Page 181 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 181

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – ORI

DIRECTORS: HickeyHH(ind ne), MosololiTF(ind ne),

Orion Minerals Ltd. NeedhamCDS(ind ne), Themba Y (ind ne),

Spencer K C (Chair, ind ne), Loots C (CEO), Louw D (FD)

ORI

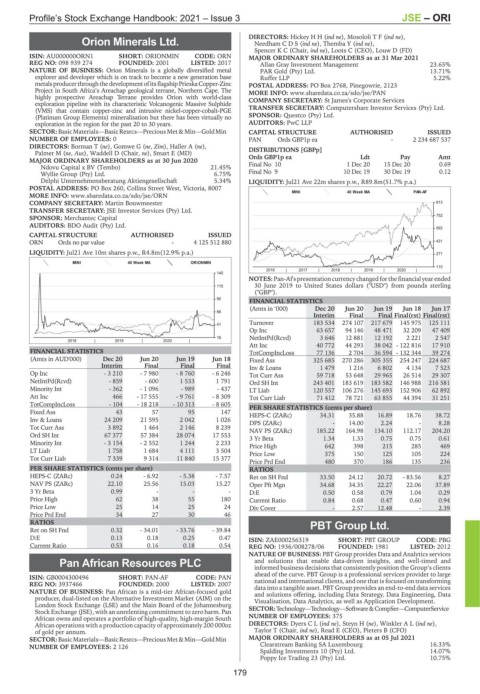

ISIN: AU000000ORN1 SHORT: ORIONMIN CODE: ORN MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021

REG NO: 098 939 274 FOUNDED: 2001 LISTED: 2017 Allan Gray Investment Management 23.65%

NATURE OF BUSINESS: Orion Minerals is a globally diversified metal PAR Gold (Pty) Ltd. 13.71%

explorer and developer which is on track to become a new generation base Ruffer LLP 5.22%

metalsproducerthrough thedevelopmentofitsflagshipPrieskaCopper-Zinc POSTAL ADDRESS: PO Box 2768, Pinegowrie, 2123

Project in South Africa’s Areachap geological terrane, Northern Cape. The MORE INFO: www.sharedata.co.za/sdo/jse/PAN

highly prospective Areachap Terrane provides Orion with world-class COMPANY SECRETARY: St James's Corporate Services

exploration pipeline with its characteristic Volcanogenic Massive Sulphide

(VMS) that contain copper-zinc and intrusive nickel-copper-cobalt-PGE TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

(Platinum Group Elements) mineralisation but there has been virtually no SPONSOR: Questco (Pty) Ltd.

exploration in the region for the past 20 to 30 years. AUDITORS: PwC LLP

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin CAPITAL STRUCTURE AUTHORISED ISSUED

NUMBER OF EMPLOYEES: 0 PAN Ords GBP1p ea - 2 234 687 537

DIRECTORS: Borman T (ne), Gomwe G (ne, Zim), Haller A (ne), DISTRIBUTIONS [GBPp]

Palmer M (ne, Aus), Waddell D (Chair, ne), Smart E (MD)

Pay

Ldt

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 Ords GBP1p ea 1 Dec 20 15 Dec 20 Amt

Final No 10

0.69

Ndovu Capital x BV (Tembo) 21.45%

Wyllie Group (Pty) Ltd. 6.75% Final No 9 10 Dec 19 30 Dec 19 0.12

Delphi Unternehmensberatung Aktiengesellschaft 5.34% LIQUIDITY: Jul21 Ave 22m shares p.w., R89.8m(51.7% p.a.)

POSTAL ADDRESS: PO Box 260, Collins Street West, Victoria, 8007

MINI 40 Week MA PAN-AF

MORE INFO: www.sharedata.co.za/sdo/jse/ORN

COMPANY SECRETARY: Martin Bouwmeester 913

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

752

SPONSOR: Merchantec Capital

AUDITORS: BDO Audit (Pty) Ltd.

592

CAPITAL STRUCTURE AUTHORISED ISSUED

ORN Ords no par value - 4 125 512 880 431

LIQUIDITY: Jul21 Ave 10m shares p.w., R4.8m(12.9% p.a.) 271

MINI 40 Week MA ORIONMIN

110

2016 | 2017 | 2018 | 2019 | 2020 |

140

NOTES: Pan-Af'spresentationcurrency changed for the financialyear ended

115 30 June 2019 to United States dollars ("USD") from pounds sterling

("GBP").

