Page 244 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 244

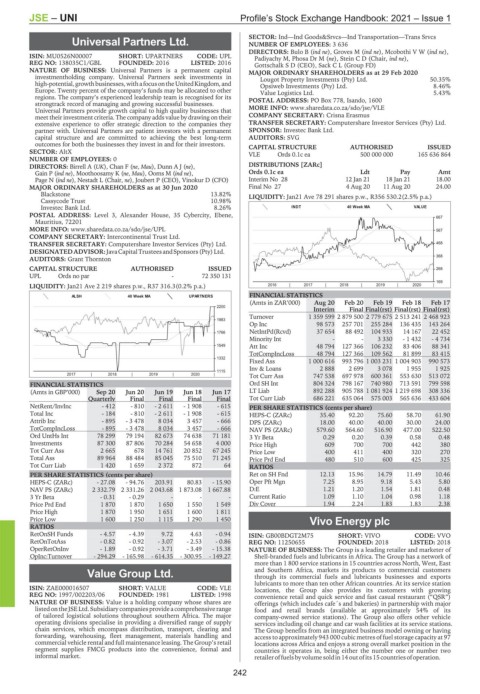

JSE – UNI Profile’s Stock Exchange Handbook: 2021 – Issue 1

SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs

Universal Partners Ltd. NUMBER OF EMPLOYEES: 3 636

UNI DIRECTORS: Bulo B (ind ne), Groves M (ind ne), McobothiVW(ind ne),

ISIN: MU0526N00007 SHORT: UPARTNERS CODE: UPL Padiyachy M, Phosa Dr M (ne), Stein C D (Chair, ind ne),

REG NO: 138035C1/GBL FOUNDED: 2016 LISTED: 2016 Gottschalk S D (CEO), Sack C L (Group FD)

NATURE OF BUSINESS: Universal Partners is a permanent capital MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

investmentholding company. Universal Partners seek investments in Lougot Property Investments (Pty) Ltd. 50.35%

high-potential,growthbusinesses,withafocusontheUnitedKingdom,and Opsiweb Investments (Pty) Ltd. 8.46%

Europe. Twenty percent of the company’s funds may be allocated to other Value Logistics Ltd. 5.43%

regions. The company’s experienced leadership team is recognised for its POSTAL ADDRESS: PO Box 778, Isando, 1600

strongtrack record of managing and growing successful businesses.

Universal Partners provide growth capital to high quality businesses that MORE INFO: www.sharedata.co.za/sdo/jse/VLE

meet their investment criteria. The company adds value by drawing on their COMPANY SECRETARY: Crisna Erasmus

extensive experience to offer strategic direction to the companies they TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

partner with. Universal Partners are patient investors with a permanent SPONSOR: Investec Bank Ltd.

capital structure and are committed to achieving the best long-term AUDITORS: SVG

outcomes for both the businesses they invest in and for their investors. CAPITAL STRUCTURE AUTHORISED ISSUED

SECTOR: AltX VLE Ords 0.1c ea 500 000 000 165 636 864

NUMBER OF EMPLOYEES: 0

DIRECTORS: Birrell A (UK), Chan F (ne, Mau), Dunn AJ(ne), DISTRIBUTIONS [ZARc]

Gain P (ind ne), Moothoosamy K (ne, Mau), Ooms M (ind ne), Ords 0.1c ea Ldt Pay Amt

Page N (ind ne), Nestadt L (Chair, ne), Joubert P (CEO), Vinokur D (CFO) Interim No 28 12 Jan 21 18 Jan 21 18.00

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 Final No 27 4 Aug 20 11 Aug 20 24.00

Blackstone 13.82% LIQUIDITY: Jan21 Ave 78 291 shares p.w., R356 530.2(2.5% p.a.)

Cassycode Trust 10.98%

Investec Bank Ltd. 8.26% INDT 40 Week MA VALUE

POSTAL ADDRESS: Level 3, Alexander House, 35 Cybercity, Ebene, 667

Mauritius, 72201

MORE INFO: www.sharedata.co.za/sdo/jse/UPL 567

COMPANY SECRETARY: Intercontinental Trust Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 468

DESIGNATEDADVISOR:JavaCapitalTrusteesandSponsors(Pty)Ltd.

AUDITORS: Grant Thornton 368

CAPITAL STRUCTURE AUTHORISED ISSUED 268

UPL Ords no par - 72 350 131

169

LIQUIDITY: Jan21 Ave 2 219 shares p.w., R37 316.3(0.2% p.a.) 2016 | 2017 | 2018 | 2019 | 2020 |

ALSH 40 Week MA UPARTNERS FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 20 Feb 20 Feb 19 Feb 18 Feb 17

2200

Interim Final Final(rst) Final(rst) Final(rst)

