Page 235 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 235

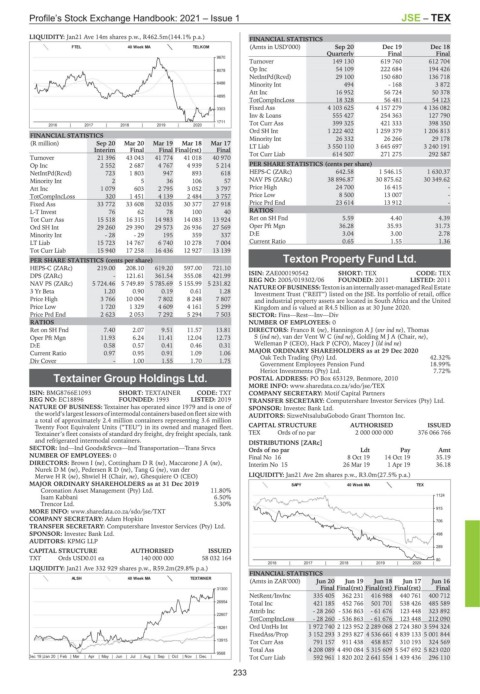

Profile’s Stock Exchange Handbook: 2021 – Issue 1 JSE – TEX

LIQUIDITY: Jan21 Ave 14m shares p.w., R462.5m(144.1% p.a.) FINANCIAL STATISTICS

FTEL 40 Week MA TELKOM (Amts in USD’000) Sep 20 Dec 19 Dec 18

Quarterly Final Final

9670

Turnover 149 130 619 760 612 704

8078 Op Inc 54 109 222 684 194 426

NetIntPd(Rcvd) 29 100 150 680 136 718

Minority Int 494 - 168 3 872

6486

Att Inc 16 952 56 724 50 378

4895

TotCompIncLoss 18 328 56 481 54 123

3303 Fixed Ass 4 103 625 4 157 279 4 136 082

Inv & Loans 555 427 254 363 127 790

1711 Tot Curr Ass 399 325 421 333 398 350

2016 | 2017 | 2018 | 2019 | 2020 |

Ord SH Int 1 222 402 1 259 379 1 206 813

FINANCIAL STATISTICS Minority Int 26 332 26 266 29 178

(R million) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17 LT Liab 3 550 110 3 645 697 3 240 191

Interim Final Final Final(rst) Final

Turnover 21 396 43 043 41 774 41 018 40 970 Tot Curr Liab 614 507 271 275 292 587

Op Inc 2 552 2 687 4 767 4 939 5 214 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 723 1 803 947 893 618 HEPS-C (ZARc) 642.58 1 546.15 1 630.37

Minority Int 2 5 36 106 57 NAV PS (ZARc) 38 896.87 30 875.62 30 349.62

Att Inc 1 079 603 2 795 3 052 3 797 Price High 24 700 16 415 -

TotCompIncLoss 320 1 451 4 139 2 484 3 757 Price Low 8 500 13 007 -

Fixed Ass 33 772 33 608 32 035 30 377 27 918 Price Prd End 23 614 13 912 -

L-T Invest 76 62 78 100 40 RATIOS

Tot Curr Ass 15 518 16 315 14 983 14 083 13 924 Ret on SH Fnd 5.59 4.40 4.39

Ord SH Int 29 260 29 390 29 573 26 936 27 569 Oper Pft Mgn 36.28 35.93 31.73

Minority Int - 28 - 29 195 359 337 D:E 3.04 3.00 2.78

LT Liab 15 723 14 767 6 740 10 278 7 004 Current Ratio 0.65 1.55 1.36

Tot Curr Liab 15 940 17 258 16 436 12 927 13 139

PER SHARE STATISTICS (cents per share) Texton Property Fund Ltd.

HEPS-C (ZARc) 219.00 208.10 619.20 597.00 721.10 TEX

DPS (ZARc) - 121.61 361.54 355.08 421.99 ISIN: ZAE000190542 SHORT: TEX CODE: TEX

NAV PS (ZARc) 5 724.46 5 749.89 5 785.69 5 155.99 5 231.82 REG NO: 2005/019302/06 FOUNDED: 2011 LISTED: 2011

NATUREOF BUSINESS:Textonisaninternallyasset-managedRealEstate

3 Yr Beta 1.20 0.90 0.19 0.61 1.28

Investment Trust (“REIT”) listed on the JSE. Its portfolio of retail, office

Price High 3 766 10 004 7 802 8 248 7 807 and industrial property assets are located in South Africa and the United

Price Low 1 720 1 329 4 609 4 161 5 299 Kingdom and is valued at R4.5 billion as at 30 June 2020.

