Page 87 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 87

Profile’s Stock Exchange Handbook: 2020 – Issue 4 JSE – ANG

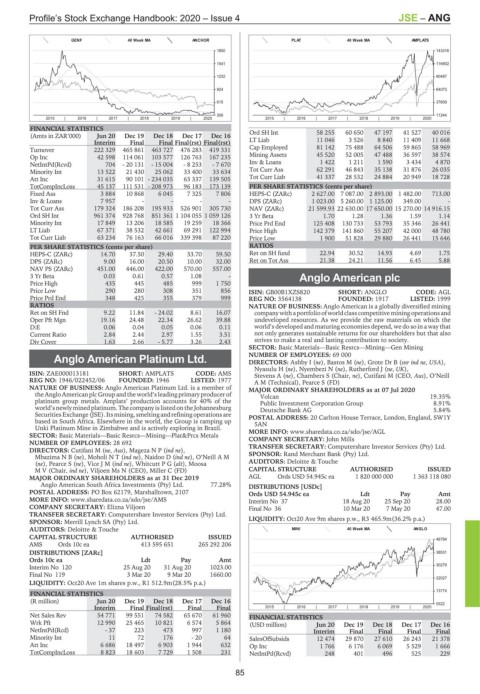

GENF 40 Week MA ANCHOR PLAT 40 Week MA AMPLATS

1850 143316

1541 116902

1232 90487

924 64073

615 37659

306 11244

2015 | 2016 | 2017 | 2018 | 2019 | 2020 2015 | 2016 | 2017 | 2018 | 2019 | 2020

FINANCIAL STATISTICS

(Amts in ZAR’000) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16 Ord SH Int 58 255 60 650 47 197 41 527 40 016

Interim Final Final Final(rst) Final(rst) LT Liab 11 046 3 526 8 840 11 409 11 668

Turnover 222 329 465 861 463 727 476 283 419 331 Cap Employed 81 142 75 488 64 506 59 865 58 969

Op Inc 42 598 114 061 103 577 126 763 167 235 Mining Assets 45 520 52 005 47 488 36 597 38 574

NetIntPd(Rcvd) 704 - 20 131 - 15 004 - 8 253 - 7 670 Inv & Loans 1 422 1 211 1 590 3 434 4 870

Minority Int 13 522 21 430 25 062 33 400 33 634 Tot Curr Ass 62 291 46 843 35 138 31 876 26 035

Att Inc 31 615 90 101 - 234 035 63 337 139 505 Tot Curr Liab 41 337 28 532 24 884 20 949 18 728

TotCompIncLoss 45 137 111 531 - 208 973 96 183 173 139 PER SHARE STATISTICS (cents per share)

Fixed Ass 3 884 10 868 6 045 7 325 7 806 HEPS-C (ZARc) 2 627.00 7 087.00 2 893.00 1 482.00 713.00

Inv & Loans 7 957 - - - - DPS (ZARc) 1 023.00 5 260.00 1 125.00 349.00 -

Tot Curr Ass 179 324 186 208 195 933 526 901 305 730 NAV (ZARc) 21 599.93 22 630.00 17 650.00 15 270.00 14 916.15

Ord SH Int 961 374 928 768 851 361 1 104 055 1 059 126 3 Yr Beta 1.70 1.28 1.36 1.59 1.14

Minority Int 17 849 13 206 18 585 19 259 18 366 Price Prd End 125 408 130 733 53 793 35 346 26 441

LT Liab 67 371 38 532 42 661 69 291 122 994 Price High 142 379 141 860 55 207 42 000 48 780

Tot Curr Liab 63 234 76 163 66 016 339 398 87 220 Price Low 1 900 51 828 29 880 26 441 15 646

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 14.70 37.50 29.40 33.70 59.50 Ret on SH fund 22.94 30.52 14.93 4.69 1.75

DPS (ZARc) 9.00 16.00 20.50 10.00 32.00 Ret on Tot Ass 21.38 24.21 11.56 6.45 5.88

NAV PS (ZARc) 451.00 446.00 422.00 570.00 557.00

3 Yr Beta 0.03 0.61 0.57 1.08 - Anglo American plc

Price High 435 445 485 999 1 750

ANG

Price Low 290 280 308 351 856 ISIN: GB00B1XZS820 SHORT: ANGLO CODE: AGL

Price Prd End 348 425 355 379 999 REG NO: 3564138 FOUNDED: 1917 LISTED: 1999

RATIOS NATURE OF BUSINESS: Anglo American is a globally diversified mining

Ret on SH Fnd 9.22 11.84 - 24.02 8.61 16.07 company with a portfolio of worldclasscompetitive mining operationsand

Oper Pft Mgn 19.16 24.48 22.34 26.62 39.88 undeveloped resources. As we provide the raw materials on which the

D:E 0.06 0.04 0.05 0.06 0.11 world’s developed and maturing economies depend, we do so in a way that

Current Ratio 2.84 2.44 2.97 1.55 3.51 not only generates sustainable returns for our shareholders but that also

Div Cover 1.63 2.66 - 5.77 3.26 2.43 strives to make a real and lasting contribution to society.

