Page 236 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 236

JSE – THA Profile’s Stock Exchange Handbook: 2021 – Issue 1

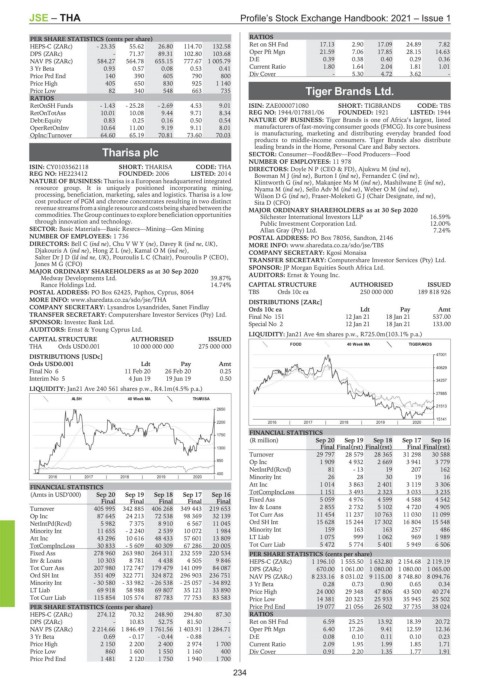

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) - 23.35 55.62 26.80 114.70 132.58 Ret on SH Fnd 17.13 2.90 17.09 24.89 7.82

DPS (ZARc) - 71.37 89.31 102.80 103.68 Oper Pft Mgn 21.59 7.06 17.85 28.15 14.63

NAV PS (ZARc) 584.27 564.78 655.15 777.67 1 005.79 D:E 0.39 0.38 0.40 0.29 0.36

3 Yr Beta 0.93 0.57 0.08 0.53 0.41 Current Ratio 1.80 1.64 2.04 1.81 1.01

Price Prd End 140 390 605 790 800 Div Cover - 5.30 4.72 3.62 -

Price High 405 650 830 925 1 140

Price Low 82 340 548 663 735 Tiger Brands Ltd.

RATIOS

TIG

RetOnSH Funds - 1.43 - 25.28 - 2.69 4.53 9.01 ISIN: ZAE000071080 SHORT: TIGBRANDS CODE: TBS

RetOnTotAss 10.01 10.08 9.44 9.71 8.34 REG NO: 1944/017881/06 FOUNDED: 1921 LISTED: 1944

Debt:Equity 0.83 0.25 0.16 0.50 0.54 NATURE OF BUSINESS: Tiger Brands is one of Africa’s largest, listed

OperRetOnInv 10.64 11.00 9.19 9.11 8.01 manufacturers of fast-moving consumer goods (FMCG). Its core business

OpInc:Turnover 64.60 65.19 70.81 73.60 70.03 is manufacturing, marketing and distributing everyday branded food

products to middle-income consumers. Tiger Brands also distribute

leading brands in the Home, Personal Care and Baby sectors.

Tharisa plc SECTOR: Consumer—Food&Bev—Food Producers—Food

THA NUMBER OF EMPLOYEES: 11 978

ISIN: CY0103562118 SHORT: THARISA CODE: THA DIRECTORS: Doyle N P (CEO & FD), Ajukwu M (ind ne),

REG NO: HE223412 FOUNDED: 2006 LISTED: 2014 BowmanMJ(ind ne), Burton I (ind ne), Fernandez C (ind ne),

NATURE OF BUSINESS: Tharisa is a European headquartered integrated Klintworth G (ind ne), Makanjee Ms M (ind ne), Mashilwane E (ind ne),

resource group. It is uniquely positioned incorporating mining, Nyama M (ind ne), Sello Adv M (ind ne), WeberOM(ind ne),

processing, beneficiation, marketing, sales and logistics. Tharisa is a low WilsonDG(ind ne), Fraser-Moleketi G J (Chair Designate, ind ne),

cost producer of PGM and chrome concentrates resulting in two distinct Sita D (CFO)

revenue streamsfromasingle resource andcostsbeing shared between the MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020

commodities. The Group continues to explore beneficiation opportunities Silchester International Investors LLP 16.59%

through innovation and technology. Public Investment Corporation Ltd. 12.00%

SECTOR: Basic Materials—Basic Resrcs—Mining—Gen Mining Allan Gray (Pty) Ltd. 7.24%

NUMBER OF EMPLOYEES: 1 736 POSTAL ADDRESS: PO Box 78056, Sandton, 2146

DIRECTORS: Bell C (ind ne), ChuVWY(ne), Davey R (ind ne, UK), MORE INFO: www.sharedata.co.za/sdo/jse/TBS

Djakouris A (ind ne), HongZL(ne), KamalOM(ind ne), COMPANY SECRETARY: Kgosi Monaisa

Salter DrJD(ld ind ne, UK), Pouroulis L C (Chair), Pouroulis P (CEO), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Jones M G (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020 SPONSOR: JP Morgan Equities South Africa Ltd.

Medway Developments Ltd. 39.87% AUDITORS: Ernst & Young Inc.

