Page 78 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 78

JSE – AEC Profile’s Stock Exchange Handbook: 2020 – Issue 4

in Rex Trueform and its group which in turn is invested in the retail and

AECI Ltd. property industries and has recently entered into an agreement to invest in

the water concession industry.

AEC

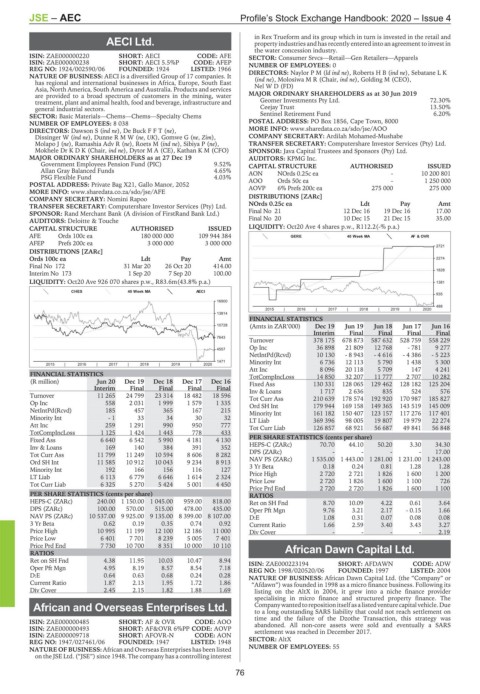

ISIN: ZAE000000220 SHORT: AECI CODE: AFE SECTOR: Consumer Srvcs—Retail—Gen Retailers—Apparels

ISIN: ZAE000000238 SHORT: AECI 5.5%P CODE: AFEP NUMBER OF EMPLOYEES: 0

REG NO: 1924/002590/06 FOUNDED: 1924 LISTED: 1966 DIRECTORS: NaylorPM(ld ind ne), RobertsHB(ind ne), Sebatane L K

NATURE OF BUSINESS: AECI is a diversified Group of 17 companies. It (ind ne), Molosiwa M R (Chair, ind ne), Golding M (CEO),

has regional and international businesses in Africa, Europe, South East

Asia, North America, South America and Australia. Products and services Nel W D (FD)

are provided to a broad spectrum of customers in the mining, water MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

treatment, plant and animal health, food and beverage, infrastructure and Geomer Investments Pty Ltd. 72.30%

general industrial sectors. Ceejay Trust 13.50%

SECTOR: Basic Materials—Chems—Chems—Specialty Chems Sentinel Retirement Fund 6.20%

NUMBER OF EMPLOYEES: 8 038 POSTAL ADDRESS: PO Box 1856, Cape Town, 8000

DIRECTORS: Dawson S (ind ne), De BuckFFT(ne), MORE INFO: www.sharedata.co.za/sdo/jse/AOO

Dissinger W (ind ne), DunneRMW(ne, UK), Gomwe G (ne, Zim), COMPANY SECRETARY: Ardilah Mohamed-Mushabe

Molapo J (ne), Ramashia Adv R (ne), Roets M (ind ne), Sibiya P (ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Mokhele DrKDK (Chair, ind ne), Dytor M A (CE), Kathan K M (CFO) SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 27 Dec 19 AUDITORS: KPMG Inc.

Government Employees Pension Fund (PIC) 9.52% CAPITAL STRUCTURE AUTHORISED ISSUED

Allan Gray Balanced Funds 4.65% AON NOrds 0.25c ea - 10 200 801

PSG Flexible Fund 4.03% AOO Ords 50c ea - 1 250 000

POSTAL ADDRESS: Private Bag X21, Gallo Manor, 2052

MORE INFO: www.sharedata.co.za/sdo/jse/AFE AOVP 6% Prefs 200c ea 275 000 275 000

COMPANY SECRETARY: Nomini Rapoo DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. NOrds 0.25c ea Ldt Pay Amt

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) Final No 21 12 Dec 16 19 Dec 16 17.00

AUDITORS: Deloitte & Touche Final No 20 10 Dec 15 21 Dec 15 35.00

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Oct20 Ave 4 shares p.w., R112.2(-% p.a.)

AFE Ords 100c ea 180 000 000 109 944 384 GERE 40 Week MA AF & OVR

AFEP Prefs 200c ea 3 000 000 3 000 000

2721

DISTRIBUTIONS [ZARc]

Ords 100c ea Ldt Pay Amt 2274

Final No 172 31 Mar 20 26 Oct 20 414.00

Interim No 173 1 Sep 20 7 Sep 20 100.00 1828

LIQUIDITY: Oct20 Ave 926 070 shares p.w., R83.6m(43.8% p.a.) 1381

CHES 40 Week MA AECI

935

16900

488

2015 | 2016 | 2017 | 2018 | 2019 | 2020

13814

FINANCIAL STATISTICS

10728 (Amts in ZAR’000) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

Interim Final Final Final Final

7643

Turnover 378 175 678 873 587 632 528 759 558 229

Op Inc 36 898 21 809 12 768 - 781 9 277

4557

NetIntPd(Rcvd) 10 130 - 8 943 - 4 616 - 4 386 - 5 223

1471 Minority Int 6 736 12 113 5 790 1 438 5 300

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Att Inc 8 096 20 118 5 709 147 4 241

