Page 190 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 190

JSE – OMN Profile’s Stock Exchange Handbook: 2021 – Issue 1

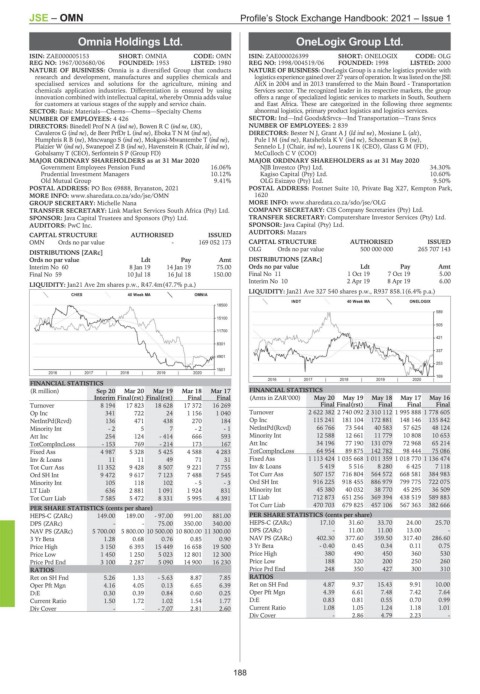

Omnia Holdings Ltd. OneLogix Group Ltd.

OMN ONE

ISIN: ZAE000005153 SHORT: OMNIA CODE: OMN ISIN: ZAE000026399 SHORT: ONELOGIX CODE: OLG

REG NO: 1967/003680/06 FOUNDED: 1953 LISTED: 1980 REG NO: 1998/004519/06 FOUNDED: 1998 LISTED: 2000

NATURE OF BUSINESS: Omnia is a diversified Group that conducts NATURE OF BUSINESS: OneLogix Group is a niche logistics provider with

research and development, manufactures and supplies chemicals and logistics experience gained over 27 years of operation. It was listed on the JSE

specialised services and solutions for the agriculture, mining and AltX in 2004 and in 2013 transferred to the Main Board - Transportation

chemicals application industries. Differentiation is ensured by using Services sector. The recognized leader in its respective markets, the group

innovation combined with intellectual capital, whereby Omnia adds value offers a range of specialized logistic services to markets in South, Southern

for customers at various stages of the supply and service chain. and East Africa. These are categorized in the following three segments:

SECTOR: Basic Materials—Chems—Chems—Specialty Chems abnormal logistics, primary product logistics and logistics services.

NUMBER OF EMPLOYEES: 4 426 SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs

DIRECTORS: Binedell Prof N A (ind ne), Bowen R C (ind ne, UK), NUMBER OF EMPLOYEES: 2 839

Cavaleros G (ind ne), de Beer PrfDr L (ind ne), EbokaTNM(ind ne), DIRECTORS: Bester N J, GrantAJ(ld ind ne), Mosiane L (alt),

Humphris R B (ne), MncwangoS(ind ne), Mokgosi-Mwantembe T (ind ne), PuleIM(ind ne), RatshefolaKV(ind ne), SchoemanKB(ne),

Plaizier W (ind ne), Swanepoel Z B (ind ne), Havenstein R (Chair, ld ind ne), Sennelo L J (Chair, ind ne), Lourens I K (CEO), Glass G M (FD),

Gobalsamy T (CEO), Serfontein S P (Group FD) McCulloch C V (COO)

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 MAJOR ORDINARY SHAREHOLDERS as at 31 May 2020

Government Employees Pension Fund 16.06% NJB Investco (Pty) Ltd. 34.30%

Prudential Investment Managers 10.12% Kagiso Capital (Pty) Ltd. 10.60%

Old Mutual Group 9.41% OLG Esizayo (Pty) Ltd. 9.50%

POSTAL ADDRESS: PO Box 69888, Bryanston, 2021 POSTAL ADDRESS: Postnet Suite 10, Private Bag X27, Kempton Park,

MORE INFO: www.sharedata.co.za/sdo/jse/OMN 1620

GROUP SECRETARY: Michelle Nana MORE INFO: www.sharedata.co.za/sdo/jse/OLG

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: PwC Inc. SPONSOR: Java Capital (Pty) Ltd.

