Page 159 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 159

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – MED

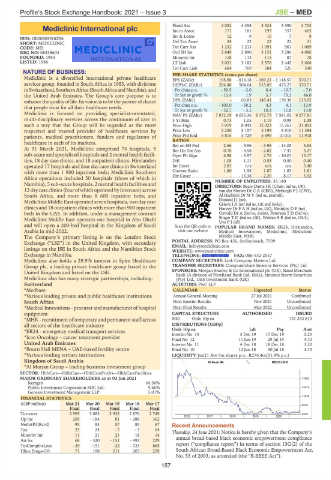

Fixed Ass 4 052 4 358 3 524 3 590 3 703

Mediclinic International plc Inv in Assoc 171 181 193 357 465

MED Inv & Loans 12 9 10 7 8

ISIN: GB00B8HX8Z88

SHORT: MEDICLINIC Def Tax Asset 34 22 22 22 21

CODE: MEI Tot Curr Ass 1 232 1 213 1 091 961 1 069

REG NO: 08338604 Ord SH Int 2 849 2 890 3 151 3 286 4 086

FOUNDED: 1983 Minority Int 118 113 115 87 78

LISTED: 1986 LT Liab 3 021 3 182 2 576 2 445 2 668

Tot Curr Liab 684 769 584 525 590

NATURE OF BUSINESS: PER SHARE STATISTICS (cents per share)

Mediclinic is a diversified international private healthcare EPS (ZARc) 195.96 - 814.18 - 369.21 - 1 148.57 570.71

services group, founded in South Africa in 1983, with divisions HEPS-C (ZARc) 204.48 504.64 515.09 475.27 570.71

inSwitzerland,SouthernAfrica(SouthAfricaandNamibia),and Pct chng p.a. - 59.5 - 2.0 8.4 - 16.7 - 7.0

the United Arab Emirates. The Group’s core purpose is to Tr 5yr av grwth % - 15.4 1.9 5.7 79.3 46.0

enhance the quality of life. Its vision is to be the partner of choice DPS (ZARc) - 60.83 145.41 139.39 133.92

4.1

4.3

that people trust for all their healthcare needs. Pct chng p.a. - 100.0 - 58.2 10.3 11.8 - 13.9

13.0

- 3.5

Tr 5yr av grwth %

- 32.7

Mediclinic is focused on providing specialist-orientated, NAV PS (ZARc) 7 872.19 8 655.36 8 372.73 7 581.02 9 277.81

multi-disciplinary services across the continuum of care in 3 Yr Beta 0.73 1.05 1.19 0.98 1.38

such a way that the Group will be regarded as the most Price High 7 019 8 043 12 023 15 261 21 803

respected and trusted provider of healthcare services by Price Low 5 250 5 157 5 199 8 810 11 384

patients, medical practitioners, funders and regulators of Price Prd End 5 815 5 729 5 699 10 015 11 918

healthcare in each of its markets. RATIOS 2.66 - 9.96 - 3.98 - 14.05 5.84

Ret on SH Fnd

At 31 March 2021, Mediclinic comprised 74 hospitals, 5 Ret On Tot Ass 0.78 - 4.58 - 2.02 - 7.47 3.27

sub-acute and specialised hospitals and 2 mental health facili- Oper Pft Mgn 6.98 - 5.97 2.76 - 10.01 13.17

ties, 18 day case clinics, and 18 outpatient clinics. Hirslanden D:E 1.05 1.11 0.53 0.50 0.40

operated 17 hospitals and four day case clinics in Switzerland Int Cover 2.83 n/a n/a n/a 5.40

with more than 1 900 inpatient beds; Mediclinic Southern Current Ratio 1.80 1.58 1.87 1.83 1.81

-

- 13.38

- 2.20

- 8.17

Africa operations included 50 hospitals (three of which in Div Cover NUMBER OF EMPLOYEES: 33 140 3.92

Namibia), 5 sub-acute hospitals, 2 mental health facilities and DIRECTORS: Beale Dame I K (Chair, ind ne, UK),

12 day caseclinics(fourofwhich operated by Intercare) across van der Merwe Dr C A (CEO), Myburgh P J (CFO),

South Africa, and more than 8 600 inpatient beds; and Al HashimiDrMY(ind ne, Emirati),

