Page 153 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 153

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – LIF

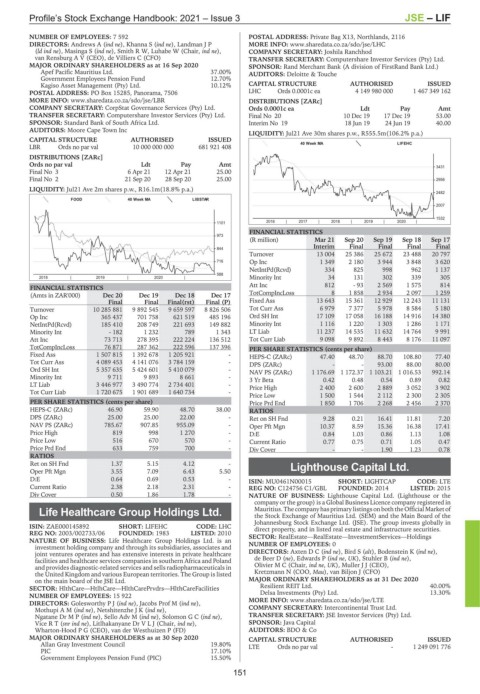

NUMBER OF EMPLOYEES: 7 592 POSTAL ADDRESS: Private Bag X13, Northlands, 2116

DIRECTORS: Andrews A (ind ne), Khanna S (ind ne), Landman J P MORE INFO: www.sharedata.co.za/sdo/jse/LHC

(ld ind ne), Masinga S (ind ne), Smith R W, Luhabe W (Chair, ind ne), COMPANY SECRETARY: Joshila Ranchhod

van Rensburg A V (CEO), de Villiers C (CFO) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 16 Sep 2020 SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

Apef Pacific Mauritius Ltd. 37.00% AUDITORS: Deloitte & Touche

Government Employees Pension Fund 12.70%

Kagiso Asset Management (Pty) Ltd. 10.12% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 15285, Panorama, 7506 LHC Ords 0.0001c ea 4 149 980 000 1 467 349 162

MORE INFO: www.sharedata.co.za/sdo/jse/LBR DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: CorpStat Governance Services (Pty) Ltd. Ords 0.0001c ea Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 20 10 Dec 19 17 Dec 19 53.00

SPONSOR: Standard Bank of South Africa Ltd. Interim No 19 18 Jun 19 24 Jun 19 40.00

AUDITORS: Moore Cape Town Inc

LIQUIDITY: Jul21 Ave 30m shares p.w., R555.5m(106.2% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

LBR Ords no par val 10 000 000 000 681 921 408 40 Week MA LIFEHC

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

3431

Final No 3 6 Apr 21 12 Apr 21 25.00

Final No 2 21 Sep 20 28 Sep 20 25.00 2956

LIQUIDITY: Jul21 Ave 2m shares p.w., R16.1m(18.8% p.a.)

2482

FOOD 40 Week MA LIBSTAR

2007

1532

2016 | 2017 | 2018 | 2019 | 2020 |

1101

FINANCIAL STATISTICS

973

(R million) Mar 21 Sep 20 Sep 19 Sep 18 Sep 17

Interim Final Final Final Final

844

Turnover 13 004 25 386 25 672 23 488 20 797

716 Op Inc 1 349 2 180 3 944 3 848 3 620

NetIntPd(Rcvd) 334 825 998 962 1 137

588

2018 | 2019 | 2020 | Minority Int 34 131 302 339 305

Att Inc 812 - 93 2 569 1 575 814

FINANCIAL STATISTICS

(Amts in ZAR'000) Dec 20 Dec 19 Dec 18 Dec 17 TotCompIncLoss 8 1 858 2 934 2 097 1 259

Final Final Final(rst) Final (P) Fixed Ass 13 643 15 361 12 929 12 243 11 131

Turnover 10 285 881 9 892 545 9 659 597 8 826 506 Tot Curr Ass 6 979 7 377 5 978 8 584 5 180

Op Inc 365 437 701 758 621 519 485 196 Ord SH Int 17 109 17 058 16 188 14 916 14 380

NetIntPd(Rcvd) 185 410 208 749 221 693 149 882 Minority Int 1 116 1 220 1 303 1 286 1 171

Minority Int - 182 1 232 789 1 343 LT Liab 11 237 14 535 11 632 14 764 9 991

Att Inc 73 713 278 395 222 224 136 512 Tot Curr Liab 9 098 9 892 8 443 8 176 11 097

TotCompIncLoss 76 871 287 362 222 596 137 396 PER SHARE STATISTICS (cents per share)