FINANCIAL STATISTICS TotCompIncLoss 14 850 32 207 11 777 2 707 10 282

(R million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16 Fixed Ass 130 331 128 065 129 462 128 182 125 204

Interim Final Final Final Final Inv & Loans 1 717 2 636 835 524 576

Turnover 11 265 24 799 23 314 18 482 18 596 Tot Curr Ass 210 639 178 574 192 920 170 987 185 827

Op Inc 558 2 031 1 999 1 579 1 335 Ord SH Int 179 944 169 158 149 365 143 519 145 009

NetIntPd(Rcvd) 185 457 365 167 215 Minority Int 161 182 150 407 123 157 117 276 117 401

Minority Int - 1 33 34 30 32 LT Liab 369 396 98 005 19 807 19 979 22 274

Att Inc 259 1 291 990 950 777 Tot Curr Liab 126 857 68 921 56 687 49 841 56 848

TotCompIncLoss 1 125 1 424 1 443 778 433

Fixed Ass 6 640 6 542 5 990 4 181 4 130 PER SHARE STATISTICS (cents per share)

Inv & Loans 169 140 384 391 352 HEPS-C (ZARc) 70.70 44.10 50.20 3.30 34.30

Tot Curr Ass 11 799 11 249 10 594 8 606 8 282 DPS (ZARc) - - - - 17.00

Ord SH Int 11 585 10 912 10 043 9 234 8 913 NAV PS (ZARc) 1 535.00 1 443.00 1 281.00 1 231.00 1 243.00

Minority Int 192 166 156 116 127 3 Yr Beta 0.18 0.24 0.81 1.28 1.28

LT Liab 6 113 6 779 6 646 1 614 2 324 Price High 2 720 2 721 1 826 1 600 1 200

1 100

Price Low

2 720

726

1 600

1 826

Tot Curr Liab 6 325 5 270 5 424 5 001 4 450

Price Prd End 2 720 2 720 1 826 1 600 1 100

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 240.00 1 150.00 1 045.00 959.00 818.00 Ret on SH Fnd 8.70 10.09 4.22 0.61 3.64

DPS (ZARc) 100.00 570.00 515.00 478.00 435.00 Oper Pft Mgn 9.76 3.21 2.17 - 0.15 1.66

NAV PS (ZARc) 10 537.00 9 925.00 9 135.00 8 399.00 8 107.00 D:E 1.08 0.31 0.07 0.08 0.08

3 Yr Beta 0.62 0.19 0.35 0.74 0.92 Current Ratio 1.66 2.59 3.40 3.43 3.27

Price High 10 995 11 199 12 100 12 186 11 000 Div Cover - - - - 2.19

Price Low 6 401 7 701 8 239 5 005 7 401

Price Prd End 7 730 10 700 8 351 10 000 10 110

RATIOS African Dawn Capital Ltd.

Ret on SH Fnd 4.38 11.95 10.03 10.47 8.94 ISIN: ZAE000223194 SHORT: AFDAWN CODE: ADW

AFR

Oper Pft Mgn 4.95 8.19 8.57 8.54 7.18 REG NO: 1998/020520/06 FOUNDED: 1997 LISTED: 2004

D:E 0.64 0.63 0.68 0.24 0.28 NATURE OF BUSINESS: African Dawn Capital Ltd. (the “Company” or

Current Ratio 1.87 2.13 1.95 1.72 1.86 “Afdawn”) was founded in 1998 as a micro finance business. Following its

Div Cover 2.45 2.15 1.82 1.88 1.69 listing on the AltX in 2004, it grew into a niche finance provider

specialising in micro finance and structured property finance. The

African and Overseas Enterprises Ltd. Companywantedtorepositionitselfasalistedventurecapitalvehicle. Due

to a long outstanding SARS liability that could not reach settlement on

AFR time and the failure of the Dzothe Transaction, this strategy was

ISIN: ZAE000000485 SHORT: AF & OVR CODE: AOO abandoned. All non-core assets were sold and eventually a SARS

ISIN: ZAE000000493 SHORT: AF&OVR 6%PP CODE: AOVP settlement was reached in December 2017.

ISIN: ZAE000009718 SHORT: AFOVR-N CODE: AON SECTOR: AltX

REG NO: 1947/027461/06 FOUNDED: 1947 LISTED: 1948

NATURE OF BUSINESS: African and Overseas Enterprises has been listed NUMBER OF EMPLOYEES: 55

on the JSE Ltd. (“JSE”) since 1948. The company has a controlling interest

76