Mediclinic Middle East operated seven hospitals, two day case Durand JJ(ne),

Grieve JA(snr ind ne, UK and Swiss),

clinics and 18 outpatient clinics with more than 900 inpatient Harvey Dr F A H (ind ne, UK), Meintjes D P (ne),

beds in the UAE. In addition, under a management contract Oswald Dr A (ind ne, Swiss), Petersen T D (ind ne),

Mediclinic Middle East operates one hospital in Abu Dhabi Singer TD(ind ne, UK), Weiner S R (ind ne, USA),

Uys P J (alt)

and will open a 200-bed hospital in the Kingdom of Saudi Scan the QR code to POPULAR BRAND NAMES: ER24, Hirslanden,

Arabia in mid-2022. visit our website Medical Innovations, Mediclinic, Mediclinic

The Company’s primary listing is on the London Stock Middle East, MHR

Exchange (“LSE”) in the United Kingdom, with secondary POSTAL ADDRESS: PO Box 456, Stellenbosch, 7599

EMAIL: info@mediclinic.com

listings on the JSE in South Africa and the Namibian Stock WEBSITE: www.mediclinic.com

Exchange in Namibia. TELEPHONE: 021-809-6500 FAX: 086-532-2557

Mediclinic also holds a 29.9% interest in Spire Healthcare COMPANY SECRETARY: Link Company Matters Ltd.

Group plc, a leading private healthcare group based in the TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

United Kingdom and listed on the LSE. SPONSORS: Morgan Stanley & Co International plc (UK), Rand Merchant

Bank (A division of FirstRand Bank Ltd. (SA)), Simonis Storm Securities

Mediclinic also has many strategic partnerships, including: (Pty) Ltd., UBS Investment Bank (UK)

Switzerland AUDITORS: PwC LLP

*Medbase CALENDAR Expected Status

*Various leading private and public healthcare institutions Annual General Meeting 27 Jul 2021 Confirmed

South Africa Next Interim Results Nov 2021 Unconfirmed

*Medical Innovations - procurer and manufacturer of hospital Next Final Results May 2022 Unconfirmed

equipment CAPITAL STRUCTURE AUTHORISED ISSUED

*MHR - recruitment of temporary and permanent staff across MEI Ords 10p ea - 737 243 810

all sectors of the healthcare industry DISTRIBUTIONS [GBPp]

Pay

Ldt

*ER24 - emergency medical transport services Ords 10p ea 3 Dec 19 17 Dec 19 Amt

Interim No 13

3.20

*Icon Oncology – cancer treatment provider

Final No 12 11 Jun 19 29 Jul 19 4.70

United Arab Emirates Interim No 11 4 Dec 18 18 Dec 18 3.20

*Bourn Hall MENA – UAE-based fertility centre Final No 10 12 Jun 18 30 Jul 18 4.70

*Various leading tertiary institutions LIQUIDITY: Jun21 Ave 5m shares p.w., R276.4m(31.9% p.a.)

Kingdom of Saudi Arabia 40 Week MA MEDICLINIC

*Al Murjan Group – leading business investment group

SECTOR: HlthCare—HtlhCare—HlthCarePrvdrs—HlthCareFacilities

MAJOR ORDINARY SHAREHOLDERS as at 03 Jun 2021 17953

Remgro 44.56%

Public Investment Corporation SOC Ltd. 9.66% 14815

Genesis Investment Management LLP 5.01%

11676

FINANCIAL STATISTICS

(GBP million) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17 8538

Final Final Final Final Final

Turnover 2 995 3 083 2 932 2 876 2 749 5400

2016 | 2017 | 2018 | 2019 | 2020 |

Op Inc 209 - 184 81 - 288 362

NetIntPd(Rcvd) 95 83 57 85 67 Recent Announcements

Tax 25 24 - 7 - 5 64 Thursday, 24 June 2021: Notice is hereby given that the Company’s

Minority Int 11 21 21 18 14 annual broad-based black economic empowerment compliance

Att Inc 68 - 320 - 151 - 492 229

TotCompIncLoss - 29 - 151 - 22 - 723 665 report (“compliance report”) in terms of section 13G(2) of the

Hline Erngs-CO 71 198 211 203 229 South African Broad-Based Black Economic Empowerment Act,

No. 53 of 2003, as amended (the “B-BBEE Act”).

157