Page 246 - 2021 Issue 2

P. 246

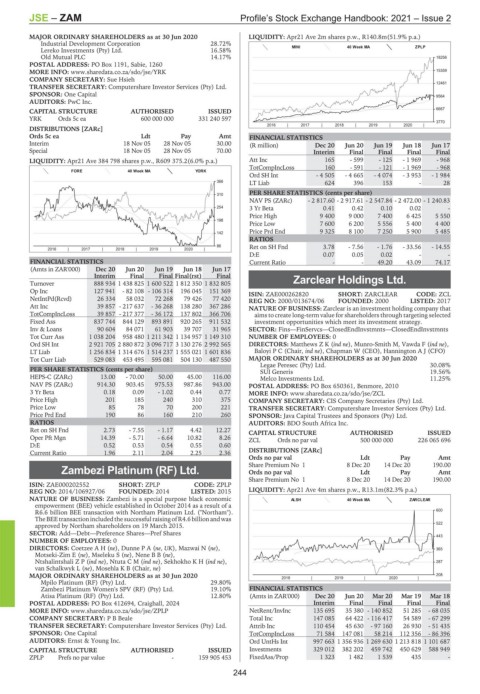

JSE – ZAM Profile’s Stock Exchange Handbook: 2021 – Issue 2

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 LIQUIDITY: Apr21 Ave 2m shares p.w., R140.8m(51.9% p.a.)

Industrial Development Corporation 28.72%

Lereko Investments (Pty) Ltd. 16.58% MINI 40 Week MA ZPLP

Old Mutual PLC 14.17% 18256

POSTAL ADDRESS: PO Box 1191, Sabie, 1260

MORE INFO: www.sharedata.co.za/sdo/jse/YRK 15359

COMPANY SECRETARY: Sue Hsieh

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 12461

SPONSOR: One Capital 9564

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED 6667

YRK Ords 5c ea 600 000 000 331 240 597

3770

2016 | 2017 | 2018 | 2019 | 2020 |

DISTRIBUTIONS [ZARc]

Ords 5c ea Ldt Pay Amt FINANCIAL STATISTICS

Interim 18 Nov 05 28 Nov 05 30.00 (R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

Special 18 Nov 05 28 Nov 05 70.00 Interim Final Final Final Final

LIQUIDITY: Apr21 Ave 384 798 shares p.w., R609 375.2(6.0% p.a.) Att Inc 165 - 599 - 125 - 1 969 - 968

TotCompIncLoss 160 - 591 - 121 - 1 969 - 968

FORE 40 Week MA YORK

Ord SH Int - 4 505 - 4 665 - 4 074 - 3 953 - 1 984

366 LT Liab 624 396 153 - 28

PER SHARE STATISTICS (cents per share)

310

NAV PS (ZARc) - 2 817.60 - 2 917.61 - 2 547.84 - 2 472.00 - 1 240.83

254 3 Yr Beta 0.41 0.42 0.10 0.02 -

Price High 9 400 9 000 7 400 6 425 5 550

198

Price Low 7 600 6 200 5 556 5 400 4 400

Price Prd End 9 325 8 100 7 250 5 900 5 485

142

RATIOS

86 Ret on SH Fnd 3.78 - 7.56 - 1.76 - 33.56 - 14.55

2016 | 2017 | 2018 | 2019 | 2020 |

D:E 0.07 0.05 0.02 - -

FINANCIAL STATISTICS Current Ratio - - 49.20 43.09 74.17

(Amts in ZAR'000) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

Interim Final Final Final(rst) Final

Turnover 888 934 1 438 825 1 600 522 1 812 350 1 832 805 Zarclear Holdings Ltd.

ZAR

Op Inc 127 941 - 82 108 - 106 314 196 045 151 369 ISIN: ZAE000262820 SHORT: ZARCLEAR CODE: ZCL

NetIntPd(Rcvd) 26 334 58 032 72 268 79 426 77 420 REG NO: 2000/013674/06 FOUNDED: 2000 LISTED: 2017

Att Inc 39 857 - 217 637 - 36 268 138 280 367 286 NATURE OF BUSINESS: Zarclear is an investment holding company that

TotCompIncLoss 39 857 - 217 377 - 36 172 137 802 366 706 aims to create long-term value for shareholders through targeting selected

Fixed Ass 837 744 844 129 893 891 920 265 911 532 investment opportunities which meet its investment strategy.

