Feb 21 3.38 2.10

van Zyl P J (CEO), Graham S (CFO) LIQUIDITY: Jul21 Ave 656 628 shares p.w., R16.6m(11.4% p.a.)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 REIV 40 Week MA STENPROP

Foxglove Capital Resourced Ltd. 24.59%

Asgard Capital Assets Ltd. 17.64% 3146

Thunder Securitisation (Pty) Ltd. 10.00%

POSTAL ADDRESS: Suite 229, Private Bag X1005, Cape Town, 7735 2668

MORE INFO: www.sharedata.co.za/sdo/jse/SCP

2191

COMPANY SECRETARY: Wilma Dreyer

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

1713

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

AUDITORS: BDO South Africa Inc. 1236

CAPITAL STRUCTURE AUTHORISED ISSUED

758

SCP Ords no par value 2 000 000 000 912 616 841 2016 | 2017 | 2018 | 2019 | 2020 |

DISTRIBUTIONS [ZARc] NOTES: Stenprop changed their reporting currency from EUR to GBP from

Ords no par value Ldt Pay Amt 1 April 2017.

Final No 1 15 Dec 11 28 Dec 11 15.00 FINANCIAL STATISTICS

(Amts in ‘000) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17

LIQUIDITY: Jul21 Ave 5m shares p.w., R3.7m(29.2% p.a.)

Final Final Final Final Final

EQII 40 Week MA STELLAR NetRent/InvInc 32 003 33 049 33 905 32 861 28 042

Total Inc 32 359 36 154 41 713 33 217 31 837

291

Attrib Inc 53 045 15 565 23 828 39 357 17 477

243 TotCompIncLoss 49 352 19 263 22 752 40 081 2 717

Ord UntHs Int 425 820 391 241 389 251 387 331 426 164

194 Investments 14 262 16 117 14 542 14 660 36 748

FixedAss/Prop 511 220 387 761 562 815 535 509 550 145

146

Tot Curr Ass 104 736 204 559 85 547 180 165 192 466

Total Ass 641 124 622 451 676 269 744 966 813 842

97

Tot Curr Liab 38 193 74 721 57 794 87 921 122 608

49 PER SHARE STATISTICS (cents per share)

2016 | 2017 | 2018 | 2019 | 2020 |

HEPS-C (ZARc) 155.64 109.99 137.67 176.06 181.07

FINANCIAL STATISTICS DPS (ZARc) 141.18 135.38 118.46 136.87 131.38

(Amts in ZAR'000) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17 NAV PS (ZARc) 3 032.15 3 070.50 2 609.64 2 268.72 2 108.34

Interim Final Final Final Final

Op Inc - 2 027 - 5 798 296 506 - 143 131 - 305 967 3 Yr Beta 0.67 0.77 0.56 0.23 -

NetIntPd(Rcvd) - - 84 897 80 782 39 877 Price Prd End 3 024 2 150 2 044 1 775 1 795

Att Inc - 12 072 - 31 187 162 408 - 261 169 - 391 603 Price High 3 192 2 700 2 330 2 080 2 699

Fixed Ass - - - - 993 Price Low 1 906 1 357 1 738 1 601 1 625

Inv & Loans 666 494 681 232 692 063 814 182 2 023 866 RATIOS

Tot Curr Ass 462 966 458 501 612 929 954 573 20 530 RetOnSH Funds 12.45 3.87 6.13 10.31 4.14

Ord SH Int 1 127 925 1 139 997 1 289 906 1 095 454 1 356 623 RetOnTotAss 5.06 5.81 6.18 4.50 2.97

LT Liab - - - - 514 657 Debt:Equity 0.41 0.39 0.62 0.66 0.63

Tot Curr Liab 1 667 1 164 17 212 655 477 166 796 OperRetOnInv 6.09 8.18 5.87 5.97 4.78

OpInc:Turnover 71.34 74.94 76.19 77.60 92.50

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 1.47 - 3.09 15.13 - 24.23 - 36.52

NAV PS (ZARc) 129.00 131.00 120.17 105.00 129.00 Stor-Age Property REIT Ltd.

3 Yr Beta 0.09 - 0.07 - 0.36 - 0.17 - 0.39 STO

CODE: SSS

Price High 82 85 82 94 157 ISIN: ZAE000208963 SHORT: STOR-AGE LISTED: 2015

REG NO: 2015/168454/06

FOUNDED: 2005

Price Low 62 55 41 44 73 NATURE OF BUSINESS: Stor-Age, a fully integrated and internally managed

Price Prd End 75 69 79 60 82 real estate investment trust (“REIT”), is the leading and largest self storage

RATIOS property fund and brand in South Africa.

Ret on SH Fnd - 2.14 - 2.74 12.59 - 23.16 - 48.34 A highly specialised property fund focusedonthe fast growingselfstorage

D:E - - - - 0.37 sector, a niche sub-sector of the broader commercial property market,

Current Ratio 277.72 393.90 35.61 1.46 0.12 Stor-Agedevelops,acquiresandmanageshighprofileselfstorageproperties.

216