Page 186 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 186

JSE – PSG Profile’s Stock Exchange Handbook: 2021 – Issue 3

FINANCIAL STATISTICS

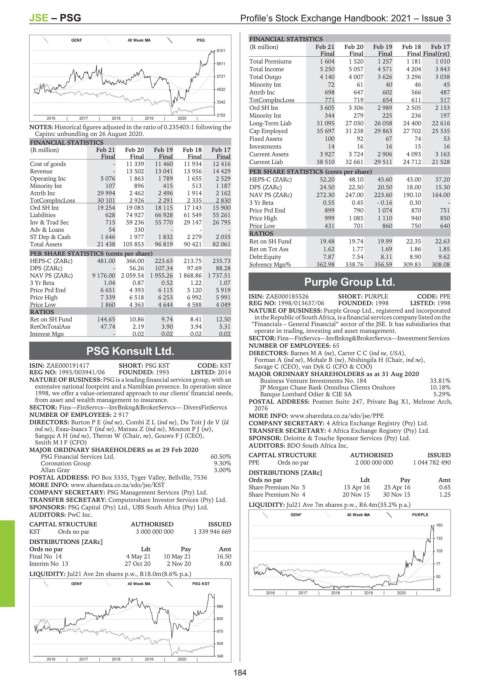

GENF 40 Week MA PSG

(R million) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17

8101

Final Final Final Final Final(rst)

Total Premiums 1 604 1 520 1 257 1 181 1 010

6911

Total Income 5 250 5 057 4 571 4 204 3 843

5721 Total Outgo 4 140 4 007 3 626 3 296 3 038

Minority Int 72 61 40 46 45

4532

Attrib Inc 698 647 602 566 487

TotCompIncLoss 771 719 654 611 517

3342

Ord SH Int 3 605 3 306 2 989 2 505 2 153

2152 Minority Int 344 279 225 236 197

2016 | 2017 | 2018 | 2019 | 2020 |

Long-Term Liab 31 095 27 030 26 058 24 400 22 616

NOTES: Historical figures adjusted in the ratio of 0.235403:1 following the

Capitec unbundling on 26 August 2020. Cap Employed 35 697 31 238 29 863 27 702 25 535

Fixed Assets 100 92 67 74 53

FINANCIAL STATISTICS

(R million) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17 Investments 14 16 16 15 16

Final Final Final Final Final Current Assets 3 927 3 724 2 906 4 093 3 163

Cost of goods - 11 339 11 460 11 934 12 416 Current Liab 38 510 32 661 29 511 24 712 21 528

Revenue - 13 502 13 041 13 956 14 429 PER SHARE STATISTICS (cents per share)

Operating Inc 5 076 1 863 1 789 1 655 2 529 HEPS-C (ZARc) 52.20 48.10 45.60 43.00 37.20

Minority Int 107 896 415 513 1 187 DPS (ZARc) 24.50 22.50 20.50 18.00 15.30

Attrib Inc 29 994 2 462 2 496 1 914 2 162 NAV PS (ZARc) 272.30 247.00 223.60 190.10 164.00

TotCompIncLoss 30 101 2 926 2 291 2 335 2 830 3 Yr Beta 0.55 0.45 - 0.16 0.30 -

Ord SH Int 19 254 19 083 18 115 17 143 15 900 Price Prd End 899 790 1 074 870 751

Liabilities 628 74 927 66 928 61 549 55 261 Price High 999 1 085 1 110 940 850

Inv & Trad Sec 715 59 236 55 770 29 147 26 795

Adv&Loans 54 330 - - - Price Low 431 701 860 750 640

RATIOS

ST Dep & Cash 1 646 1 977 1 832 2 279 2 035

Total Assets 21 438 105 853 96 819 90 421 82 061 Ret on SH Fund 19.48 19.74 19.99 22.35 22.63

Ret on Tot Ass 1.62 1.77 1.69 1.86 1.85

PER SHARE STATISTICS (cents per share) Debt:Equity 7.87 7.54 8.11 8.90 9.62

HEPS-C (ZARc) 481.00 366.00 223.63 213.75 235.73

DPS (ZARc) - 56.26 107.34 97.69 88.28 Solvency Mgn% 362.98 338.76 356.59 309.83 308.08

