Page 83 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 83

Profile’s Stock Exchange Handbook: 2020 – Issue 4 JSE – ALA

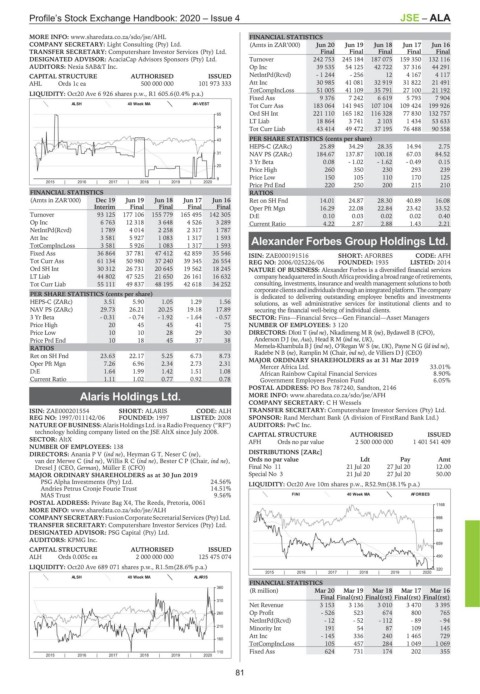

MORE INFO: www.sharedata.co.za/sdo/jse/AHL FINANCIAL STATISTICS

COMPANY SECRETARY: Light Consulting (Pty) Ltd. (Amts in ZAR’000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final Final Final Final Final

DESIGNATED ADVISOR: AcaciaCap Advisors Sponsors (Pty) Ltd. Turnover 242 753 245 184 187 075 159 350 132 116

AUDITORS: Nexia SAB&T Inc. Op Inc 39 535 54 125 42 722 37 316 44 291

CAPITAL STRUCTURE AUTHORISED ISSUED NetIntPd(Rcvd) - 1 244 - 256 12 4 167 4 117

AHL Ords 1c ea 500 000 000 101 973 333 Att Inc 30 985 41 081 32 919 31 822 21 491

TotCompIncLoss 51 005 41 109 35 791 27 100 21 192

LIQUIDITY: Oct20 Ave 6 926 shares p.w., R1 605.6(0.4% p.a.)

Fixed Ass 9 376 7 242 6 619 5 793 7 904

ALSH 40 Week MA AH-VEST Tot Curr Ass 183 064 141 945 107 104 109 424 199 926

65 Ord SH Int 221 110 165 182 116 328 77 830 132 757

LT Liab 18 864 3 741 2 103 1 434 53 633

54 Tot Curr Liab 43 414 49 472 37 195 76 488 90 558

43 PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 25.89 34.29 28.35 14.94 2.75

31 NAV PS (ZARc) 184.67 137.87 100.18 67.03 84.52

3 Yr Beta 0.08 - 1.02 - 1.62 - 0.49 0.15

20

Price High 260 350 230 293 239

9 Price Low 150 105 110 170 125

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Price Prd End 220 250 200 215 210

FINANCIAL STATISTICS RATIOS

(Amts in ZAR’000) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16 Ret on SH Fnd 14.01 24.87 28.30 40.89 16.08

Interim Final Final Final Final Oper Pft Mgn 16.29 22.08 22.84 23.42 33.52

Turnover 93 125 177 106 155 779 165 495 142 305 D:E 0.10 0.03 0.02 0.02 0.40

Op Inc 6 763 12 318 3 648 4 526 3 289 Current Ratio 4.22 2.87 2.88 1.43 2.21

NetIntPd(Rcvd) 1 789 4 014 2 258 2 317 1 787

Att Inc 3 581 5 927 1 083 1 317 1 593 Alexander Forbes Group Holdings Ltd.

TotCompIncLoss 3 581 5 926 1 083 1 317 1 593

ALE

Fixed Ass 36 864 37 781 47 412 42 859 35 546 ISIN: ZAE000191516 SHORT: AFORBES CODE: AFH

Tot Curr Ass 61 134 50 980 37 240 39 345 26 554 REG NO: 2006/025226/06 FOUNDED: 1935 LISTED: 2014

Ord SH Int 30 312 26 731 20 645 19 562 18 245 NATURE OF BUSINESS: Alexander Forbes is a diversified financial services

LT Liab 44 802 47 525 21 650 26 161 16 632 companyheadquarteredinSouthAfricaprovidingabroadrangeofretirements,

Tot Curr Liab 55 111 49 837 48 195 42 618 34 252 consulting, investments, insurance and wealth management solutions to both

corporateclientsandindividualsthroughanintegratedplatform.Thecompany

PER SHARE STATISTICS (cents per share) is dedicated to delivering outstanding employee benefits and investments

HEPS-C (ZARc) 3.51 5.90 1.05 1.29 1.56 solutions, as well administrative services for institutional clients and to

NAV PS (ZARc) 29.73 26.21 20.25 19.18 17.89 securing the financial well-being of individual clients.

