Page 186 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 186

JSE – NUW Profile’s Stock Exchange Handbook: 2021 – Issue 1

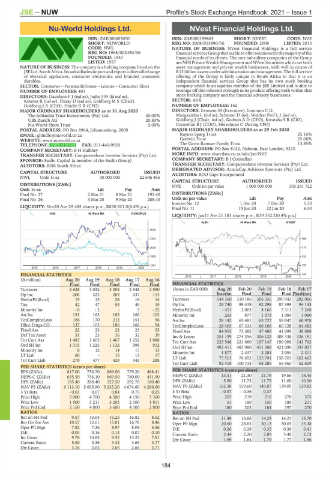

Nu-World Holdings Ltd. NVest Financial Holdings Ltd.

NUW NVE

ISIN: ZAE000005070 ISIN: ZAE000199865 SHORT: NVEST CODE: NVE

SHORT: NUWORLD REG NO: 2008/015990/06 FOUNDED: 2008 LISTED: 2015

CODE: NWL NATURE OF BUSINESS: NVest Financial Holdings is a full service

REG NO: 1968/002490/06 financialservicesGroupthatisabletooffersolutionsforthemajorityofthe

FOUNDED: 1947 financial needs of its clients. The core subsidiary companies of the Group

LISTED: 1987 are NFB Private Wealth Management and NVest Securities which are both

NATURE OF BUSINESS: The company is a holding company listed on the asset management and private wealth businesses, with well in excess of

JSE Ltd. South Africa. Its subsidiaries import and export a diversified range R13 billion assets under administration and management. The full service

of electrical appliances, consumer electronics and branded consumer offering of the Group is fairly unique in South Africa in that it is an

durables. independent financial services Group that has its own stock broking

SECTOR: Consumer—Personal&House—Leisure—Consumer Elecs company which is an equities member of the JSE Limited and is able to

NUMBER OF EMPLOYEES: 401 leverage off this inherent strength in its product offering both within that

DIRECTORS: DavidsonFJ(ind ne), JudinJM(ld ind ne), stock broking company and the financial advisory businesses.

Kinross R (ind ne), Piaray D (ind ne), Goldberg M S (Chair), SECTOR: AltX

Goldberg J A (CEO), Hindle G R (CFO) NUMBER OF EMPLOYEES: 162

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2020 DIRECTORS: Estment M (Executive), Lemmon C G,

The Inhlanhla Trust Investments (Pty) Ltd. 30.00% Mangxamba L (ind ne), Schemel D (ne), Weldon ProfLJ(ind ne),

UBS Zurich AG 20.80% Goldberg J (Chair, ind ne), Godwin A D (CEO), Kwatsha S R (CIO),

Nu-World Share Trust 5.00% Connellan B J (COO), Herselman C (Acting CFO)

POSTAL ADDRESS: PO Box 8964, Johannesburg, 2000 MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

EMAIL: ghindle@nuworld.co.za Rayner Sparg Trust 25.16%

WEBSITE: www.nuworld.co.za Godwin Trust 25.06%

TELEPHONE: 011-321-2111 FAX: 011-440-9920 The Gavin Ramsay Family Trust 13.85%

COMPANY SECRETARY: B H Haikney POSTAL ADDRESS: PO Box 8132, Nahoon, East London, 5210

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/NVE

SPONSOR: Sasfin Capital (a member of the Sasfin Group) COMPANY SECRETARY: B J Connellan

AUDITORS: RSM South Africa TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: AcaciaCap Advisors Sponsors (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: BDO Cape Incorporated

NWL Ords 1c ea 30 000 000 22 646 465

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [ZARc] NVE Ords no par value 1 000 000 000 303 241 722

Ords 1c ea Ldt Pay Amt

Final No 27 2 Mar 21 8 Mar 21 195.40 DISTRIBUTIONS [ZARc]

Final No 26 3 Mar 20 9 Mar 20 288.40 Ords no par value Ldt Pay Amt

Interim No 12 1 Dec 20 7 Dec 20 5.50

LIQUIDITY: Nov20 Ave 29 485 shares p.w., R830 821.0(6.8% p.a.) Final No 11 15 Jun 20 22 Jun 20 6.50

IIND 40 Week MA NUWORLD

LIQUIDITY: Jan21 Ave 21 183 shares p.w., R39 352.2(0.4% p.a.)

