Page 237 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 237

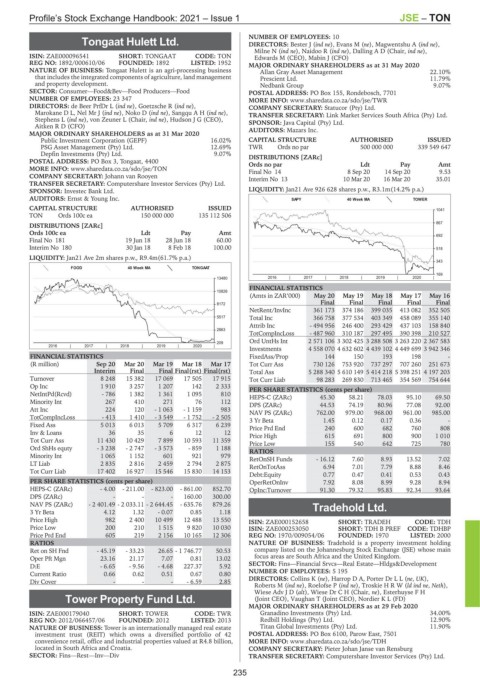

Profile’s Stock Exchange Handbook: 2021 – Issue 1 JSE – TON

NUMBER OF EMPLOYEES: 10

Tongaat Hulett Ltd. DIRECTORS: Bester J (ind ne), Evans M (ne), Magwentshu A (ind ne),

TON Milne N (ind ne), Naidoo R (ind ne), Dalling A D (Chair, ind ne),

ISIN: ZAE000096541 SHORT: TONGAAT CODE: TON Edwards M (CEO), Mabin J (CFO)

REG NO: 1892/000610/06 FOUNDED: 1892 LISTED: 1952 MAJOR ORDINARY SHAREHOLDERS as at 31 May 2020

NATURE OF BUSINESS: Tongaat Hulett is an agri-processing business Allan Gray Asset Management 22.10%

that includes the integrated components of agriculture, land management Prescient Ltd. 11.79%

and property development. Nedbank Group 9.07%

SECTOR: Consumer—Food&Bev—Food Producers—Food POSTAL ADDRESS: PO Box 155, Rondebosch, 7701

NUMBER OF EMPLOYEES: 23 347 MORE INFO: www.sharedata.co.za/sdo/jse/TWR

DIRECTORS: de Beer PrfDr L (ind ne), Goetzsche R (ind ne), COMPANY SECRETARY: Statucor (Pty) Ltd.

Marokane D L, Nel Mr J (ind ne), Noko D (ind ne), SangquAH(ind ne), TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Stephens L (ind ne), von Zeuner L (Chair, ind ne), Hudson J G (CEO), SPONSOR: Java Capital (Pty) Ltd.

Aitken R D (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 AUDITORS: Mazars Inc.

Public Investment Corporation (GEPF) 16.02% CAPITAL STRUCTURE AUTHORISED ISSUED

PSG Asset Management (Pty) Ltd. 12.69% TWR Ords no par 500 000 000 339 549 647

Depfin Investments (Pty) Ltd. 9.07% DISTRIBUTIONS [ZARc]

POSTAL ADDRESS: PO Box 3, Tongaat, 4400 Ords no par Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/TON Final No 14 8 Sep 20 14 Sep 20 9.53

COMPANY SECRETARY: Johann van Rooyen Interim No 13 10 Mar 20 16 Mar 20 35.01

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd. LIQUIDITY: Jan21 Ave 926 628 shares p.w., R3.1m(14.2% p.a.)

AUDITORS: Ernst & Young Inc. SAPY 40 Week MA TOWER

CAPITAL STRUCTURE AUTHORISED ISSUED 1041

TON Ords 100c ea 150 000 000 135 112 506

DISTRIBUTIONS [ZARc] 867

Ords 100c ea Ldt Pay Amt

692

Final No 181 19 Jun 18 28 Jun 18 60.00

Interim No 180 30 Jan 18 8 Feb 18 100.00 518

LIQUIDITY: Jan21 Ave 2m shares p.w., R9.4m(61.7% p.a.)

343

FOOD 40 Week MA TONGAAT

169

13480 2016 | 2017 | 2018 | 2019 | 2020 |

FINANCIAL STATISTICS

10826

(Amts in ZAR’000) May 20 May 19 May 18 May 17 May 16

8172 Final Final Final Final Final

NetRent/InvInc 361 173 374 186 399 035 413 082 352 505

5517 Total Inc 366 758 377 534 403 349 458 089 355 140

Attrib Inc - 494 956 246 400 293 429 437 103 158 840

2863

TotCompIncLoss - 487 960 310 187 297 495 390 398 210 527

209 Ord UntHs Int 2 571 106 3 302 425 3 288 508 3 263 220 2 367 583

2016 | 2017 | 2018 | 2019 | 2020 |

Investments 4 558 070 4 632 602 4 439 102 4 449 699 3 942 346

FINANCIAL STATISTICS FixedAss/Prop 144 150 193 198 -

(R million) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17 Tot Curr Ass 730 126 753 920 737 297 707 260 251 673