3 Yr Beta - 0.31 - 0.74 - 1.92 - 1.64 - 0.57 SECTOR: Fins—Financial Srvcs—Gen Financial—Asset Managers

Price High 20 45 45 41 75 NUMBER OF EMPLOYEES: 3 120

Price Low 10 10 28 29 30 DIRECTORS: Dloti T (ind ne), Nkadimeng M R (ne), Bydawell B (CFO),

Price Prd End 10 18 45 37 38 Anderson D J (ne, Aus), Head R M (ind ne, UK),

RATIOS Memela-Khambula B J (ind ne), O’Regan W S (ne, UK), Payne N G (ld ind ne),

RadebeNB(ne), Ramplin M (Chair, ind ne), de Villiers D J (CEO)

Ret on SH Fnd 23.63 22.17 5.25 6.73 8.73 MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

Oper Pft Mgn 7.26 6.96 2.34 2.73 2.31

Mercer Africa Ltd. 33.01%

D:E 1.64 1.99 1.42 1.51 1.08 African Rainbow Capital Financial Services 8.90%

Current Ratio 1.11 1.02 0.77 0.92 0.78 Government Employees Pension Fund 6.05%

POSTAL ADDRESS: PO Box 787240, Sandton, 2146

Alaris Holdings Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/AFH

COMPANY SECRETARY: C H Wessels

ALA

ISIN: ZAE000201554 SHORT: ALARIS CODE: ALH TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

REG NO: 1997/011142/06 FOUNDED: 1997 LISTED: 2008 SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

NATURE OF BUSINESS: Alaris Holdings Ltd. is a Radio Frequency (“RF”) AUDITORS: PwC Inc.

technology holding company listed on the JSE AltX since July 2008. CAPITAL STRUCTURE AUTHORISED ISSUED

SECTOR: AltX AFH Ords no par value 2 500 000 000 1 401 541 409

NUMBER OF EMPLOYEES: 138

DIRECTORS: AnaniaPV(ind ne), Heyman G T, Neser C (ne), DISTRIBUTIONS [ZARc]

van der Merwe C (ind ne), WillisRC(ind ne), Bester C P (Chair, ind ne), Ords no par value Ldt Pay Amt

Dresel J (CEO, German), Müller E (CFO) Final No 11 21 Jul 20 27 Jul 20 12.00

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 Special No 3 21 Jul 20 27 Jul 20 50.00

PSG Alpha Investments (Pty) Ltd. 24.56% LIQUIDITY: Oct20 Ave 10m shares p.w., R52.9m(38.1% p.a.)

Andries Petrus Cronje Fourie Trust 14.51%

MAS Trust 9.56% FINI 40 Week MA AFORBES

POSTAL ADDRESS: Private Bag X4, The Reeds, Pretoria, 0061 1168

MORE INFO: www.sharedata.co.za/sdo/jse/ALH

COMPANY SECRETARY:FusionCorporateSecretarialServices(Pty)Ltd. 998

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: PSG Capital (Pty) Ltd. 829

AUDITORS: KPMG Inc.

659

CAPITAL STRUCTURE AUTHORISED ISSUED

ALH Ords 0.005c ea 2 000 000 000 125 475 074 490

LIQUIDITY: Oct20 Ave 689 071 shares p.w., R1.5m(28.6% p.a.) 320

2015 | 2016 | 2017 | 2018 | 2019 | 2020

ALSH 40 Week MA ALARIS

FINANCIAL STATISTICS

360

(R million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

Final Final(rst) Final(rst) Final(rst) Final(rst)

310

Net Revenue 3 153 3 136 3 010 3 470 3 395

260 Op Profit - 526 523 674 800 765

NetIntPd(Rcvd) - 12 - 52 - 112 - 89 - 94

210 Minority Int 191 54 87 109 145

Att Inc - 145 336 240 1 465 729

160

TotCompIncLoss 105 457 284 1 049 1 069

110 Fixed Ass 624 731 174 202 355

2015 | 2016 | 2017 | 2018 | 2019 | 2020

81