Page 230 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 230

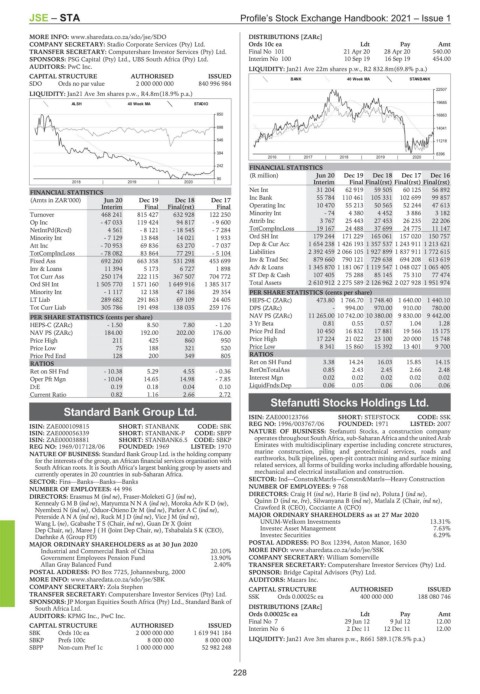

JSE – STA Profile’s Stock Exchange Handbook: 2021 – Issue 1

MORE INFO: www.sharedata.co.za/sdo/jse/SDO DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: Stadio Corporate Services (Pty) Ltd. Ords 10c ea Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 101 21 Apr 20 28 Apr 20 540.00

SPONSORS: PSG Capital (Pty) Ltd., UBS South Africa (Pty) Ltd. Interim No 100 10 Sep 19 16 Sep 19 454.00

AUDITORS: PwC Inc. LIQUIDITY: Jan21 Ave 22m shares p.w., R2 832.8m(69.8% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

BANK 40 Week MA STANBANK

SDO Ords no par value 2 000 000 000 840 996 984

22507

LIQUIDITY: Jan21 Ave 3m shares p.w., R4.8m(18.9% p.a.)

ALSH 40 Week MA STADIO 19685

850 16863

698 14041

546 11218

394 8396

2016 | 2017 | 2018 | 2019 | 2020 |

242

FINANCIAL STATISTICS

(R million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16

90

2018 | 2019 | 2020 | Interim Final Final(rst) Final(rst) Final(rst)

Net Int 31 204 62 919 59 505 60 125 56 892

FINANCIAL STATISTICS

(Amts in ZAR’000) Jun 20 Dec 19 Dec 18 Dec 17 Inc Bank 55 784 110 461 105 331 102 699 99 857

Interim Final Final(rst) Final Operating Inc 10 470 55 213 50 565 52 244 47 613

Turnover 468 241 815 427 632 928 122 250 Minority Int - 74 4 380 4 452 3 886 3 182

Op Inc - 47 033 119 424 94 817 - 9 600 Attrib Inc 3 767 25 443 27 453 26 235 22 206

NetIntPd(Rcvd) 4 561 - 8 121 - 18 545 - 7 284 TotCompIncLoss 19 167 24 488 37 699 24 775 11 147

Minority Int - 7 129 13 848 14 021 1 933 Ord SH Int 179 244 171 229 165 061 157 020 150 757

Att Inc - 70 953 69 836 63 270 - 7 037 Dep & Cur Acc 1 654 238 1 426 193 1 357 537 1 243 911 1 213 621

TotCompIncLoss - 78 082 83 864 77 291 - 5 104 Liabilities 2 392 459 2 066 105 1 927 899 1 837 911 1 772 615

Fixed Ass 692 260 663 358 531 298 453 699 Inv & Trad Sec 879 660 790 121 729 638 694 208 613 619

Inv & Loans 11 394 5 173 6 727 1 898 Adv & Loans 1 345 870 1 181 067 1 119 547 1 048 027 1 065 405

Tot Curr Ass 250 174 222 115 367 507 704 772 ST Dep & Cash 107 405 75 288 85 145 75 310 77 474

Ord SH Int 1 505 770 1 571 160 1 649 916 1 385 317 Total Assets 2 610 912 2 275 589 2 126 962 2 027 928 1 951 974

Minority Int - 1 117 12 138 47 186 29 354 PER SHARE STATISTICS (cents per share)

LT Liab 289 682 291 863 69 109 24 405 HEPS-C (ZARc) 473.80 1 766.70 1 748.40 1 640.00 1 440.10

Tot Curr Liab 305 786 191 498 138 035 259 176 DPS (ZARc) - 994.00 970.00 910.00 780.00

PER SHARE STATISTICS (cents per share) NAV PS (ZARc) 11 265.00 10 742.00 10 380.00 9 830.00 9 442.00

HEPS-C (ZARc) - 1.50 8.50 7.80 - 1.20 3 Yr Beta 0.81 0.55 0.57 1.04 1.28

NAV PS (ZARc) 184.00 192.00 202.00 176.00 Price Prd End 10 450 16 832 17 881 19 566 15 175

