Page 240 - 2021 Issue 2

P. 240

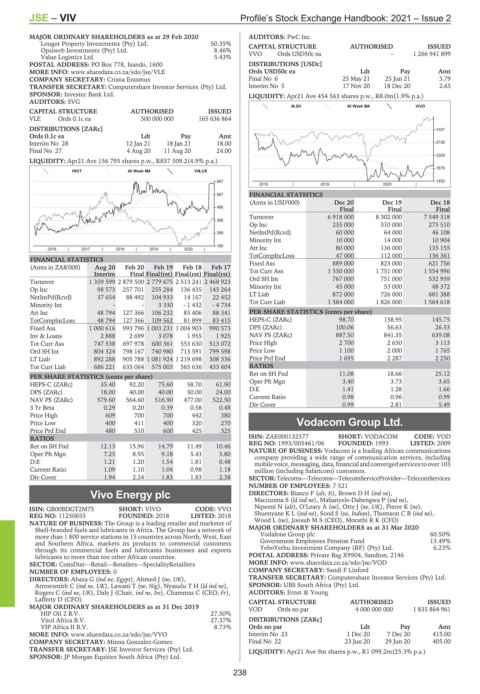

JSE – VIV Profile’s Stock Exchange Handbook: 2021 – Issue 2

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020 AUDITORS: PwC Inc.

Lougot Property Investments (Pty) Ltd. 50.35% CAPITAL STRUCTURE AUTHORISED ISSUED

Opsiweb Investments (Pty) Ltd. 8.46%

Value Logistics Ltd. 5.43% VVO Ords USD50c ea - 1 266 941 899

POSTAL ADDRESS: PO Box 778, Isando, 1600 DISTRIBUTIONS [USDc]

MORE INFO: www.sharedata.co.za/sdo/jse/VLE Ords USD50c ea Ldt Pay Amt

COMPANY SECRETARY: Crisna Erasmus Final No 6 25 May 21 25 Jun 21 3.79

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Interim No 5 17 Nov 20 18 Dec 20 2.65

SPONSOR: Investec Bank Ltd. LIQUIDITY: Apr21 Ave 454 563 shares p.w., R8.0m(1.9% p.a.)

AUDITORS: SVG

ALSH 40 Week MA VIVO

CAPITAL STRUCTURE AUTHORISED ISSUED

VLE Ords 0.1c ea 500 000 000 165 636 864

DISTRIBUTIONS [ZARc] 3167

Ords 0.1c ea Ldt Pay Amt

Interim No 28 12 Jan 21 18 Jan 21 18.00 2738

Final No 27 4 Aug 20 11 Aug 20 24.00

2309

LIQUIDITY: Apr21 Ave 156 795 shares p.w., R857 509.2(4.9% p.a.)

1879

INDT 40 Week MA VALUE

667 1450

2018 | 2019 | 2020 |

567 FINANCIAL STATISTICS

(Amts in USD'000) Dec 20 Dec 19 Dec 18

468

Final Final Final

Turnover 6 918 000 8 302 000 7 549 318

368

Op Inc 235 000 310 000 275 510

NetIntPd(Rcvd) 60 000 64 000 46 108

268

Minority Int 10 000 14 000 10 904

169 Att Inc 80 000 136 000 135 155

2016 | 2017 | 2018 | 2019 | 2020 |

TotCompIncLoss 47 000 112 000 136 361

FINANCIAL STATISTICS

(Amts in ZAR'000) Aug 20 Feb 20 Feb 19 Feb 18 Feb 17 Fixed Ass 889 000 823 000 621 756

Interim Final Final(rst) Final(rst) Final(rst) Tot Curr Ass 1 550 000 1 751 000 1 554 996

Turnover 1 359 599 2 879 500 2 779 675 2 513 241 2 468 923 Ord SH Int 767 000 751 000 532 959

Op Inc 98 573 257 701 255 284 136 435 143 264 Minority Int 45 000 53 000 48 372

NetIntPd(Rcvd) 37 654 88 492 104 933 14 167 22 452 LT Liab 872 000 726 000 681 388

Minority Int - - 3 330 - 1 432 - 4 734 Tot Curr Liab 1 584 000 1 826 000 1 564 618

Att Inc 48 794 127 366 106 232 83 406 88 341 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 48 794 127 366 109 562 81 899 83 415 HEPS-C (ZARc) 98.70 158.95 145.75

Fixed Ass 1 000 616 993 796 1 003 231 1 004 903 990 573 DPS (ZARc) 100.06 56.63 26.53

