Page 241 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 241

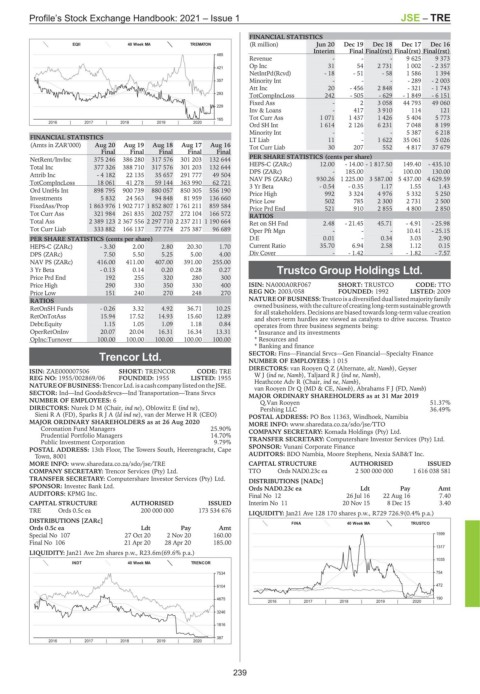

Profile’s Stock Exchange Handbook: 2021 – Issue 1 JSE – TRE

FINANCIAL STATISTICS

EQII 40 Week MA TREMATON (R million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16

Interim Final Final(rst) Final(rst) Final(rst)

485

Revenue - - - 9 625 9 373

Op Inc 31 54 2 731 1 002 - 2 357

421

NetIntPd(Rcvd) - 18 - 51 - 58 1 586 1 394

357 Minority Int - - - - 289 - 2 003

Att Inc 20 - 456 2 848 - 321 - 1 743

293 TotCompIncLoss 242 - 505 - 629 - 1 849 - 6 151

Fixed Ass - 2 3 058 44 793 49 060

229

Inv & Loans - 417 3 910 114 121

165 Tot Curr Ass 1 071 1 437 1 426 5 404 5 773

2016 | 2017 | 2018 | 2019 | 2020 |

Ord SH Int 1 614 2 126 6 231 7 048 8 199

Minority Int - - - 5 387 6 218

FINANCIAL STATISTICS LT Liab 11 - 1 622 35 061 5 026

(Amts in ZAR’000) Aug 20 Aug 19 Aug 18 Aug 17 Aug 16 Tot Curr Liab 30 207 552 4 817 37 679

Final Final Final Final Final

NetRent/InvInc 375 246 386 280 317 576 301 203 132 644 PER SHARE STATISTICS (cents per share)

Total Inc 377 326 388 710 317 576 301 203 132 644 HEPS-C (ZARc) 12.00 - - 14.00 - 1 817.50 - 149.40 - 435.10

100.00

130.00

DPS (ZARc)

185.00

Attrib Inc - 4 182 22 135 35 657 291 777 49 504

TotCompIncLoss 18 061 41 278 59 144 363 990 62 721 NAV PS (ZARc) 930.26 1 225.00 3 587.00 5 437.00 4 629.59

1.17

- 0.54

- 0.35

3 Yr Beta

1.55

1.43

Ord UntHs Int 898 795 900 739 880 057 850 305 556 190 Price High 992 3 324 4 976 5 332 5 250

Investments 5 832 24 563 94 848 81 959 136 660 Price Low 502 785 2 300 2 731 2 500

FixedAss/Prop 1 863 976 1 902 717 1 852 807 1 761 211 859 584 Price Prd End 521 910 2 855 4 800 2 850

Tot Curr Ass 321 984 261 835 202 757 272 104 166 572 RATIOS

Total Ass 2 389 123 2 367 556 2 297 710 2 237 211 1 190 664 Ret on SH Fnd 2.48 - 21.45 45.71 - 4.91 - 25.98

Tot Curr Liab 333 882 166 137 77 774 275 387 96 689 Oper Pft Mgn - - - 10.41 - 25.15

PER SHARE STATISTICS (cents per share) D:E 0.01 - 0.34 3.03 2.90

HEPS-C (ZARc) - 3.30 2.00 2.80 20.30 1.70 Current Ratio 35.70 6.94 2.58 1.12 0.15