90

FINANCIAL STATISTICS

(Amts in ‘000) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

66

Interim Final Final Final(rst) Final(rst)

41 Turnover 183 534 274 107 217 679 145 975 125 111

Op Inc 63 657 94 146 48 471 32 209 47 409

16 NetIntPd(Rcvd) 3 646 12 881 12 192 2 221 2 547

2018 | 2019 | 2020 |

Att Inc 40 772 44 293 38 042 - 122 816 17 910

FINANCIAL STATISTICS TotCompIncLoss 77 136 2 704 36 594 - 132 344 39 274

(Amts in AUD'000) Dec 20 Jun 20 Jun 19 Jun 18 Fixed Ass 325 685 270 286 305 355 254 247 224 687

Interim Final Final Final Inv & Loans 1 479 1 216 6 802 4 134 7 523

Op Inc - 3 210 - 7 980 - 8 760 - 6 246 Tot Curr Ass 59 718 53 648 29 965 26 514 29 307

NetIntPd(Rcvd) - 859 - 600 1 533 1 791 Ord SH Int 243 401 183 619 183 582 146 988 216 581

Minority Int - 362 - 1 096 - 989 - 437 LT Liab 120 557 106 276 145 693 152 906 62 892

Att Inc 466 - 17 555 - 9 761 - 8 309 Tot Curr Liab 71 412 78 721 63 855 44 394 31 251

TotCompIncLoss - 104 - 18 218 - 10 313 - 8 605 PER SHARE STATISTICS (cents per share)

Fixed Ass 43 57 95 147 HEPS-C (ZARc) 34.31 35.88 16.89 18.76 38.72

Inv & Loans 24 209 21 595 2 042 1 026 DPS (ZARc) - 14.00 2.24 - 8.28

Tot Curr Ass 3 892 1 464 2 146 8 239 NAV PS (ZARc) 185.22 164.98 134.10 112.17 204.20

Ord SH Int 67 377 57 384 28 074 17 553 3 Yr Beta 1.34 1.33 0.75 0.75 0.61

Minority Int - 3 154 - 2 552 1 244 2 233 Price High 642 398 215 285 469

LT Liab 1 758 1 684 4 111 3 504 Price Low 375 150 125 105 224

Tot Curr Liab 7 339 9 314 11 840 15 377

Price Prd End 480 370 186 135 236

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 0.24 - 6.92 - 5.38 - 7.57 Ret on SH Fnd 33.50 24.12 20.72 - 83.56 8.27

NAV PS (ZARc) 22.10 25.56 15.03 15.27 Oper Pft Mgn 34.68 34.35 22.27 22.06 37.89

3 Yr Beta 0.99 - - - D:E 0.50 0.58 0.79 1.04 0.29

Price High 62 38 55 180 Current Ratio 0.84 0.68 0.47 0.60 0.94

Price Low 25 14 25 24 Div Cover - 2.57 12.48 - 2.39

Price Prd End 34 27 30 46

RATIOS PBT Group Ltd.

Ret on SH Fnd 0.32 - 34.01 - 33.76 - 39.84

PBT

D:E 0.13 0.18 0.25 0.47

ISIN: ZAE000256319 SHORT: PBT GROUP CODE: PBG

Current Ratio 0.53 0.16 0.18 0.54 REG NO: 1936/008278/06 FOUNDED: 1981 LISTED: 2012

NATURE OF BUSINESS: PBT Group provides Data and Analytics services

Pan African Resources PLC and solutions that enable data-driven insights, and well-timed and

informed business decisions that consistently position the Group’s clients

PAN ahead of the curve. PBT Group is a professional services provider to large

ISIN: GB0004300496 SHORT: PAN-AF CODE: PAN national and international clients, and one that is focused on transforming

REG NO: 3937466 FOUNDED: 2000 LISTED: 2007 data into a tangible asset. PBT Group provides an end-to-end data services

NATURE OF BUSINESS: Pan African is a mid-tier African-focused gold and solutions offering, including Data Strategy, Data Engineering, Data

producer, dual-listed on the Alternative Investment Market (AIM) on the Visualisation, Data Analytics, as well as Application Development.

London Stock Exchange (LSE) and the Main Board of the Johannesburg SECTOR:Technology—Technology—Software&CompSer—ComputerService

Stock Exchange (JSE), with an unrelenting commitment to zero harm. Pan

African owns and operates a portfolio of high-quality, high-margin South NUMBER OF EMPLOYEES: 375

African operations with a production capacity of approximately 200 000oz DIRECTORS: DyersCL(ind ne), Steyn H (ne), WinklerAL(ind ne),

of gold per annum. Taylor T (Chair, ind ne), Read E (CEO), Pieters B (CFO)

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin MAJOR ORDINARY SHAREHOLDERS as at 05 Jul 2021

NUMBER OF EMPLOYEES: 2 126 Clearstream Banking SA Luxembourg 16.33%

Spalding Investments 10 (Pty) Ltd. 14.07%

Poppy Ice Trading 23 (Pty) Ltd. 10.75%

179