Inv & Loans 2 888 2 699 3 078 1 955 1 925 NAV PS (ZARc) 887.50 841.35 639.08

Tot Curr Ass 747 538 697 978 600 361 553 630 513 072 Price High 2 700 2 650 3 113

Ord SH Int 804 324 798 167 740 980 713 591 799 598 Price Low 1 100 2 000 1 765

LT Liab 892 288 905 788 1 081 924 1 219 698 308 336 Price Prd End 1 695 2 287 2 250

Tot Curr Liab 686 221 635 064 575 003 565 636 433 604 RATIOS

Ret on SH Fnd 11.08 18.66 25.12

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 35.40 92.20 75.60 58.70 61.90 Oper Pft Mgn 3.40 3.73 3.65

DPS (ZARc) 18.00 40.00 40.00 30.00 24.00 D:E 1.41 1.28 1.66

NAV PS (ZARc) 579.60 564.60 516.90 477.00 522.50 Current Ratio 0.98 0.96 0.99

3 Yr Beta 0.29 0.20 0.39 0.58 0.48 Div Cover 0.99 2.81 5.49

Price High 609 700 700 442 380

Price Low 400 411 400 320 270 Vodacom Group Ltd.

Price Prd End 480 510 600 425 325 VOD

RATIOS ISIN: ZAE000132577 SHORT: VODACOM CODE: VOD

Ret on SH Fnd 12.13 15.96 14.79 11.49 10.46 REG NO: 1993/005461/06 FOUNDED: 1993 LISTED: 2009

NATURE OF BUSINESS: Vodacom is a leading African communications

Oper Pft Mgn 7.25 8.95 9.18 5.43 5.80 company providing a wide range of communication services, including

D:E 1.21 1.20 1.54 1.81 0.48 mobile voice, messaging, data,financialandconverged services toover103

Current Ratio 1.09 1.10 1.04 0.98 1.18 million (including Safaricom) customers.

Div Cover 1.94 2.24 1.83 1.83 2.38 SECTOR:Telecoms—Telecoms—TelecomServiceProvider—TelecomServices

NUMBER OF EMPLOYEES: 7 521

Vivo Energy plc DIRECTORS: Bianco F (alt, It), BrownDH(ind ne),

Macozoma S (ld ind ne), Mahanyele-Dabengwa P (ind ne),

VIV Nqweni N (alt), O’Leary A (ne), Otty J (ne, UK), Pierre K (ne),

ISIN: GB00BDGT2M75 SHORT: VIVO CODE: VVO

REG NO: 11250655 FOUNDED: 2018 LISTED: 2018 ShuenyaneKL(ind ne), Sood S (ne, Indian), ThomsonCB(ind ne),

Wood L (ne), Joosub M S (CEO), Morathi R K (CFO)

NATURE OF BUSINESS: The Group is a leading retailer and marketer of

Shell-branded fuels and lubricants in Africa. The Group has a network of MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

more than 1 800 service stations in 15 countries across North, West, East Vodafone Group plc 60.50%

and Southern Africa, markets its products to commercial customers Government Employees Pension Fund 13.49%

through its commercial fuels and lubricants businesses and exports YeboYethu Investment Company (RF) (Pty) Ltd. 6.23%

lubricants to more than ten other African countries. POSTAL ADDRESS: Private Bag X9904, Sandton, 2146

SECTOR: ConsDisr—Retail—Retailers—SpecialityRetaillers MORE INFO: www.sharedata.co.za/sdo/jse/VOD

NUMBER OF EMPLOYEES: 0 COMPANY SECRETARY: Sandi F Linford

DIRECTORS: Abaza G (ind ne, Egypt), Ahmed J (ne, UK), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Arrowsmith C (ind ne, UK), Lawani T (ne, Nig), NyasuluTH(ld ind ne), SPONSOR: UBS South Africa (Pty) Ltd.

Rogers C (ind ne, UK), Daly J (Chair, ind ne, Ire), Chammas C (CEO, Fr), AUDITORS: Ernst & Young

Lafferty D (CFO) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019 VOD Ords no par 4 000 000 000 1 835 864 961

HIP Oil 2 B.V. 27.50%

Vitol Africa B.V. 27.37% DISTRIBUTIONS [ZARc]

VIP Africa II B.V. 8.73% Ords no par Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/VVO Interim No 23 1 Dec 20 7 Dec 20 415.00

COMPANY SECRETARY: Minna Gonzalez-Gomez Final No 22 23 Jun 20 29 Jun 20 405.00

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. LIQUIDITY: Apr21 Ave 9m shares p.w., R1 099.2m(25.3% p.a.)

SPONSOR: JP Morgan Equities South Africa (Pty) Ltd.

238