Page 83 - 2021 Issue 2

P. 83

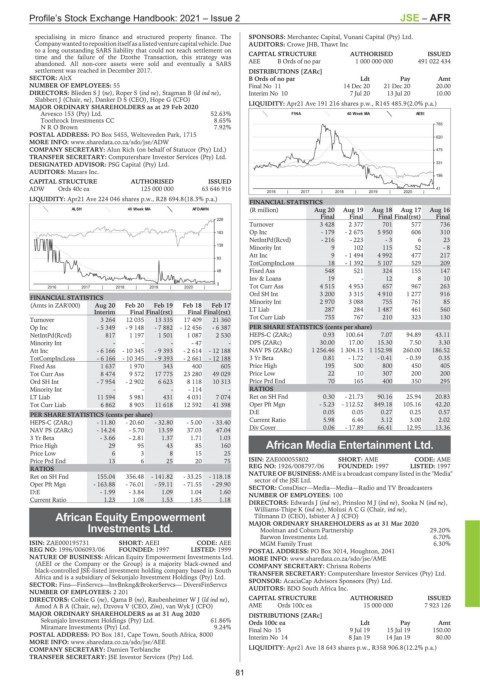

Profile’s Stock Exchange Handbook: 2021 – Issue 2 JSE – AFR

specialising in micro finance and structured property finance. The SPONSORS: Merchantec Capital, Vunani Capital (Pty) Ltd.

Companywantedtorepositionitselfasalistedventurecapitalvehicle. Due AUDITORS: Crowe JHB, Thawt Inc

to a long outstanding SARS liability that could not reach settlement on

time and the failure of the Dzothe Transaction, this strategy was CAPITAL STRUCTURE AUTHORISED ISSUED

abandoned. All non-core assets were sold and eventually a SARS AEE B Ords of no par 1 000 000 000 491 022 434

settlement was reached in December 2017. DISTRIBUTIONS [ZARc]

SECTOR: AltX B Ords of no par Ldt Pay Amt

NUMBER OF EMPLOYEES: 55 Final No 11 14 Dec 20 21 Dec 20 20.00

DIRECTORS: BliedenSJ(ne), Roper S (ind ne), Stagman B (ld ind ne), Interim No 10 7 Jul 20 13 Jul 20 10.00

Slabbert J (Chair, ne), Danker D S (CEO), Hope G (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020 LIQUIDITY: Apr21 Ave 191 216 shares p.w., R145 485.9(2.0% p.a.)

Arvesco 153 (Pty) Ltd. 52.63% FINA 40 Week MA AEEI

Toothrock Investments CC 8.65%

N R O Brown 7.92% 765

POSTAL ADDRESS: PO Box 5455, Weltevreden Park, 1715 620

MORE INFO: www.sharedata.co.za/sdo/jse/ADW

COMPANY SECRETARY: Alun Rich (on behalf of Statucor (Pty) Ltd.) 475

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: PSG Capital (Pty) Ltd. 331

AUDITORS: Mazars Inc.

186

CAPITAL STRUCTURE AUTHORISED ISSUED

ADW Ords 40c ea 125 000 000 63 646 916 41

2016 | 2017 | 2018 | 2019 | 2020 |

LIQUIDITY: Apr21 Ave 224 046 shares p.w., R28 694.8(18.3% p.a.)

FINANCIAL STATISTICS

ALSH 40 Week MA AFDAWN (R million) Aug 20 Aug 19 Aug 18 Aug 17 Aug 16

Final Final Final Final(rst) Final

228

Turnover 3 428 2 377 701 577 736

183 Op Inc - 179 - 2 675 5 950 606 310

NetIntPd(Rcvd) - 216 - 223 - 3 6 23

138

Minority Int 9 102 115 52 - 8

Att Inc 9 - 1 494 4 992 477 217

93

TotCompIncLoss 18 - 1 392 5 107 529 209

48 Fixed Ass 548 521 324 155 147

Inv & Loans 19 - 12 8 10

3 Tot Curr Ass 4 515 4 953 657 967 263

2016 | 2017 | 2018 | 2019 | 2020 |

Ord SH Int 3 200 3 315 4 910 1 277 916

FINANCIAL STATISTICS Minority Int 2 970 3 088 755 761 85

(Amts in ZAR'000) Aug 20 Feb 20 Feb 19 Feb 18 Feb 17

Interim Final Final(rst) Final Final(rst) LT Liab 287 284 1 487 461 560

Turnover 3 264 12 035 13 335 17 409 21 360 Tot Curr Liab 755 767 210 323 130

Op Inc - 5 349 - 9 148 - 7 882 - 12 456 - 6 387 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 817 1 197 1 501 1 087 2 530 HEPS-C (ZARc) 0.93 100.64 7.07 94.89 43.11

