Page 158 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 158

JSE – MCM Profile’s Stock Exchange Handbook: 2021 – Issue 3

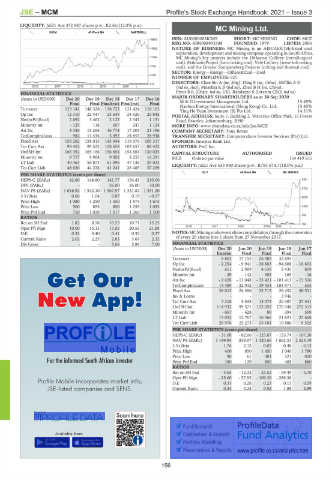

LIQUIDITY: Jul21 Ave 372 887 shares p.w., R2.6m(12.8% p.a.)

MC Mining Ltd.

INDM 40 Week MA MASTDRILL

MCM

18600 ISIN: AU000000MCM9 SHORT: MC MINING CODE: MCZ

REG NO: ABN008905388 FOUNDED: 1979 LISTED: 2006

14982 NATURE OF BUSINESS: MC Mining is an AIM/ASX/JSE-listed coal

exploration, development and mining company operating in South Africa.

11364 MC Mining’s key projects include the Uitkomst Colliery (metallurgical

coal), Makhado Project (hard coking coal). Vele Colliery (semi-soft coking

7746 coal), and the Greater Soutpansberg Projects (coking and thermal coal).

SECTOR: Energy—Energy—OilGas&Coal—Coal

4128

NUMBER OF EMPLOYEES: 625

DIRECTORS: Chee Sin A (ne, Sing), Ding S (ne, China), Mifflin A D

510

2016 | 2017 | 2018 | 2019 | 2020 | (ind ne, Aus), MosehlaKB(ind ne), ZhenBH(ne, China),

FINANCIAL STATISTICS Pryor B R (Chair, ind ne, UK), Randazzo S (Interim CEO, ind ne)

(Amts in USD'000) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16 MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020 15.49%

M & G Investment Management Ltd.

Final Final Final(rst) Final(rst) Final

Turnover 123 142 148 328 138 722 121 424 118 103 Haohua Energy International (Hong Kong) Co. Ltd. 15.45%

Ying He Yuan Investment (S) Pte Ltd.

14.31%

Op Inc 12 310 22 447 23 649 24 926 25 845 POSTAL ADDRESS: Suite 7, Building 2, Waverley Office Park, 15 Forest

NetIntPd(Rcvd) 2 692 3 462 2 122 2 341 1 131 Road, Bramley, Johannesburg, 2090

Minority Int - 129 118 697 247 1 124 MORE INFO: www.sharedata.co.za/sdo/jse/MCZ

Att Inc 3 336 15 264 16 774 17 203 21 196 COMPANY SECRETARY: Tony Bevan

TotCompIncLoss 982 11 434 5 492 24 853 28 938 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Fixed Ass 156 282 158 015 145 044 119 076 105 317 SPONSOR: Investec Bank Ltd.

Tot Curr Ass 98 452 99 522 108 658 103 657 86 422 AUDITORS: PwC Inc.

Ord SH Int 166 392 165 166 156 654 154 681 130 025 CAPITAL STRUCTURE AUTHORISED ISSUED

Minority Int 9 757 9 964 9 002 8 255 16 291 MCZ Ords no par value - 154 419 555

LT Liab 40 363 56 873 61 096 47 136 29 023

Tot Curr Liab 48 626 44 228 41 241 28 485 37 269 LIQUIDITY: Jul21 Ave 533 980 shares p.w., R793 674.7(18.0% p.a.)

OILP 40 Week MA MC MINING

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 42.80 148.80 141.77 154.43 210.00 3351

DPS (ZARc) - - 26.00 26.00 30.00

2702

NAV PS (ZARc) 1 616.92 1 542.10 1 567.97 1 331.82 1 351.20

3 Yr Beta 0.66 1.04 0.87 0.19 - 0.17 2052

Price High 1 080 1 250 1 550 1 874 1 675

Price Low 500 895 850 1 255 1 093 1403

Price Prd End 750 1 028 1 017 1 260 1 500

753

RATIOS

Ret on SH Fnd 1.82 8.78 10.55 10.71 15.25 104

2016 | 2017 | 2018 | 2019 | 2020 |

Oper Pft Mgn 10.00 15.13 17.05 20.53 21.88

D:E 0.32 0.40 0.41 0.32 0.27 NOTES: MC Mining underwent share consolidationthrough the conversion

Current Ratio 2.02 2.25 2.63 3.64 2.32 of every 20 shares into 1 share from 27 November 2017.

Div Cover - - 5.66 5.89 7.00 FINANCIAL STATISTICS

(Amts in USD'000) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

Interim Final Final Final Final

Turnover 8 803 17 155 26 403 32 693 -

Op Inc - 2 254 - 9 941 - 28 883 - 94 608 - 16 803

NetIntPd(Rcvd) 651 2 909 4 639 2 435 859

Minority Int - 29 - 142 - 305 - 165 - 16

Att Inc - 2 628 - 12 048 - 33 421 - 101 413 - 15 536

TotCompIncLoss 14 489 - 32 932 - 39 434 - 103 971 505

Fixed Ass 28 015 24 396 32 713 29 452 30 531

Inv & Loans - - - 3 946 -

Tot Curr Ass 7 318 5 534 13 073 20 487 27 541

Ord SH Int 114 932 99 571 132 052 170 340 272 315

Minority Int - 657 - 628 89 394 559

LT Liab 15 052 12 767 16 566 21 821 23 668

Tot Curr Liab 29 976 23 273 25 101 10 886 9 525

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 31.08 - 82.06 - 125.07 - 155.74 - 107.38

NAV PS (ZARc) 1 149.95 839.07 1 320.66 1 662.51 2 523.19

3 Yr Beta 1.76 2.12 0.05 0.48 - 0.13

Price High 400 950 1 450 1 040 1 780

Price Low 90 61 301 321 800

Price Prd End 180 129 850 465 880

RATIOS

Ret on SH Fnd - 4.65 - 12.32 - 25.52 - 59.49 - 5.70

Oper Pft Mgn - 25.60 - 57.95 - 109.39 - 289.38 -

D:E 0.31 0.28 0.23 0.13 0.09

Current Ratio 0.24 0.24 0.52 1.88 2.89

Fund Research

Comparison & Analysis

Portfolio Modelling

Presentations & Reports www.profile.co.za/analytics.htm

156