Rance Holdings Ltd. 14.74% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 62425, Paphos, Cyprus, 8064 TBS Ords 10c ea 250 000 000 189 818 926

MORE INFO: www.sharedata.co.za/sdo/jse/THA DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: Lysandros Lysandrides, Sanet Findlay Ords 10c ea Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 151 12 Jan 21 18 Jan 21 537.00

SPONSOR: Investec Bank Ltd. Special No 2 12 Jan 21 18 Jan 21 133.00

AUDITORS: Ernst & Young Cyprus Ltd.

LIQUIDITY: Jan21 Ave 4m shares p.w., R725.0m(103.1% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

THA Ords USD0.001 10 000 000 000 275 000 000 FOOD 40 Week MA TIGBRANDS

DISTRIBUTIONS [USDc] 47001

Ords USD0.001 Ldt Pay Amt

Final No 6 11 Feb 20 26 Feb 20 0.25 40629

Interim No 5 4 Jun 19 19 Jun 19 0.50 34257

LIQUIDITY: Jan21 Ave 240 561 shares p.w., R4.1m(4.5% p.a.)

27885

ALSH 40 Week MA THARISA

21513

2650

15141

2200 2016 | 2017 | 2018 | 2019 | 2020 |

FINANCIAL STATISTICS

1750

(R million) Sep 20 Sep 19 Sep 18 Sep 17 Sep 16

1300 Final Final(rst) Final(rst) Final Final(rst)

Turnover 29 797 28 579 28 365 31 298 30 588

850 Op Inc 1 909 4 932 2 669 3 941 3 779

NetIntPd(Rcvd) 81 - 13 19 207 162

400

2016 | 2017 | 2018 | 2019 | 2020 | Minority Int 26 28 30 19 16

FINANCIAL STATISTICS Att Inc 1 014 3 863 2 401 3 119 3 306

(Amts in USD’000) Sep 20 Sep 19 Sep 18 Sep 17 Sep 16 TotCompIncLoss 1 151 3 493 2 323 3 033 3 235

Final Final Final Final Final Fixed Ass 5 059 4 976 4 599 4 588 4 542

Turnover 405 995 342 885 406 268 349 443 219 653 Inv & Loans 2 855 2 732 5 102 4 720 4 905

Op Inc 87 645 24 213 72 538 98 369 32 139 Tot Curr Ass 11 454 11 237 10 763 11 030 11 099

NetIntPd(Rcvd) 5 982 7 375 8 910 6 567 11 045 Ord SH Int 15 628 15 244 17 302 16 804 15 548

Minority Int 11 655 - 2 240 2 539 10 072 1 984 Minority Int 159 163 163 257 486

Att Inc 43 296 10 616 48 433 57 601 13 809 LT Liab 1 075 999 1 062 969 1 989

TotCompIncLoss 30 833 - 5 609 40 309 67 286 20 005 Tot Curr Liab 5 472 5 774 5 401 5 949 6 506

Fixed Ass 278 960 263 980 264 311 232 559 220 534 PER SHARE STATISTICS (cents per share)

Inv & Loans 10 303 8 781 4 438 4 505 9 846 HEPS-C (ZARc) 1 196.10 1 555.50 1 632.80 2 154.68 2 119.19

Tot Curr Ass 207 980 172 747 179 479 141 099 84 087 DPS (ZARc) 670.00 1 061.00 1 080.00 1 080.00 1 065.00

Ord SH Int 351 409 322 771 324 872 296 903 236 751 NAV PS (ZARc) 8 233.16 8 031.02 9 115.00 8 748.80 8 094.76

Minority Int - 30 580 - 33 982 - 26 538 - 25 057 - 34 892 3 Yr Beta 0.28 0.73 0.90 0.65 0.34

LT Liab 69 918 58 988 69 807 35 121 33 890 Price High 24 000 29 348 47 806 43 500 40 274

Tot Curr Liab 115 854 105 574 87 783 77 753 83 583 Price Low 14 381 20 323 25 933 35 945 25 502

PER SHARE STATISTICS (cents per share) Price Prd End 19 077 21 056 26 502 37 735 38 024

HEPS-C (ZARc) 274.12 70.32 248.90 294.80 87.30 RATIOS

DPS (ZARc) - 10.83 52.75 81.50 - Ret on SH Fnd 6.59 25.25 13.92 18.39 20.72

NAV PS (ZARc) 2 214.66 1 846.49 1 761.56 1 403.91 1 284.71 Oper Pft Mgn 6.40 17.26 9.41 12.59 12.36

3 Yr Beta 0.69 - 0.17 - 0.44 - 0.88 - D:E 0.08 0.10 0.11 0.10 0.23

Price High 2 150 2 200 2 400 2 974 1 700 Current Ratio 2.09 1.95 1.99 1.85 1.71

Price Low 860 1 600 1 550 1 160 400 Div Cover 0.91 2.20 1.35 1.77 1.91

Price Prd End 1 481 2 120 1 750 1 940 1 700

234