Page 136 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 136

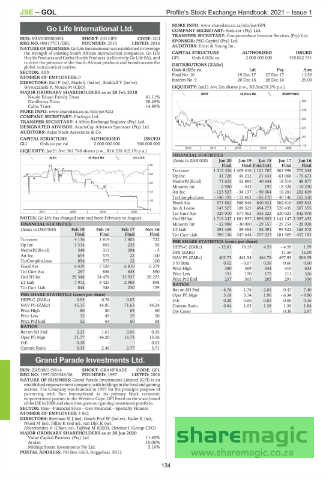

JSE – GOL Profile’s Stock Exchange Handbook: 2021 – Issue 1

MORE INFO: www.sharedata.co.za/sdo/jse/GPL

Go Life International Ltd. COMPANY SECRETARY: Statucor (Pty) Ltd.

GOL TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ISIN: MU0330N00004 SHORT: GO LIFE CODE: GLI SPONSOR: PSG Capital (Pty) Ltd.

REG NO: 098177C1/GBL FOUNDED: 2010 LISTED: 2016 AUDITORS: Ernst & Young Inc.

NATURE OF BUSINESS: Go Life International was established to leverage

the strength of existing South African nutraceutical companies, Go Life CAPITAL STRUCTURE AUTHORISED ISSUED

Health Products and Gotha Health Products (collectively Go Life SA), and GPL Ords 0.025c ea 2 000 000 000 470 022 741

to drive the presence of the South African products and brands across the DISTRIBUTIONS [ZARc]

global nutraceutical market.

Ldt

Amt

Pay

SECTOR: AltX Ords 0.025c ea 19 Dec 17 27 Dec 17 11.50

Final No 10

NUMBER OF EMPLOYEES: 0

DIRECTORS: Koll P (ne), Marie L (ind ne), Sooklall Y (ind ne), Interim No 9 20 Dec 16 28 Dec 16 25.00

Wysoczanski P, Motau M (CEO) LIQUIDITY: Jan21 Ave 2m shares p.w., R5.3m(19.3% p.a.)

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2018 GENF 40 Week MA GRANPRADE

Naude Eduan Family Trust 41.11%

Danilinova Trust 28.49% 555

Calitz Trust 14.89%

MORE INFO: www.sharedata.co.za/sdo/jse/GLI 479

COMPANY SECRETARY: FinAegis Ltd.

403

TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

DESIGNATED ADVISOR: AcaciaCap Advisors Sponsors (Pty) Ltd. 327

AUDITORS: Aejaz Nazir Associates & Co

251

CAPITAL STRUCTURE AUTHORISED ISSUED

GLI Ords no par val 2 000 000 000 900 000 000

2016 | 2017 | 2018 | 2019 | 2020 | 175

LIQUIDITY: Jan21 Ave 361 748 shares p.w., R16 238.4(2.1% p.a.)

FINANCIAL STATISTICS

ALSH 40 Week MA GO LIFE

(Amts in ZAR’000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

80 Final Final Final(rst) Final Final

Turnover 1 312 326 1 409 418 1 101 707 962 998 772 344

64

Op Inc 41 720 44 212 21 641 - 61 068 - 75 673

NetIntPd(Rcvd) 71 655 52 895 40 644 18 510 48 877

49

Minority Int - 2 980 - 443 197 - 8 328 - 10 290

33 Att Inc - 123 527 - 36 137 - 50 064 19 281 202 809

TotCompIncLoss - 140 193 - 112 462 - 85 170 - 40 146 155 510

18

Fixed Ass 573 862 586 546 640 631 582 610 695 843

Inv & Loans 143 527 189 523 494 273 520 435 307 355

2

2017 | 2018 | 2019 | 2020 | Tot Curr Ass 329 010 577 462 355 223 230 023 842 970

NOTES: Go Life has changed year end from February to August. Ord SH Int 1 719 347 1 881 937 1 995 855 2 141 147 2 397 492

FINANCIAL STATISTICS Minority Int - 32 980 - 30 000 - 29 557 - 29 754 - 28 038

(Amts in USD’000) Feb 19 Feb 18 Feb 17 Nov 16 LT Liab 391 469 59 454 58 491 99 522 165 578

Final Final Final Final Tot Curr Liab 390 136 547 444 257 023 181 909 457 183

Turnover 4 136 1 819 1 405 722 PER SHARE STATISTICS (cents per share)

Op Inc 1 314 804 235 95 HEPS-C (ZARc) - 12.81 19.13 4.59 - 4.59 1.99

NetIntPd(Rcvd) 548 313 284 - 5 DPS (ZARc) - - - 11.50 15.00

Att Inc 654 575 22 100 NAV PS (ZARc) 402.73 441.54 464.78 497.95 508.39

TotCompIncLoss 654 575 22 100 3 Yr Beta 0.02 - 0.07 0.58 0.66 0.60

Fixed Ass 6 439 7 520 6 810 6 379 Price High 380 369 334 410 633

Tot Curr Ass 297 856 638 590 Price Low 191 170 175 111 326

Ord SH Int 29 348 34 478 33 937 28 225 Price Prd End 237 305 205 291 350

LT Liab 7 972 3 425 2 988 898 RATIOS

Tot Curr Liab 844 348 230 159

Ret on SH Fnd - 6.76 - 1.76 - 2.02 0.47 7.40

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 3.18 3.14 1.96 - 6.34 - 9.80

HEPS-C (ZARc) 0.95 0.78 0.05 - D:E 0.28 0.06 0.05 0.06 0.16

NAV PS (ZARc) 45.35 44.85 71.63 44.24 Current Ratio 0.84 1.05 1.38 1.26 1.84

Price High 80 80 65 60 Div Cover - - - 0.38 2.87

Price Low 15 49 29 50

Price Prd End 52 64 60 58

RATIOS

Ret on SH Fnd 2.23 1.67 0.06 0.35

Oper Pft Mgn 31.77 44.20 16.73 13.16

D:E 0.28 - - 0.03

Current Ratio 0.35 2.46 2.77 3.71

Grand Parade Investments Ltd.

GRA

ISIN: ZAE000119814 SHORT: GRANPRADE CODE: GPL

REG NO: 1997/003548/06 FOUNDED: 1997 LISTED: 2008

NATURE OF BUSINESS: Grand Parade Investments Limited (GPI) is an

established empowermentcompany, with holdings in the foodandgaming

sectors. The Company was founded in 1997 for the principle purpose of

partnering with Sun International as its primary black economic

empowerment partner in the Western Cape. GPI listed on the main board

oftheJSEin2008 andsincethengrewourgaminginvestmentportfolio.

SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance

NUMBER OF EMPLOYEES: 2 862

DIRECTORS: BowmanMJ(ne), Geach Prof W (ind ne), Kader R (ne),

Nkosi M (ne), Pillay K (ind ne), van Dijk R (ne),

Abercrombie A (Chair, ne), Tajbhai M (CEO), October J (Group CFO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

Value Capital Partners (Pty) Ltd. 11.65%

Arakot 10.06%

Midnigt Storm Investments Pty Ltd. 5.16%

POSTAL ADDRESS: PO Box 6563, Roggebaai, 8012

134