Price Prd End 2 623 2 053 7 292 5 294 7 503 SECTOR: Fins—Rest—Inv—Div

RATIOS NUMBER OF EMPLOYEES: 0

Ret on SH Fnd 7.40 2.07 9.51 11.57 13.81 DIRECTORS: Franco R (ne), HanningtonAJ(snr ind ne), Thomas

Oper Pft Mgn 11.93 6.24 11.41 12.04 12.73 S(ind ne), van der VentWC(ind ne), GoldingMJA (Chair, ne),

D:E 0.58 0.57 0.41 0.46 0.31 Welleman P (CEO), Hack P (CFO), Macey J (ld ind ne)

Current Ratio 0.97 0.95 0.91 1.09 1.06 MAJOR ORDINARY SHAREHOLDERS as at 29 Dec 2020

Div Cover - 1.00 1.55 1.70 1.75 Oak Tech Trading (Pty) Ltd. 42.32%

Government Employees Pension Fund 18.99%

Heriot Investments (Pty) Ltd. 7.72%

Textainer Group Holdings Ltd. POSTAL ADDRESS: PO Box 653129, Benmore, 2010

MORE INFO: www.sharedata.co.za/sdo/jse/TEX

TEX

ISIN: BMG8766E1093 SHORT: TEXTAINER CODE: TXT COMPANY SECRETARY: Motif Capital Partners

REG NO: EC18896 FOUNDED: 1993 LISTED: 2019 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NATURE OF BUSINESS: Textainer has operated since 1979 and is one of SPONSOR: Investec Bank Ltd.

the world’s largest lessorsof intermodal containers based on fleet size with AUDITORS: SizweNtsalubaGobodo Grant Thornton Inc.

a total of approximately 2.4 million containers representing 3.6 million

Twenty Foot Equivalent Units (“TEU”) in its owned and managed fleet. CAPITAL STRUCTURE AUTHORISED ISSUED

Textainer’s fleet consists of standard dry freight, dry freight specials, tank TEX Ords of no par 2 000 000 000 376 066 766

and refrigerated intermodal containers. DISTRIBUTIONS [ZARc]

SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs Ords of no par Ldt Pay Amt

NUMBER OF EMPLOYEES: 0 Final No 16 8 Oct 19 14 Oct 19 35.19

DIRECTORS: Brown I (ne), CottinghamDR(ne), MaccaroneJA(ne), Interim No 15 26 Mar 19 1 Apr 19 36.18

NurekDM(ne), PedersenRD(ne), Tang G (ne), van der

MerweHR(ne), Shwiel H (Chair, ne), Ghesquiere O (CEO) LIQUIDITY: Jan21 Ave 2m shares p.w., R3.0m(27.5% p.a.)

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019 SAPY 40 Week MA TEX

Coronation Asset Management (Pty) Ltd. 11.80%

Isam Kabbani 6.50% 1124

Trencor Ltd. 5.30%

915

MORE INFO: www.sharedata.co.za/sdo/jse/TXT

COMPANY SECRETARY: Adam Hopkin 706

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd. 498

AUDITORS: KPMG LLP

289

CAPITAL STRUCTURE AUTHORISED ISSUED

TXT Ords USD0.01 ea 140 000 000 58 032 164 80

2016 | 2017 | 2018 | 2019 | 2020 |

LIQUIDITY: Jan21 Ave 332 929 shares p.w., R59.2m(29.8% p.a.)

FINANCIAL STATISTICS

ALSH 40 Week MA TEXTAINER

(Amts in ZAR’000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

31300 Final Final(rst) Final(rst) Final(rst) Final

NetRent/InvInc 335 405 362 231 416 988 440 761 400 712

26954 Total Inc 421 185 452 766 501 701 538 426 485 589

Attrib Inc - 28 260 - 536 863 - 61 676 123 448 323 892

22607

TotCompIncLoss - 28 260 - 536 863 - 61 676 123 448 212 090

18261 Ord UntHs Int 1 972 740 2 123 952 2 289 068 2 724 380 3 594 324

FixedAss/Prop 3 152 293 3 293 827 4 536 661 4 839 133 5 001 844

13915

Tot Curr Ass 791 157 911 438 458 857 310 193 324 569

Total Ass 4 208 089 4 490 084 5 315 609 5 547 692 5 823 020

9568

Dec 19 |Jan 20 | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Tot Curr Liab 592 961 1 820 202 2 641 554 1 439 436 296 110

233