Inv & Loans 90 604 84 071 61 903 39 707 31 965 SECTOR: Fins—FinServcs—ClosedEndInvstmnts—ClosedEndInvstmnts

Tot Curr Ass 1 038 204 958 480 1 211 342 1 134 957 1 149 310 NUMBER OF EMPLOYEES: 0

Ord SH Int 2 921 705 2 880 872 3 096 717 3 130 276 2 992 565 DIRECTORS: MatthewsZK(ind ne), Munro-Smith M, Vawda F (ind ne),

LT Liab 1 256 834 1 314 676 1 514 237 1 555 021 1 601 836 Baloyi P C (Chair, ind ne), Chapman W (CEO), Hannington A J (CFO)

Tot Curr Liab 529 083 453 495 595 081 504 130 487 550 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

Legae Peresec (Pty) Ltd. 30.08%

PER SHARE STATISTICS (cents per share) SUI Generis 19.56%

HEPS-C (ZARc) 13.00 - 70.00 50.00 45.00 116.00 Melco Investments Ltd. 11.25%

NAV PS (ZARc) 914.30 903.45 975.53 987.86 943.00 POSTAL ADDRESS: PO Box 650361, Benmore, 2010

3 Yr Beta 0.18 0.09 - 1.02 0.44 0.77 MORE INFO: www.sharedata.co.za/sdo/jse/ZCL

Price High 201 185 240 310 375 COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

Price Low 85 78 70 200 221 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Price Prd End 190 86 160 210 260 SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

RATIOS AUDITORS: BDO South Africa Inc.

Ret on SH Fnd 2.73 - 7.55 - 1.17 4.42 12.27 CAPITAL STRUCTURE AUTHORISED ISSUED

Oper Pft Mgn 14.39 - 5.71 - 6.64 10.82 8.26 ZCL Ords no par val 500 000 000 226 065 696

D:E 0.52 0.53 0.54 0.55 0.60

Current Ratio 1.96 2.11 2.04 2.25 2.36 DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

Share Premium No 1 8 Dec 20 14 Dec 20 190.00

Zambezi Platinum (RF) Ltd. Ords no par val Ldt Pay Amt

ZAM Share Premium No 1 8 Dec 20 14 Dec 20 190.00

ISIN: ZAE000202552 SHORT: ZPLP CODE: ZPLP

REG NO: 2014/106927/06 FOUNDED: 2014 LISTED: 2015 LIQUIDITY: Apr21 Ave 4m shares p.w., R13.1m(82.3% p.a.)

NATURE OF BUSINESS: Zambezi is a special purpose black economic ALSH 40 Week MA ZARCLEAR

empowerment (BEE) vehicle established in October 2014 as a result of a

R6.6 billion BEE transaction with Northam Platinum Ltd. ("Northam"). 600

The BEEtransactionincludedthe successful raising ofR4.6 billion andwas

approved by Northam shareholders on 19 March 2015. 522

SECTOR: Add—Debt—Preference Shares—Pref Shares

443

NUMBER OF EMPLOYEES: 0

DIRECTORS: CoetzeeAH(ne), DunnePA(ne, UK), Mazwai N (ne), 365

Motseki-Zim E (ne), Mseleku S (ne), NeneBB(ne),

NtshalintshaliZP(ind ne), NtutaCM(ind ne), SekhokhoKH(ind ne), 287

van Schalkwyk L (ne), Mosehla K B (Chair, ne)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 2018 | 2019 | 2020 | 208

Mpilo Platinum (RF) (Pty) Ltd. 29.80%

Zambezi Platinum Women's SPV (RF) (Pty) Ltd. 19.10% FINANCIAL STATISTICS

Atisa Platinum (RF) (Pty) Ltd. 12.80% (Amts in ZAR'000) Dec 20 Jun 20 Mar 20 Mar 19 Mar 18

POSTAL ADDRESS: PO Box 412694, Craighall, 2024 Interim Final Final Final Final

MORE INFO: www.sharedata.co.za/sdo/jse/ZPLP NetRent/InvInc 135 695 35 380 - 140 852 51 285 - 68 035

COMPANY SECRETARY: P B Beale Total Inc 147 085 64 422 - 116 417 54 589 - 67 299

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Attrib Inc 110 454 45 630 - 97 160 26 930 - 51 435

SPONSOR: One Capital TotCompIncLoss 71 584 147 081 58 214 112 356 - 86 396

AUDITORS: Ernst & Young Inc. Ord UntHs Int 997 663 1 356 936 1 269 630 1 213 818 1 101 687

CAPITAL STRUCTURE AUTHORISED ISSUED Investments 329 012 382 202 459 742 450 629 588 949

ZPLP Prefs no par value - 159 905 453 FixedAss/Prop 1 323 1 482 1 539 435 -

244