AUDITORS: Mazars

CAPITAL STRUCTURE AUTHORISED ISSUED

OMN Ords no par value - 169 052 173 CAPITAL STRUCTURE AUTHORISED ISSUED

OLG Ords no par value 500 000 000 265 707 143

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt DISTRIBUTIONS [ZARc]

Interim No 60 8 Jan 19 14 Jan 19 75.00 Ords no par value Ldt Pay Amt

Final No 59 10 Jul 18 16 Jul 18 150.00 Final No 11 1 Oct 19 7 Oct 19 5.00

Interim No 10 2 Apr 19 8 Apr 19 6.00

LIQUIDITY: Jan21 Ave 2m shares p.w., R47.4m(47.7% p.a.)

LIQUIDITY: Jan21 Ave 327 540 shares p.w., R937 858.1(6.4% p.a.)

CHES 40 Week MA OMNIA

INDT 40 Week MA ONELOGIX

18500

589

15100

505

11700

421

8301

337

4901

253

1501

2016 | 2017 | 2018 | 2019 | 2020 |

169

2016 | 2017 | 2018 | 2019 | 2020 |

FINANCIAL STATISTICS

(R million) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17 FINANCIAL STATISTICS

Interim Final(rst) Final(rst) Final Final (Amts in ZAR’000) May 20 May 19 May 18 May 17 May 16

Turnover 8 194 17 823 18 628 17 372 16 269 Final Final(rst) Final Final Final

Op Inc 341 722 24 1 156 1 040 Turnover 2 622 382 2 740 092 2 310 112 1 995 888 1 778 605

NetIntPd(Rcvd) 136 471 438 270 184 Op Inc 115 241 181 104 172 881 148 146 135 842

Minority Int - 2 5 7 - 2 - 1 NetIntPd(Rcvd) 66 766 73 544 40 583 57 625 48 124

Att Inc 254 124 - 414 666 593 Minority Int 12 588 12 661 11 779 10 808 10 653

TotCompIncLoss - 153 769 - 214 173 167 Att Inc 34 196 77 190 131 079 72 968 65 214

Fixed Ass 4 987 5 328 5 425 4 588 4 283 TotCompIncLoss 64 954 89 875 142 782 98 444 75 086

Inv & Loans 11 11 49 71 31 Fixed Ass 1 113 424 1 035 668 1 011 359 1 018 770 1 136 474

Tot Curr Ass 11 352 9 428 8 507 9 221 7 755 Inv & Loans 5 419 5 516 8 280 6 425 7 118

Ord SH Int 9 472 9 617 7 123 7 488 7 545 Tot Curr Ass 507 157 716 804 564 572 668 581 384 983

Minority Int 105 118 102 - 5 - 3 Ord SH Int 916 225 918 455 886 979 799 775 722 075

LT Liab 636 2 881 1 091 1 924 831 Minority Int 45 380 40 032 38 770 45 295 36 509

Tot Curr Liab 7 585 5 472 8 331 5 995 4 391 LT Liab 712 873 651 256 369 394 438 519 589 883

Tot Curr Liab 470 703 679 825 457 106 567 363 382 666

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 149.00 189.00 - 97.00 991.00 881.00 PER SHARE STATISTICS (cents per share)

DPS (ZARc) - - 75.00 350.00 340.00 HEPS-C (ZARc) 17.10 31.60 33.70 24.00 25.70

NAV PS (ZARc) 5 700.00 5 800.00 10 500.00 10 800.00 11 300.00 DPS (ZARc) - 11.00 11.00 13.00 -

3 Yr Beta 1.28 0.68 0.76 0.85 0.90 NAV PS (ZARc) 402.30 377.60 359.50 317.40 286.60

Price High 3 150 6 393 15 449 16 658 19 500 3 Yr Beta - 0.40 0.45 0.34 0.11 0.75

Price Low 1 450 1 250 5 023 12 801 12 300 Price High 380 490 450 360 530

Price Prd End 3 100 2 287 5 090 14 900 16 230 Price Low 188 320 200 250 260

RATIOS Price Prd End 248 350 427 300 310

Ret on SH Fnd 5.26 1.33 - 5.63 8.87 7.85 RATIOS

Oper Pft Mgn 4.16 4.05 0.13 6.65 6.39 Ret on SH Fnd 4.87 9.37 15.43 9.91 10.00

D:E 0.30 0.39 0.84 0.60 0.25 Oper Pft Mgn 4.39 6.61 7.48 7.42 7.64

Current Ratio 1.50 1.72 1.02 1.54 1.77 D:E 0.83 0.81 0.55 0.70 0.99

Div Cover - - - 7.07 2.81 2.60 Current Ratio 1.08 1.05 1.24 1.18 1.01

Div Cover - 2.86 4.79 2.23 -

188