Price High 211 425 860 950 Price High 17 224 21 022 23 100 20 000 15 748

Price Low 75 188 321 520 Price Low 8 341 15 860 15 392 13 401 9 700

Price Prd End 128 200 349 805 RATIOS

RATIOS Ret on SH Fund 3.38 14.24 16.03 15.85 14.15

Ret on SH Fnd - 10.38 5.29 4.55 - 0.36 RetOnTotalAss 0.85 2.43 2.45 2.66 2.48

Oper Pft Mgn - 10.04 14.65 14.98 - 7.85 Interest Mgn 0.02 0.02 0.02 0.02 0.02

D:E 0.19 0.18 0.04 0.10 LiquidFnds:Dep 0.06 0.05 0.06 0.06 0.06

Current Ratio 0.82 1.16 2.66 2.72

Stefanutti Stocks Holdings Ltd.

Standard Bank Group Ltd. STE

ISIN: ZAE000123766 SHORT: STEFSTOCK CODE: SSK

STA REG NO: 1996/003767/06 FOUNDED: 1971 LISTED: 2007

ISIN: ZAE000109815 SHORT: STANBANK CODE: SBK

ISIN: ZAE000056339 SHORT: STANBANK-P CODE: SBPP NATURE OF BUSINESS: Stefanutti Stocks, a construction company

ISIN: ZAE000038881 SHORT: STANBANK6.5 CODE: SBKP operates throughout South Africa, sub-Saharan Africa and the united Arab

REG NO: 1969/017128/06 FOUNDED: 1969 LISTED: 1970 Emirates with multidisciplinary expertise including concrete structures,

NATURE OF BUSINESS: Standard Bank Group Ltd. is the holding company marine construction, piling and geotechnical services, roads and

for the interests of the group, an African financial services organisation with earthworks, bulk pipelines, open-pit contract mining and surface mining

South African roots. It is South Africa’s largest banking group by assets and related services, all forms of building works including affordable housing,

currently operates in 20 countries in sub-Saharan Africa. mechanical and electrical installation and construction.

SECTOR: Fins—Banks—Banks—Banks SECTOR: Ind—Constn&Matrls—Constn&Matrls—Heavy Construction

NUMBER OF EMPLOYEES: 44 996 NUMBER OF EMPLOYEES: 9 768

DIRECTORS: Erasmus M (ind ne), Fraser-Moleketi G J (ind ne), DIRECTORS: Craig H (ind ne), Harie B (ind ne), Poluta J (ind ne),

Kennealy G M B (ind ne), Matyumza N N A (ind ne), Moroka Adv K D (ne), Quinn D (ind ne, Ire), Silwanyana B (ind ne), Matlala Z (Chair, ind ne),

Nyembezi N (ind ne), Oduor-Otieno Dr M (ind ne), Parker A C (ind ne), Crawford R (CEO), Cocciante A (CFO)

Peterside A N A (ind ne), Ruck M J D (ind ne), Vice J M (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 27 Mar 2020

Wang L (ne), Gcabashe T S (Chair, ind ne), Guan Dr X (Joint UNUM-Welkom Investments 13.31%

Dep Chair, ne), Maree J ( H (Joint Dep Chair, ne), Tshabalala S K (CEO), Investec Asset Management 7.63%

Daehnke A (Group FD) Investec Securities 6.29%

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 POSTAL ADDRESS: PO Box 12394, Aston Manor, 1630

Industrial and Commercial Bank of China 20.10% MORE INFO: www.sharedata.co.za/sdo/jse/SSK

Government Employees Pension Fund 13.90% COMPANY SECRETARY: William Somerville

Allan Gray Balanced Fund 2.40% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: PO Box 7725, Johannesburg, 2000 SPONSOR: Bridge Capital Advisors (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/SBK AUDITORS: Mazars Inc.

COMPANY SECRETARY: Zola Stephen CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SSK Ords 0.00025c ea 400 000 000 188 080 746

SPONSORS: JP Morgan Equities South Africa (Pty) Ltd., Standard Bank of

South Africa Ltd. DISTRIBUTIONS [ZARc]

AUDITORS: KPMG Inc., PwC Inc. Ords 0.00025c ea Ldt Pay Amt

Final No 7 29 Jun 12 9 Jul 12 12.00

CAPITAL STRUCTURE AUTHORISED ISSUED Interim No 6 2 Dec 11 12 Dec 11 12.00

SBK Ords 10c ea 2 000 000 000 1 619 941 184

SBKP Prefs 100c 8 000 000 8 000 000 LIQUIDITY: Jan21 Ave 3m shares p.w., R661 589.1(78.5% p.a.)

SBPP Non-cum Pref 1c 1 000 000 000 52 982 248

228