Fixed Ass 1 507 815 1 392 678 1 205 921 - HEPS-C (ZARc) 47.40 48.70 88.70 108.80 77.40

Tot Curr Ass 4 089 453 4 141 076 3 784 159 - DPS (ZARc) - - 93.00 88.00 80.00

Ord SH Int 5 357 635 5 424 601 5 410 079 - NAV PS (ZARc) 1 176.69 1 172.37 1 103.21 1 016.53 992.14

Minority Int 9 711 9 893 8 661 - 3 Yr Beta 0.42 0.48 0.54 0.89 0.82

LT Liab 3 446 977 3 490 774 2 734 401 - Price High 2 400 2 600 2 889 3 052 3 902

Tot Curr Liab 1 720 675 1 901 689 1 640 734 -

Price Low 1 500 1 544 2 112 2 300 2 305

PER SHARE STATISTICS (cents per share) Price Prd End 1 850 1 706 2 268 2 456 2 370

HEPS-C (ZARc) 46.90 59.90 48.70 38.00 RATIOS

DPS (ZARc) 25.00 25.00 22.00 - Ret on SH Fnd 9.28 0.21 16.41 11.81 7.20

NAV PS (ZARc) 785.67 907.85 955.09 - Oper Pft Mgn 10.37 8.59 15.36 16.38 17.41

Price High 819 998 1 270 - D:E 0.84 1.03 0.86 1.13 1.08

Price Low 516 670 570 - Current Ratio 0.77 0.75 0.71 1.05 0.47

Price Prd End 633 759 700 - Div Cover - - 1.90 1.23 0.78

RATIOS

Ret on SH Fnd 1.37 5.15 4.12 - Lighthouse Capital Ltd.

Oper Pft Mgn 3.55 7.09 6.43 5.50

LIG

D:E 0.64 0.69 0.53 - ISIN: MU0461N00015 SHORT: LIGHTCAP CODE: LTE

Current Ratio 2.38 2.18 2.31 - REG NO: C124756 C1/GBL FOUNDED: 2014 LISTED: 2015

Div Cover 0.50 1.86 1.78 - NATURE OF BUSINESS: Lighthouse Capital Ltd. (Lighthouse or the

company or the group) is a Global Business Licence company registered in

Life Healthcare Group Holdings Ltd. Mauritius. The companyhasprimary listingsonboth the Official Market of

the Stock Exchange of Mauritius Ltd. (SEM) and the Main Board of the

LIF Johannesburg Stock Exchange Ltd. (JSE). The group invests globally in

ISIN: ZAE000145892 SHORT: LIFEHC CODE: LHC direct property, and in listed real estate and infrastructure securities.

REG NO: 2003/002733/06 FOUNDED: 1983 LISTED: 2010 SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

NATURE OF BUSINESS: Life Healthcare Group Holdings Ltd. is an NUMBER OF EMPLOYEES: 0

investment holding company and through its subsidiaries, associates and

joint ventures operates and has extensive interests in private healthcare DIRECTORS: AxtenDC(ind ne), Bird S (alt), Bodenstein K (ind ne),

facilities and healthcare services companies in southern Africa and Poland de Beer D (ne), Edwards P (ind ne, UK), Stuhler B (ind ne),

and provides diagnostic-related services and sells radiopharmaceuticals in Olivier M C (Chair, ind ne, UK), Muller J J (CEO),

the United Kingdom and various European territories. The Group is listed Kretzmann N (COO, Mau), van Biljon J (CFO)

on the main board of the JSE Ltd. MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

SECTOR: HlthCare—HtlhCare—HlthCarePrvdrs—HlthCareFacilities Resilient REIT Ltd. 40.00%

NUMBER OF EMPLOYEES: 15 922 Delsa Investments (Pty) Ltd. 13.30%

DIRECTORS: GolesworthyPJ(ind ne), Jacobs Prof M (ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/LTE

MothupiAM(ind ne), NetshitenzheJK(ind ne), COMPANY SECRETARY: Intercontinental Trust Ltd.

Ngatane DrMP(ind ne), Sello Adv M (ind ne), SolomonGC(ind ne), TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

ViceRT(snr ind ne), Litlhakanyane DrVLJ (Chair, ind ne), SPONSOR: Java Capital

Wharton-Hood P G (CEO), van der Westhuizen P (FD) AUDITORS: BDO & Co

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020 CAPITAL STRUCTURE AUTHORISED ISSUED

Allan Gray Investment Council 19.80% LTE Ords no par val - 1 249 091 776

PIC 17.10%

Government Employees Pension Fund (PIC) 15.50%

151