DPS (ZARc) 7.50 5.50 5.25 5.00 4.00 Div Cover - - 1.42 - - 1.82 - 7.57

NAV PS (ZARc) 416.00 411.00 407.00 391.00 255.00

3 Yr Beta - 0.13 0.14 0.20 0.28 0.27 Trustco Group Holdings Ltd.

Price Prd End 192 255 320 280 300 TRU

Price High 290 330 350 330 400 ISIN: NA000A0RF067 SHORT: TRUSTCO CODE: TTO

Price Low 151 240 270 248 270 REG NO: 2003/058 FOUNDED: 1992 LISTED: 2009

RATIOS NATURE OF BUSINESS:Trustco is a diversified dual listed majority family

RetOnSH Funds - 0.26 3.32 4.92 36.71 10.25 ownedbusiness, with the culture of creating long-term sustainable growth

RetOnTotAss 15.94 17.52 14.93 15.60 12.89 for all stakeholders. Decisions are biased towards long-term value creation

and short-term hurdles are viewed as catalysts to drive success. Trustco

Debt:Equity 1.15 1.05 1.09 1.18 0.84 operates from three business segments being:

OperRetOnInv 20.07 20.04 16.31 16.34 13.31 * Insurance and its investments

OpInc:Turnover 100.00 100.00 100.00 100.00 100.00 * Resources and

* Banking and finance

Trencor Ltd. SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance

NUMBER OF EMPLOYEES: 1 015

TRE DIRECTORS: van Rooyen Q Z (Alternate, alt, Namb), Geyser

ISIN: ZAE000007506 SHORT: TRENCOR CODE: TRE

REG NO: 1955/002869/06 FOUNDED: 1955 LISTED: 1955 WJ(ind ne, Namb), TaljaardRJ(ind ne, Namb),

NATUREOFBUSINESS:TrencorLtd.isacashcompanylistedontheJSE. Heathcote Adv R (Chair, ind ne, Namb),

van Rooyen Dr Q (MD & CE, Namb), Abrahams F J (FD, Namb)

SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

NUMBER OF EMPLOYEES: 6 Q.Van Rooyen 51.37%

DIRECTORS: Nurek D M (Chair, ind ne), Oblowitz E (ind ne), Pershing LLC 36.49%

Sieni R A (FD), SparksRJA(ld ind ne), van der Merwe H R (CEO) POSTAL ADDRESS: PO Box 11363, Windhoek, Namibia

MAJOR ORDINARY SHAREHOLDERS as at 26 Aug 2020 MORE INFO: www.sharedata.co.za/sdo/jse/TTO

Coronation Fund Managers 25.90% COMPANY SECRETARY: Komada Holdings (Pty) Ltd.

Prudential Portfolio Managers 14.70%

Public Investment Corporation 9.79% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: 13th Floor, The Towers South, Heerengracht, Cape SPONSOR: Vunani Corporate Finance

Town, 8001 AUDITORS: BDO Nambia, Moore Stephens, Nexia SAB&T Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/TRE CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: Trencor Services (Pty) Ltd. TTO Ords NAD0.23c ea 2 500 000 000 1 616 038 581

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. DISTRIBUTIONS [NADc]

SPONSOR: Investec Bank Ltd. Ords NAD0.23c ea Ldt Pay Amt

AUDITORS: KPMG Inc. Final No 12 26 Jul 16 22 Aug 16 7.40

CAPITAL STRUCTURE AUTHORISED ISSUED Interim No 11 20 Nov 15 8 Dec 15 3.40

TRE Ords 0.5c ea 200 000 000 173 534 676 LIQUIDITY: Jan21 Ave 128 170 shares p.w., R729 726.9(0.4% p.a.)

DISTRIBUTIONS [ZARc] FINA 40 Week MA TRUSTCO

Ords 0.5c ea Ldt Pay Amt

Special No 107 27 Oct 20 2 Nov 20 160.00 1599

Final No 106 21 Apr 20 28 Apr 20 185.00

1317

LIQUIDITY: Jan21 Ave 2m shares p.w., R23.6m(69.6% p.a.)

1035

INDT 40 Week MA TRENCOR

7534 754

6104 472

4675 190

2016 | 2017 | 2018 | 2019 | 2020 |

3246

1816

387

2016 | 2017 | 2018 | 2019 | 2020 |

239