Interim Final Final Final(rst) Final(rst) Total Ass 5 288 340 5 610 149 5 414 218 5 398 251 4 197 203

Turnover 8 248 15 382 17 069 17 505 17 915 Tot Curr Liab 98 283 269 830 713 465 354 569 754 644

Op Inc 1 910 3 257 1 207 142 2 333 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) - 786 1 382 1 361 1 095 810 HEPS-C (ZARc) 45.30 58.21 78.03 95.10 69.50

Minority Int 267 410 271 76 112 DPS (ZARc) 44.53 74.19 80.96 77.08 92.00

Att Inc 224 120 - 1 063 - 1 159 983 NAV PS (ZARc) 762.00 979.00 968.00 961.00 985.00

TotCompIncLoss - 413 1 410 - 3 549 - 1 752 - 2 505 3 Yr Beta 1.45 0.12 0.17 0.36 -

Fixed Ass 5 013 6 013 5 709 6 317 6 239 Price Prd End 240 600 682 760 808

Inv & Loans 36 35 6 12 12 Price High 615 691 800 900 1 010

Tot Curr Ass 11 430 10 429 7 899 10 593 11 359 Price Low 155 540 642 725 780

Ord ShHs equty - 3 238 - 2 747 - 3 573 - 859 1 188

RATIOS

Minority Int 1 065 1 152 601 921 979 RetOnSH Funds - 16.12 7.60 8.93 13.52 7.02

LT Liab 2 835 2 816 2 459 2 794 2 875 RetOnTotAss 6.94 7.01 7.79 8.88 8.46

Tot Curr Liab 17 402 16 927 15 546 15 830 14 153

Debt:Equity 0.77 0.47 0.41 0.53 0.43

PER SHARE STATISTICS (cents per share) OperRetOnInv 7.92 8.08 8.99 9.28 8.94

HEPS-C (ZARc) - 4.00 - 211.00 - 823.00 - 861.00 852.70 OpInc:Turnover 91.30 79.32 95.83 92.34 93.64

DPS (ZARc) - - - 160.00 300.00

NAV PS (ZARc) - 2 401.49 - 2 033.11 - 2 644.45 - 635.76 879.26 Tradehold Ltd.

3 Yr Beta 4.12 1.32 - 0.07 0.85 1.18

TRA

Price High 982 2 400 10 499 12 488 13 550 ISIN: ZAE000152658 SHORT: TRADEH CODE: TDH

Price Low 200 210 1 515 9 820 10 030 ISIN: ZAE000253050 SHORT: TDH B PREF CODE: TDHBP

Price Prd End 605 219 2 156 10 165 12 306 REG NO: 1970/009054/06 FOUNDED: 1970 LISTED: 2000

RATIOS NATURE OF BUSINESS: Tradehold is a property investment holding

Ret on SH Fnd - 45.19 - 33.23 26.65 - 1 746.77 50.53 company listed on the Johannesburg Stock Exchange (JSE) whose main

Oper Pft Mgn 23.16 21.17 7.07 0.81 13.02 focus areas are South Africa and the United Kingdom.

D:E - 6.65 - 9.56 - 4.68 227.37 5.92 SECTOR: Fins—Financial Srvcs—Real Estate—Hldgs&Development

Current Ratio 0.66 0.62 0.51 0.67 0.80 NUMBER OF EMPLOYEES: 5 195

Div Cover - - - - 6.59 2.85 DIRECTORS: Collins K (ne), Harrop D A, Porter DrLL(ne, UK),

Roberts M (ind ne), Roelofse P (ind ne), TroskieHRW(ld ind ne, Neth),

Wiese AdvJD(alt), Wiese Dr C H (Chair, ne), Esterhuyse F H

Tower Property Fund Ltd. (Joint CEO), Vaughan T (Joint CEO), Nordier K L (FD)

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

TOW

ISIN: ZAE000179040 SHORT: TOWER CODE: TWR Granadino Investments (Pty) Ltd. 34.00%

REG NO: 2012/066457/06 FOUNDED: 2012 LISTED: 2013 Redbill Holdings (Pty) Ltd. 12.90%

NATURE OF BUSINESS: Tower is an internationally managed real estate Titan Global Investments (Pty) Ltd. 11.90%

investment trust (REIT) which owns a diversified portfolio of 42 POSTAL ADDRESS: PO Box 6100, Parow East, 7501

convenience retail, office and industrial properties valued at R4.8 billion, MORE INFO: www.sharedata.co.za/sdo/jse/TDH

located in South Africa and Croatia. COMPANY SECRETARY: Pieter Johan Janse van Rensburg

SECTOR: Fins—Rest—Inv—Div TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

235