Page 192 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 192

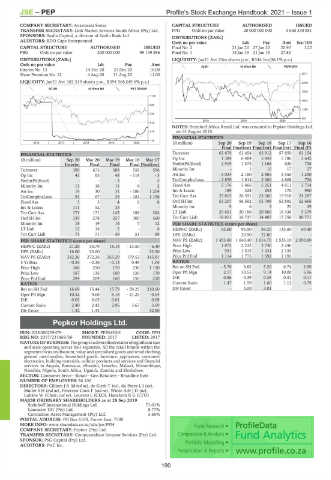

JSE – PEP Profile’s Stock Exchange Handbook: 2021 – Issue 1

COMPANY SECRETARY: Anastassia Sousa CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. PPH Ords no par value 20 000 000 000 3 660 350 881

SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd. DISTRIBUTIONS [ZARc]

AUDITORS: BDO Cape Incorporated Ords no par value Ldt Pay Amt Scr/100

CAPITAL STRUCTURE AUTHORISED ISSUED Final No 2 21 Jan 20 27 Jan 20 20.90 1.22

PBG Ords no par value 200 000 000 99 149 896 Final No 1 15 Jan 19 21 Jan 19 27.80 -

DISTRIBUTIONS [ZARc] LIQUIDITY: Jan21 Ave 25m shares p.w., R344.1m(36.1% p.a.)

Ords no par value Ldt Pay Amt

ALSH 40 Week MA PEPKORH

Interim No 13 14 Dec 20 21 Dec 20 16.00

Share Premium No 12 4 Aug 20 11 Aug 20 11.00 2571

LIQUIDITY: Jan21 Ave 182 519 shares p.w., R394 568.0(9.6% p.a.) 2248

SCOM 40 Week MA PBT GROUP

1925

1130

1603

926

1280

722

957

2018 | 2019 | 2020 |

518

NOTES: Steinhoff Africa Retail Ltd. was renamed to Pepkor Holdings Ltd.

314 on 15 August 2018.

FINANCIAL STATISTICS

110

2016 | 2017 | 2018 | 2019 | 2020 | (R million) Sep 20 Sep 19 Sep 18 Sep 17 Sep 16

Final Final(rst) Final(rst) Final(rst) Final (P)

FINANCIAL STATISTICS Turnover 63 679 61 454 63 912 57 850 61 154

(R million) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17 Op Inc 1 384 6 484 5 843 5 786 3 642

Interim Final Final Final Final(rst) NetIntPd(Rcvd) 2 919 1 575 1 168 620 738

Turnover 389 673 588 556 596 Minority Int - 1 10 17 27

Op Inc 41 65 48 - 118 - 3 Att Inc - 3 034 2 160 2 885 3 550 1 290

NetIntPd(Rcvd) - - - 3 - 5 TotCompIncLoss - 2 859 1 814 2 686 4 868 756

Minority Int 11 16 11 6 2 Fixed Ass 5 176 5 466 5 251 4 613 3 714

Att Inc 19 30 31 - 188 1 204 Inv & Loans 189 328 253 170 950

TotCompIncLoss 91 67 35 - 181 1 198 Tot Curr Ass 27 815 26 591 23 060 19 918 24 287

Fixed Ass 3 3 4 6 8 Ord SH Int 53 207 56 592 55 708 52 892 52 666

Inv & Loans 111 52 33 - - Minority Int 9 6 3 25 29

Tot Curr Ass 171 171 145 188 364 LT Liab 29 651 20 186 20 860 16 438 5 379

Ord SH Int 339 278 257 300 560 Tot Curr Liab 18 911 16 737 14 407 17 758 30 771

Minority Int 18 19 14 7 12 PER SHARE STATISTICS (cents per share)

LT Liab 12 14 2 - 6 HEPS-C (ZARc) 62.60 95.50 84.20 133.60 60.40

Tot Curr Liab 71 71 49 51 99 DPS (ZARc) - 20.90 27.80 - -

PER SHARE STATISTICS (cents per share) NAV PS (ZARc) 1 453.60 1 640.40 1 614.70 1 533.10 2 050.60

HEPS-C (ZARc) 21.20 30.79 18.18 - 13.50 - 6.40 Price High 1 875 2 232 2 740 2 246 -

DPS (ZARc) 16.00 23.00 - - 22.50 Price Low 931 1 515 1 434 2 135 -

NAV PS (ZARc) 342.26 272.26 263.29 179.52 345.81 Price Prd End 1 114 1 775 1 592 2 192 -

3 Yr Beta - 0.24 - 0.36 - 0.13 0.49 1.04 RATIOS

Price High 366 250 170 230 1 150 Ret on SH Fnd - 5.70 3.82 5.20 6.74 2.50

Price Low 167 135 100 130 170 Oper Pft Mgn 2.17 10.55 9.14 10.00 5.96

Price Prd End 294 209 160 150 210 D:E 0.56 0.39 0.39 0.31 0.11

RATIOS Current Ratio 1.47 1.59 1.60 1.12 0.79

Ret on SH Fnd 16.69 15.44 15.79 - 59.25 210.60 Div Cover - 3.00 3.01 - -

Oper Pft Mgn 10.52 9.68 8.18 - 21.25 - 0.54

D:E 0.03 0.05 0.01 - 0.09

Current Ratio 2.40 2.42 2.96 3.67 3.69

Div Cover 1.32 1.33 - - 32.50

Pepkor Holdings Ltd.

PEP

ISIN: ZAE000259479 SHORT: PEPKORH CODE: PPH

REG NO: 2017/221869/06 FOUNDED: 2017 LISTED: 2017

NATUREOFBUSINESS:Thegroupisadiversifiedretailerofsignificantsize

and scale operating across four segments. All the retail brands within the

segments focus on discount, value and specialised goods and retail clothing,

general merchandise, household goods, furniture, appliances, consumer

electronics, building materials, cellular products and services and financial

services in Angola, Botswana, eSwatini, Lesotho, Malawi, Mozambique,

Namibia, Nigeria, South Africa, Uganda, Zambia and Zimbabwe.

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Broadline Rets

NUMBER OF EMPLOYEES: 56 100

DIRECTORS: CilliersJB(ld ind ne), de Klerk T (ne), du PreezLJ(ne),

MullerSH(ind ne), Petersen-Cook F (ind ne), Wiese AdvJD(ne),

Luhabe W (Chair, ind ne), Lourens L (CEO), Hanekom R G (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 28 Sep 2019

Steinhoff International Holdings Ltd. 71.01%

Lancaster 101 (Pty) Ltd. 8.77%

Coronation Asset Management (Pty) Ltd. 3.66%

POSTAL ADDRESS: PO Box 6100, Parow East, 7500

MORE INFO: www.sharedata.co.za/sdo/jse/PPH

COMPANY SECRETARY: Pepkor (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: PwC Inc.

190