Minority Int - - - - 47 - DPS (ZARc) 30.00 17.00 15.30 7.50 3.30

Att Inc - 6 166 - 10 345 - 9 393 - 2 614 - 12 188 NAV PS (ZARc) 1 256.46 1 304.15 1 152.98 260.00 186.52

TotCompIncLoss - 6 166 - 10 345 - 9 393 - 2 661 - 12 188 3 Yr Beta 0.81 - 1.72 - 0.41 - 0.39 0.35

Fixed Ass 1 637 1 970 343 400 605 Price High 195 500 800 450 405

Tot Curr Ass 8 474 9 572 17 775 23 280 49 029 Price Low 22 10 307 200 200

Ord SH Int - 7 954 - 2 902 6 623 8 118 10 313 Price Prd End 70 165 400 350 295

Minority Int - - - - 114 - RATIOS

LT Liab 11 594 5 981 431 4 031 7 074 Ret on SH Fnd 0.30 - 21.73 90.16 25.94 20.83

Tot Curr Liab 6 862 8 903 11 618 12 592 41 398 Oper Pft Mgn - 5.23 - 112.52 849.18 105.16 42.20

D:E 0.05 0.05 0.27 0.25 0.57

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 11.80 - 20.60 - 32.80 - 5.00 - 33.40 Current Ratio 5.98 6.46 3.12 3.00 2.02

NAV PS (ZARc) - 14.24 - 5.70 13.59 37.03 47.04 Div Cover 0.06 - 17.89 66.41 12.95 13.36

3 Yr Beta - 3.66 - 2.81 1.37 1.71 1.03

Price High 29 95 43 85 160 African Media Entertainment Ltd.

Price Low 6 3 8 15 25 AFR

Price Prd End 13 6 25 20 75 ISIN: ZAE000055802 SHORT: AME CODE: AME

RATIOS REG NO: 1926/008797/06 FOUNDED: 1997 LISTED: 1997

Ret on SH Fnd 155.04 356.48 - 141.82 - 33.25 - 118.18 NATURE OF BUSINESS: AME is a broadcast company listed in the "Media"

sector of the JSE Ltd.

Oper Pft Mgn - 163.88 - 76.01 - 59.11 - 71.55 - 29.90 SECTOR: ConsDiscr—Media—Media—Radio and TV Broadcasters

D:E - 1.99 - 3.84 1.09 1.04 1.60 NUMBER OF EMPLOYEES: 100

Current Ratio 1.23 1.08 1.53 1.85 1.18

DIRECTORS: Edwards J (ind ne), PrinslooMJ(ind ne), Sooka N (ind ne),

Williams-Thipe K (ind ne), MolusiACG (Chair, ind ne),

African Equity Empowerment Tiltmann D (CEO), Isbister A J (CFO)

Investments Ltd. MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 29.20%

Moolman and Coburn Partnership

Barwon Investments Ltd. 6.70%

AFR

ISIN: ZAE000195731 SHORT: AEEI CODE: AEE MGM Family Trust 6.30%

REG NO: 1996/006093/06 FOUNDED: 1997 LISTED: 1999 POSTAL ADDRESS: PO Box 3014, Houghton, 2041

NATURE OF BUSINESS: African Equity Empowerment Investments Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/AME

(AEEI or the Company or the Group) is a majority black-owned and COMPANY SECRETARY: Chrisna Roberts

black-controlled JSE-listed investment holding company based in South TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Africa and is a subsidiary of Sekunjalo Investment Holdings (Pty) Ltd. SPONSOR: AcaciaCap Advisors Sponsors (Pty) Ltd.

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs

NUMBER OF EMPLOYEES: 2 201 AUDITORS: BDO South Africa Inc.

DIRECTORS: Colbie G (ne), Qama B (ne), RaubenheimerWJ(ld ind ne), CAPITAL STRUCTURE AUTHORISED ISSUED

AmodABA (Chair, ne), Dzvova V (CEO, Zim), van Wyk J (CFO) AME Ords 100c ea 15 000 000 7 923 126

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2020 DISTRIBUTIONS [ZARc]

Sekunjalo Investment Holdings (Pty) Ltd. 61.86% Ords 100c ea Ldt Pay Amt

Miramare Investments (Pty) Ltd. 9.24% Final No 15 9 Jul 19 15 Jul 19 150.00

POSTAL ADDRESS: PO Box 181, Cape Town, South Africa, 8000 Interim No 14 8 Jan 19 14 Jan 19 80.00

MORE INFO: www.sharedata.co.za/sdo/jse/AEE

COMPANY SECRETARY: Damien Terblanche LIQUIDITY: Apr21 Ave 18 643 shares p.w., R358 906.8(12.2% p.a.)

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

81