Turnover 1 359 599 2 879 500 2 779 675 2 513 241 2 468 923

1983

Op Inc 98 573 257 701 255 284 136 435 143 264

1766 NetIntPd(Rcvd) 37 654 88 492 104 933 14 167 22 452

Minority Int - - 3 330 - 1 432 - 4 734

1549 Att Inc 48 794 127 366 106 232 83 406 88 341

TotCompIncLoss 48 794 127 366 109 562 81 899 83 415

1332

Fixed Ass 1 000 616 993 796 1 003 231 1 004 903 990 573

Inv & Loans 2 888 2 699 3 078 1 955 1 925

1115

2017 | 2018 | 2019 | 2020 |

Tot Curr Ass 747 538 697 978 600 361 553 630 513 072

FINANCIAL STATISTICS Ord SH Int 804 324 798 167 740 980 713 591 799 598

(Amts in GBP’000) Sep 20 Jun 20 Jun 19 Jun 18 Jun 17 LT Liab 892 288 905 788 1 081 924 1 219 698 308 336

Quarterly Final Final Final Final Tot Curr Liab 686 221 635 064 575 003 565 636 433 604

NetRent/InvInc - 412 - 810 - 2 611 - 1 908 - 615 PER SHARE STATISTICS (cents per share)

Total Inc - 184 - 810 - 2 611 - 1 908 - 615 HEPS-C (ZARc) 35.40 92.20 75.60 58.70 61.90

Attrib Inc - 895 - 3 478 8 034 3 457 - 666 DPS (ZARc) 18.00 40.00 40.00 30.00 24.00

TotCompIncLoss - 895 - 3 478 8 034 3 457 - 666 NAV PS (ZARc) 579.60 564.60 516.90 477.00 522.50

Ord UntHs Int 78 299 79 194 82 673 74 638 71 181 3 Yr Beta 0.29 0.20 0.39 0.58 0.48

Investments 87 300 87 806 70 284 54 658 4 000 Price High 609 700 700 442 380

Tot Curr Ass 2 665 678 14 761 20 852 67 245 Price Low 400 411 400 320 270

Total Ass 89 964 88 484 85 045 75 510 71 245 Price Prd End 480 510 600 425 325

Tot Curr Liab 1 420 1 659 2 372 872 64 RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH Fnd 12.13 15.96 14.79 11.49 10.46

HEPS-C (ZARc) - 27.08 - 94.76 203.91 80.83 - 15.90 Oper Pft Mgn 7.25 8.95 9.18 5.43 5.80

NAV PS (ZARc) 2 332.79 2 331.26 2 043.68 1 873.08 1 667.88 D:E 1.21 1.20 1.54 1.81 0.48

3 Yr Beta - 0.31 - 0.29 - - - Current Ratio 1.09 1.10 1.04 0.98 1.18

Price Prd End 1 870 1 870 1 650 1 550 1 549 Div Cover 1.94 2.24 1.83 1.83 2.38

Price High 1 870 1 950 1 651 1 600 1 811

Price Low 1 600 1 250 1 115 1 290 1 450 Vivo Energy plc

RATIOS

VIV

RetOnSH Funds - 4.57 - 4.39 9.72 4.63 - 0.94 ISIN: GB00BDGT2M75 SHORT: VIVO CODE: VVO

RetOnTotAss - 0.82 - 0.92 - 3.07 - 2.53 - 0.86 REG NO: 11250655 FOUNDED: 2018 LISTED: 2018

OperRetOnInv - 1.89 - 0.92 - 3.71 - 3.49 - 15.38 NATURE OF BUSINESS: The Group is a leading retailer and marketer of

OpInc:Turnover - 294.29 - 165.98 - 614.35 - 300.95 - 149.27 Shell-branded fuels and lubricants in Africa. The Group has a network of

more than 1 800 service stations in 15 countries across North, West, East

Value Group Ltd. and Southern Africa, markets its products to commercial customers

through its commercial fuels and lubricants businesses and exports

VAL lubricants to more than ten other African countries. At its service station

ISIN: ZAE000016507 SHORT: VALUE CODE: VLE locations, the Group also provides its customers with growing

REG NO: 1997/002203/06 FOUNDED: 1981 LISTED: 1998 convenience retail and quick service and fast casual restaurant (“QSR”)

NATURE OF BUSINESS: Value is a holding company whose shares are offerings (which includes cafe´s and bakeries) in partnership with major

listedonthe JSELtd.Subsidiary companiesprovideacomprehensive range food and retail brands (available at approximately 54% of its

of tailored logistical solutions throughout southern Africa. The major company-owned service stations). The Group also offers other vehicle

operating divisions specialise in providing a diversified range of supply services including oil change and car wash facilities at its service stations.

chain services, which encompass distribution, transport, clearing and The Group benefits from an integrated business model owning or having

forwarding, warehousing, fleet management, materials handling and access to approximately 943 000 cubic metres of fuel storage capacity at 97

commercial vehicle rental and full maintenance leasing. The Group’s retail locations across Africa and enjoys a strong overall market position in the

segment supplies FMCG products into the convenience, formal and countries it operates in, being either the number one or number two

informal market. retaileroffuelsbyvolumesoldin14outofits15countriesofoperation.

242