ALSH 40 Week MA NVEST

3976

3303 366

2629 310

1955 253

1281 197

2015 | 2016 | 2017 | 2018 | 2019 | 2020

FINANCIAL STATISTICS 140

2016 | 2017 | 2018 | 2019 | 2020 |

(R million) Aug 20 Aug 19 Aug 18 Aug 17 Aug 16

Final Final Final Final Final FINANCIAL STATISTICS

Turnover 2 628 3 032 3 004 2 948 2 590 (Amts in ZAR’000) Aug 20 Feb 20 Feb 19 Feb 18 Feb 17

Op Inc 206 223 269 237 113 Interim Final Final Final Final(rst)

NetIntPd(Rcvd) 19 15 28 18 14 Turnover 144 360 310 186 306 336 290 943 282 066

Tax 42 47 55 49 19 Op Inc 29 740 89 419 92 298 87 398 94 143

Minority Int - 6 - 2 - 5 - 22 NetIntPd(Rcvd) - 451 2 003 4 166 5 311 7 268

Att Inc 133 163 185 166 102 Minority Int 263 977 1 073 1 084 1 090

TotCompIncLoss 166 170 213 151 96 Att Inc 28 142 65 481 63 727 59 047 60 978

Hline Erngs-CO 137 163 186 166 94 TotCompIncLoss 28 405 67 333 66 106 60 728 64 483

Fixed Ass 22 23 22 23 25 Fixed Ass 84 953 73 382 47 488 41 099 39 088

Def Tax Asset 31 23 36 32 39 Inv & Loans 251 199 274 256 306 122 308 338 326 181

Tot Curr Ass 1 483 1 605 1 467 1 252 1 088 Tot Curr Ass 225 548 221 660 197 147 190 006 143 762

Ord SH Int 1 315 1 225 1 132 998 912 Ord SH Int 492 411 483 980 451 308 421 090 393 007

Minority Int 8 12 14 17 13 Minority Int 1 877 2 437 2 284 2 054 2 311

LT Liab 66 - 15 13 17

Tot Curr Liab 270 477 429 343 288 LT Liab 75 513 76 652 125 701 158 701 162 462

Tot Curr Liab 92 418 100 733 68 286 55 965 52 609

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 617.00 756.70 869.00 779.20 488.41 PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 635.50 756.10 869.50 780.00 451.90 HEPS-C (ZARc) 13.51 21.30 21.78 19.66 18.45

DPS (ZARc) 195.40 288.40 327.50 292.70 180.40 DPS (ZARc) 5.50 11.75 11.75 11.00 10.30

NAV PS (ZARc) 6 113.10 5 695.90 5 235.20 4 674.60 4 286.60 NAV PS (ZARc) 162.38 159.60 149.07 139.09 129.82

3 Yr Beta - 0.03 0.07 0.84 0.75 0.25 3 Yr Beta - 0.57 - 0.36 0.37 - -

Price High 5 000 4 700 4 500 4 150 3 300 Price High 203 219 210 270 375

Price Low 1 900 3 211 3 205 2 100 1 811 Price Low 51 160 150 180 211

Price Prd End 2 150 4 000 3 600 4 100 2 800 Price Prd End 180 203 184 197 270

RATIOS RATIOS

Ret on SH Fnd 9.57 13.04 16.25 16.82 8.62 Ret on SH Fnd 11.49 13.66 14.29 14.21 15.70

Ret On Tot Ass 10.57 12.61 15.81 16.78 8.46 Oper Pft Mgn 20.60 28.83 30.13 30.04 33.38

Oper Pft Mgn 7.82 7.36 8.97 8.04 4.36 D:E 0.26 0.28 0.35 0.38 0.41

D:E 0.05 0.16 0.13 0.07 0.10 Current Ratio 2.44 2.20 2.89 3.40 2.73

Int Cover 9.76 14.83 9.52 13.23 7.81 Div Cover 1.69 1.84 1.79 1.77 1.96

Current Ratio 5.50 3.36 3.42 3.65 3.77

Div Cover 3.16 2.62 2.65 2.66 2.71

184