NAV PS (ZARc) 9 176.00 2 059.54 1 955.26 1 868.86 1 737.51

3 Yr Beta 1.04 0.87 0.52 1.22 1.07 Purple Group Ltd.

Price Prd End 6 651 4 393 6 115 5 120 5 919 PUR

Price High 7 339 6 518 6 253 6 992 5 991 ISIN: ZAE000185526 SHORT: PURPLE CODE: PPE

Price Low 1 860 4 363 4 644 4 588 4 049 REG NO: 1998/013637/06 FOUNDED: 1998 LISTED: 1998

RATIOS NATURE OF BUSINESS: Purple Group Ltd., registered and incorporated

Ret on SH Fund 144.65 10.86 9.74 8.41 12.50 inthe Republic ofSouth Africa, isafinancialservices companylistedonthe

RetOnTotalAss 47.74 2.19 3.90 3.94 5.31 “Financials – General Financial” sector of the JSE. It has subsidiaries that

Interest Mgn - 0.02 0.02 0.02 0.02 operate in trading, investing and asset management.

SECTOR:Fins—FinServcs—InvBnkng&BrokerServcs—InvestmentServices

NUMBER OF EMPLOYEES: 65

PSG Konsult Ltd. DIRECTORS: BarnesMA(ne), CarterCC(ind ne, USA),

Forman A (ind ne), Mohale B (ne), Ntshingila H (Chair, ind ne),

PSG

ISIN: ZAE000191417 SHORT: PSG KST CODE: KST Savage C (CEO), van Dyk G (CFO & COO)

REG NO: 1993/003941/06 FOUNDED: 1993 LISTED: 2014 MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2020

NATURE OF BUSINESS: PSG is a leading financial services group, with an Business Venture Investments No. 184 33.81%

extensive national footprint and a Namibian presence. In operation since JP Morgan Chase Bank Omnibus Clients Onshore 10.18%

1998, we offer a value-orientated approach to our clients' financial needs, Banque Lombard Odier & CIE SA 5.29%

from asset and wealth management to insurance. POSTAL ADDRESS: Postnet Suite 247, Private Bag X1, Melrose Arch,

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs 2076

NUMBER OF EMPLOYEES: 2 917 MORE INFO: www.sharedata.co.za/sdo/jse/PPE

DIRECTORS: BurtonPE(ind ne), CombiZL(ind ne), Du Toit J de V (ld COMPANY SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

ind ne), Esau-Isaacs T (ind ne), Matsau Z (ind ne), MoutonPJ(ne), TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

SangquAH(ind ne), Theron W (Chair, ne), Gouws F J (CEO), SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd.

SmithMIF (CFO) AUDITORS: BDO South Africa Inc.

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

PSG Financial Services Ltd. 60.50% CAPITAL STRUCTURE AUTHORISED ISSUED

Coronation Group 9.30% PPE Ords no par 2 000 000 000 1 044 782 490

Allan Gray 3.00% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: PO Box 3335, Tyger Valley, Bellville, 7536 Ords no par Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/KST Share Premium No 5 15 Apr 16 25 Apr 16 0.65

COMPANY SECRETARY: PSG Management Services (Pty) Ltd. Share Premium No 4 20 Nov 15 30 Nov 15 1.25

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSORS: PSG Capital (Pty) Ltd., UBS South Africa (Pty) Ltd. LIQUIDITY: Jul21 Ave 7m shares p.w., R6.4m(35.2% p.a.)

AUDITORS: PwC Inc. GENF 40 Week MA PURPLE

CAPITAL STRUCTURE AUTHORISED ISSUED 160

KST Ords no par 3 000 000 000 1 339 946 669

132

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt

105

Final No 14 4 May 21 10 May 21 16.50

Interim No 13 27 Oct 20 2 Nov 20 8.00 77

LIQUIDITY: Jul21 Ave 2m shares p.w., R18.0m(8.6% p.a.)

50

GENF 40 Week MA PSG KST

22

2016 | 2017 | 2018 | 2019 | 2020 |

990

830

670

509

349

2016 | 2017 | 2018 | 2019 | 2020 |

184