Page 185 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 185

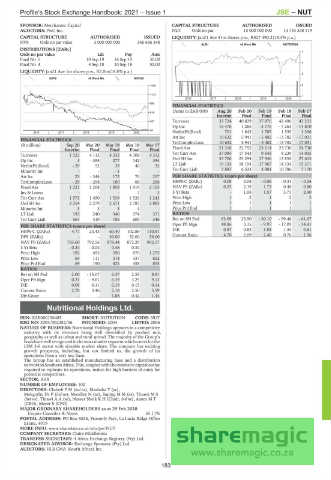

Profile’s Stock Exchange Handbook: 2021 – Issue 1 JSE – NUT

SPONSOR: Merchantec Capital CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: PwC Inc. NUT Ords no par 15 000 000 000 13 743 368 179

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jan21 Ave 51m shares p.w., R527 490.2(19.3% p.a.)

NVS Ords no par value 3 000 000 000 346 656 348

ALSH 40 Week MA NUTRITION

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 4

Final No 5 10 Sep 19 16 Sep 19 30.00

3

Final No 4 4 Sep 18 10 Sep 18 52.00

LIQUIDITY: Jan21 Ave 1m shares p.w., R2.0m(18.8% p.a.)

2

SUPS 40 Week MA NOVUS

1450 2

1173

1

2016 | 2017 | 2018 | 2019 | 2020 |

895

FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 20 Feb 20 Feb 19 Feb 18 Feb 17

618

Interim Final Final Final Final

341 Turnover 33 724 40 829 37 876 42 496 43 215

Op Inc 16 476 1 285 - 3 776 - 7 263 - 14 870

64 NetIntPd(Rcvd) 701 1 842 1 785 1 535 1 336

2016 | 2017 | 2018 | 2019 | 2020 |

Att Inc 10 632 5 941 - 5 402 - 13 782 - 17 031

FINANCIAL STATISTICS TotCompIncLoss 10 632 5 941 - 5 402 - 13 782 - 17 031

(R million) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17

Interim Final Final Final Final Fixed Ass 21 318 22 752 23 214 23 730 24 730

Turnover 1 523 4 112 4 332 4 308 4 312 Tot Curr Ass 37 084 17 543 9 643 8 239 14 035

Op Inc 3 - 395 277 142 394 Ord SH Int 33 706 23 294 17 946 13 854 27 615

NetIntPd(Rcvd) - 29 52 39 40 32 LT Liab 19 124 18 194 17 967 14 334 15 371

Minority Int - - - 1 - - Tot Curr Liab 7 887 6 533 3 981 10 786 7 170

Att Inc 23 - 344 172 70 257 PER SHARE STATISTICS (cents per share)

TotCompIncLoss - 29 - 298 180 68 256 HEPS-C (ZARc) 0.08 0.04 - 0.06 - 0.31 - 0.24

Fixed Ass 1 221 1 268 1 858 1 919 2 103 NAV PS (ZARc) 0.25 2.19 1.73 0.40 0.80

Inv & Loans - - - 7 3 3 Yr Beta - 1.06 1.57 3.71 2.40

Tot Curr Ass 1 573 1 450 1 539 1 520 1 243 Price High 1 2 1 2 2

Ord SH Int 2 254 2 279 2 671 2 787 2 883 Price Low 1 1 1 1 1

Minority Int 3 3 3 4 - Price Prd End 1 1 1 1 1

LT Liab 193 240 340 374 371 RATIOS

Tot Curr Liab 567 419 706 609 346 Ret on SH Fnd 63.09 25.50 - 30.10 - 99.48 - 61.67

Oper Pft Mgn 48.86 3.15 - 9.97 - 17.09 - 34.41

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 4.77 23.43 60.40 102.88 110.81 D:E 0.57 0.83 1.05 1.34 0.61

DPS (ZARc) - - 30.00 52.00 56.00 Current Ratio 4.70 2.69 2.40 0.76 1.96

NAV PS (ZARc) 783.60 792.56 878.44 872.20 902.17

3 Yr Beta - 0.24 - 0.04 0.46 0.34 -

Price High 192 495 590 870 1 275

Price Low 64 111 314 337 652

Price Prd End 69 190 421 458 855

RATIOS

Ret on SH Fnd 2.00 - 15.07 6.37 2.55 8.91

Oper Pft Mgn 0.21 - 9.61 6.39 3.29 9.13

D:E 0.09 0.11 0.19 0.15 0.14

Current Ratio 2.78 3.46 2.18 2.50 3.59

Div Cover - - 1.88 0.42 1.44

Nutritional Holdings Ltd.

NUT

ISIN: ZAE000156485 SHORT: NUTRITION CODE: NUT

REG NO: 2004/002282/06 FOUNDED: 2004 LISTED: 2006

NATURE OF BUSINESS: Nutritional Holdings operates in a competitive

industry with its revenues being well diversified by product mix,

geography as well as urban and rural spread. The majority of the Group’s

brandsarewellrecognizedinthemassmarketsegmentwhichcatersforthe

LSM 3-6 sector with sizeable market share. The company has exciting

growth prospects, including, but not limited to, the growth of its

operations from a very low base.

The Group has an established manufacturing base and a distribution

network in Southern Africa. This, coupled with the extensive capital outlay

required to replicate its operations, makes for high barriers of entry for

potential competitors.

SECTOR: AltX

NUMBER OF EMPLOYEES: 102

DIRECTORS: ChabeliPM(ind ne), Mashaba T (ne),

Mokgothu Dr P (ind ne), Moodley N (ne), SupingMM(ne), Tinawi M S

(ind ne), TinawiAA(ne), Nasser Sheik K H (Chair, ind ne), Azum M T

(CEO), Meyer S (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

Empire Cannabis & Noms 65.11%

POSTAL ADDRESS: PO Box 5026, Frosterly Park, La Lucia Ridge Office

Estate, 4019

MORE INFO: www.sharedata.co.za/sdo/jse/NUT

COMPANY SECRETARY: Claire Middlemiss

TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

DESIGNATED ADVISOR: Exchange Sponsors (Pty) Ltd.

AUDITORS: HLB CMA (South Africa) Inc.

183