SECTOR: Basic Materials—Basic Resrcs—Mining—Gen Mining

NUMBER OF EMPLOYEES: 69 000

Anglo American Platinum Ltd. DIRECTORS: Ashby I (ne), Bastos M (ne), Grote Dr B (snr ind ne, USA),

ANG Nyasulu H (ne), Nyembezi N (ne), Rutherford J (ne, UK),

ISIN: ZAE000013181 SHORT: AMPLATS CODE: AMS Stevens A (ne), Chambers S (Chair, ne), Cutifani M (CEO, Aus), O’Neill

REG NO: 1946/022452/06 FOUNDED: 1946 LISTED: 1977 A M (Technical), Pearce S (FD)

NATURE OF BUSINESS: Anglo American Platinum Ltd. is a member of MAJOR ORDINARY SHAREHOLDERS as at 07 Jul 2020

the Anglo American plc Group andthe world’s leading primary producer of Volcan 19.35%

platinum group metals. Amplats’ production accounts for 40% of the Public Investment Corporation Group 8.91%

world’s newly mined platinum. The company is listed on the Johannesburg Deutsche Bank AG 5.84%

Securities Exchange(JSE).Itsmining,smeltingandrefiningoperationsare POSTAL ADDRESS: 20 Carlton House Terrace, London, England, SW1Y

based in South Africa. Elsewhere in the world, the Group is ramping up 5AN

Unki Platinum Mine in Zimbabwe and is actively exploring in Brazil.

SECTOR: Basic Materials—Basic Resrcs—Mining—Plat&Prcs Metals MORE INFO: www.sharedata.co.za/sdo/jse/AGL

COMPANY SECRETARY: John Mills

NUMBER OF EMPLOYEES: 28 692 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: Cutifani M (ne, Aus), MagezaNP(ind ne),

MbazimaNB(ne), MoholiNT(ind ne), Naidoo D (ind ne), O’Neill A M SPONSOR: Rand Merchant Bank (Pty) Ltd.

(ne), Pearce S (ne), ViceJM(ind ne), WhitcuttPG(alt), Moosa AUDITORS: Deloitte & Touche

M V (Chair, ind ne), Viljoen Ms N (CEO), Miller C (FD) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019 AGL Ords USD 54.945c ea 1 820 000 000 1 363 118 080

Anglo American South Africa Investments (Pty) Ltd. 77.28% DISTRIBUTIONS [USDc]

POSTAL ADDRESS: PO Box 62179, Marshalltown, 2107 Ords USD 54.945c ea Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/AMS Interim No 37 18 Aug 20 25 Sep 20 28.00

COMPANY SECRETARY: Elizna Viljoen Final No 36 10 Mar 20 7 May 20 47.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Merrill Lynch SA (Pty) Ltd. LIQUIDITY: Oct20 Ave 9m shares p.w., R3 465.9m(36.2% p.a.)

AUDITORS: Deloitte & Touche MINI 40 Week MA ANGLO

CAPITAL STRUCTURE AUTHORISED ISSUED 46784

AMS Ords 10c ea 413 595 651 265 292 206

DISTRIBUTIONS [ZARc] 38531

Ords 10c ea Ldt Pay Amt

Interim No 120 25 Aug 20 31 Aug 20 1023.00 30279

Final No 119 3 Mar 20 9 Mar 20 1660.00

22027

LIQUIDITY: Oct20 Ave 1m shares p.w., R1 512.9m(28.5% p.a.)

13774

FINANCIAL STATISTICS

(R million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16 5522

Interim Final Final(rst) Final Final 2015 | 2016 | 2017 | 2018 | 2019 | 2020

Net Sales Rev 54 771 99 551 74 582 65 670 61 960 FINANCIAL STATISTICS

Wrk Pft 12 990 25 465 10 821 6 574 5 864 (USD million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16

NetIntPd(Rcd) - 37 223 473 997 1 180 Interim Final Final Final Final

Minority Int 11 72 176 - 20 64 SalesOfSubsids 12 474 29 870 27 610 26 243 21 378

Att Inc 6 686 18 497 6 903 1 944 632 Op Inc 1 766 6 176 6 069 5 529 1 666

TotCompIncLoss 8 823 18 603 7 729 1 508 231 NetIntPd(Rcvd) 248 401 496 525 229

85