Page 180 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 180

JSE – OMN Profile’s Stock Exchange Handbook: 2021 – Issue 3

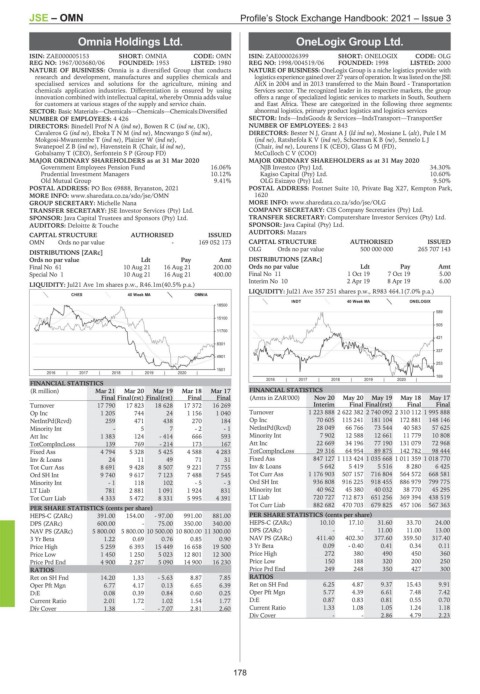

Omnia Holdings Ltd. OneLogix Group Ltd.

OMN ONE

ISIN: ZAE000005153 SHORT: OMNIA CODE: OMN ISIN: ZAE000026399 SHORT: ONELOGIX CODE: OLG

REG NO: 1967/003680/06 FOUNDED: 1953 LISTED: 1980 REG NO: 1998/004519/06 FOUNDED: 1998 LISTED: 2000

NATURE OF BUSINESS: Omnia is a diversified Group that conducts NATURE OF BUSINESS: OneLogix Group is a niche logistics provider with

research and development, manufactures and supplies chemicals and logistics experience gained over 27 years of operation. It was listed on the JSE

specialised services and solutions for the agriculture, mining and AltX in 2004 and in 2013 transferred to the Main Board - Transportation

chemicals application industries. Differentiation is ensured by using Services sector. The recognized leader in its respective markets, the group

innovation combined with intellectual capital, whereby Omnia adds value offers a range of specialized logistic services to markets in South, Southern

for customers at various stages of the supply and service chain. and East Africa. These are categorized in the following three segments:

SECTOR: Basic Materials—Chemicals—Chemicals—Chemicals:Diversified abnormal logistics, primary product logistics and logistics services

NUMBER OF EMPLOYEES: 4 426 SECTOR: Inds—IndsGoods & Services—IndsTransport—TransportSer

DIRECTORS: Binedell ProfNA(ind ne), BowenRC(ind ne, UK), NUMBER OF EMPLOYEES: 2 843

Cavaleros G (ind ne), EbokaTNM(ind ne), Mncwango S (ind ne), DIRECTORS: Bester N J, GrantAJ(ld ind ne), Mosiane L (alt), Pule I M

Mokgosi-Mwantembe T (ind ne), Plaizier W (ind ne), (ind ne), RatshefolaKV(ind ne), SchoemanKB(ne), Sennelo L J

SwanepoelZB(ind ne), Havenstein R (Chair, ld ind ne), (Chair, ind ne), Lourens I K (CEO), Glass G M (FD),

Gobalsamy T (CEO), Serfontein S P (Group FD) McCulloch C V (COO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 MAJOR ORDINARY SHAREHOLDERS as at 31 May 2020

Government Employees Pension Fund 16.06% NJB Investco (Pty) Ltd. 34.30%

Prudential Investment Managers 10.12% Kagiso Capital (Pty) Ltd. 10.60%

Old Mutual Group 9.41% OLG Esizayo (Pty) Ltd. 9.50%

POSTAL ADDRESS: PO Box 69888, Bryanston, 2021 POSTAL ADDRESS: Postnet Suite 10, Private Bag X27, Kempton Park,

MORE INFO: www.sharedata.co.za/sdo/jse/OMN 1620

GROUP SECRETARY: Michelle Nana MORE INFO: www.sharedata.co.za/sdo/jse/OLG

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: Deloitte & Touche SPONSOR: Java Capital (Pty) Ltd.

AUDITORS: Mazars

CAPITAL STRUCTURE AUTHORISED ISSUED

OMN Ords no par value - 169 052 173 CAPITAL STRUCTURE AUTHORISED ISSUED

OLG Ords no par value 500 000 000 265 707 143

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt DISTRIBUTIONS [ZARc]

Final No 61 10 Aug 21 16 Aug 21 200.00 Ords no par value Ldt Pay Amt

Special No 1 10 Aug 21 16 Aug 21 400.00 Final No 11 1 Oct 19 7 Oct 19 5.00

Interim No 10 2 Apr 19 8 Apr 19 6.00

LIQUIDITY: Jul21 Ave 1m shares p.w., R46.1m(40.5% p.a.)

LIQUIDITY: Jul21 Ave 357 251 shares p.w., R983 464.1(7.0% p.a.)

CHES 40 Week MA OMNIA

INDT 40 Week MA ONELOGIX

18500

589

15100

505

11700

421

8301

337

4901

253

1501

2016 | 2017 | 2018 | 2019 | 2020 |

169

2016 | 2017 | 2018 | 2019 | 2020 |

FINANCIAL STATISTICS

(R million) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17 FINANCIAL STATISTICS

Final Final(rst) Final(rst) Final Final (Amts in ZAR'000) Nov 20 May 20 May 19 May 18 May 17

Turnover 17 790 17 823 18 628 17 372 16 269 Interim Final Final(rst) Final Final

Op Inc 1 205 744 24 1 156 1 040 Turnover 1 223 888 2 622 382 2 740 092 2 310 112 1 995 888

NetIntPd(Rcvd) 259 471 438 270 184 Op Inc 70 605 115 241 181 104 172 881 148 146

Minority Int - 5 7 - 2 - 1 NetIntPd(Rcvd) 28 049 66 766 73 544 40 583 57 625

Att Inc 1 383 124 - 414 666 593 Minority Int 7 902 12 588 12 661 11 779 10 808

TotCompIncLoss 139 769 - 214 173 167 Att Inc 22 669 34 196 77 190 131 079 72 968

Fixed Ass 4 794 5 328 5 425 4 588 4 283 TotCompIncLoss 29 316 64 954 89 875 142 782 98 444

Inv & Loans 24 11 49 71 31 Fixed Ass 847 127 1 113 424 1 035 668 1 011 359 1 018 770

Tot Curr Ass 8 691 9 428 8 507 9 221 7 755 Inv & Loans 5 642 5 419 5 516 8 280 6 425

Ord SH Int 9 740 9 617 7 123 7 488 7 545 Tot Curr Ass 1 176 903 507 157 716 804 564 572 668 581

Minority Int - 1 118 102 - 5 - 3 Ord SH Int 936 808 916 225 918 455 886 979 799 775

LT Liab 781 2 881 1 091 1 924 831 Minority Int 40 962 45 380 40 032 38 770 45 295

Tot Curr Liab 4 333 5 472 8 331 5 995 4 391 LT Liab 720 727 712 873 651 256 369 394 438 519

Tot Curr Liab 882 682 470 703 679 825 457 106 567 363

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 391.00 154.00 - 97.00 991.00 881.00 PER SHARE STATISTICS (cents per share)

DPS (ZARc) 600.00 - 75.00 350.00 340.00 HEPS-C (ZARc) 10.10 17.10 31.60 33.70 24.00

NAV PS (ZARc) 5 800.00 5 800.00 10 500.00 10 800.00 11 300.00 DPS (ZARc) - - 11.00 11.00 13.00

3 Yr Beta 1.22 0.69 0.76 0.85 0.90 NAV PS (ZARc) 411.40 402.30 377.60 359.50 317.40

Price High 5 259 6 393 15 449 16 658 19 500 3 Yr Beta 0.09 - 0.40 0.41 0.34 0.11

Price Low 1 450 1 250 5 023 12 801 12 300 Price High 272 380 490 450 360

Price Prd End 4 900 2 287 5 090 14 900 16 230 Price Low 150 188 320 200 250

RATIOS Price Prd End 249 248 350 427 300

Ret on SH Fnd 14.20 1.33 - 5.63 8.87 7.85 RATIOS

Oper Pft Mgn 6.77 4.17 0.13 6.65 6.39 Ret on SH Fnd 6.25 4.87 9.37 15.43 9.91

D:E 0.08 0.39 0.84 0.60 0.25 Oper Pft Mgn 5.77 4.39 6.61 7.48 7.42

Current Ratio 2.01 1.72 1.02 1.54 1.77 D:E 0.87 0.83 0.81 0.55 0.70

Div Cover 1.38 - - 7.07 2.81 2.60 Current Ratio 1.33 1.08 1.05 1.24 1.18

Div Cover - - 2.86 4.79 2.23

178