Page 79 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 79

Profile’s Stock Exchange Handbook: 2020 – Issue 4 JSE – AFR

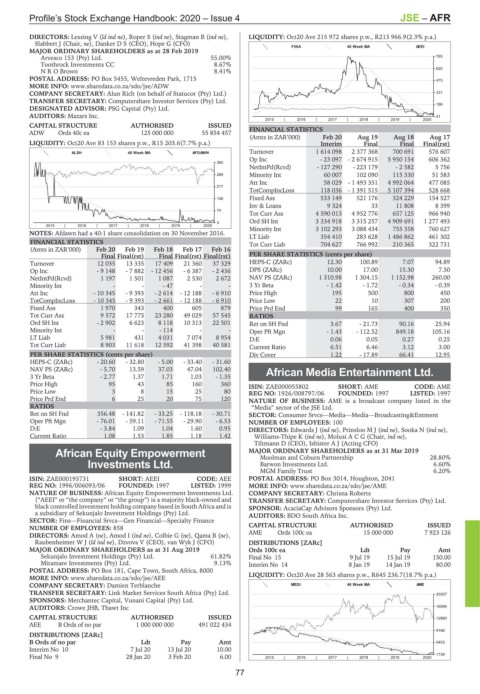

DIRECTORS: Lessing V (ld ind ne), Roper S (ind ne), Stagman B (ind ne), LIQUIDITY: Oct20 Ave 215 972 shares p.w., R213 966.9(2.3% p.a.)

Slabbert J (Chair, ne), Danker D S (CEO), Hope G (CFO)

FINA 40 Week MA AEEI

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

Arvesco 153 (Pty) Ltd. 55.00% 765

Toothrock Investments CC 8.67%

N R O Brown 8.41% 620

POSTAL ADDRESS: PO Box 5455, Weltevreden Park, 1715 475

MORE INFO: www.sharedata.co.za/sdo/jse/ADW

COMPANY SECRETARY: Alun Rich (on behalf of Statucor (Pty) Ltd.) 331

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DESIGNATED ADVISOR: PSG Capital (Pty) Ltd. 186

AUDITORS: Mazars Inc. 41

2015 | 2016 | 2017 | 2018 | 2019 | 2020

CAPITAL STRUCTURE AUTHORISED ISSUED

ADW Ords 40c ea 125 000 000 55 854 457 FINANCIAL STATISTICS

(Amts in ZAR’000) Feb 20 Aug 19 Aug 18 Aug 17

LIQUIDITY: Oct20 Ave 83 153 shares p.w., R15 203.6(7.7% p.a.) Interim Final Final Final(rst)

ALSH 40 Week MA AFDAWN Turnover 1 614 098 2 377 368 700 691 576 607

Op Inc - 23 097 - 2 674 915 5 950 154 606 362

360

NetIntPd(Rcvd) - 127 290 - 223 179 - 2 582 5 756

289 Minority Int 60 007 102 090 115 330 51 583

Att Inc 58 029 - 1 493 351 4 992 064 477 085

217

TotCompIncLoss 118 036 - 1 391 515 5 107 394 528 668

146 Fixed Ass 533 149 521 176 324 229 154 527

Inv & Loans 9 324 33 11 808 8 399

74

Tot Curr Ass 4 590 013 4 952 776 657 125 966 940

Ord SH Int 3 334 918 3 315 257 4 909 691 1 277 493

3

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Minority Int 3 102 293 3 088 434 755 358 760 627

NOTES: Afdawn had a 40:1 share consolidation on 30 November 2016.

LT Liab 354 410 283 628 1 486 862 461 302

FINANCIAL STATISTICS Tot Curr Liab 704 627 766 992 210 365 322 731

(Amts in ZAR’000) Feb 20 Feb 19 Feb 18 Feb 17 Feb 16

Final Final(rst) Final Final(rst) Final(rst) PER SHARE STATISTICS (cents per share)

Turnover 12 035 13 335 17 409 21 360 37 329 HEPS-C (ZARc) 12.30 100.89 7.07 94.89

Op Inc - 9 148 - 7 882 - 12 456 - 6 387 - 2 436 DPS (ZARc) 10.00 17.00 15.30 7.50

NetIntPd(Rcvd) 1 197 1 501 1 087 2 530 2 672 NAV PS (ZARc) 1 310.98 1 304.15 1 152.98 260.00

Minority Int - - - 47 - - 3 Yr Beta - 1.42 - 1.72 - 0.34 - 0.39

Att Inc - 10 345 - 9 393 - 2 614 - 12 188 - 6 910 Price High 195 500 800 450

TotCompIncLoss - 10 345 - 9 393 - 2 661 - 12 188 - 6 910 Price Low 22 10 307 200

Fixed Ass 1 970 343 400 605 879 Price Prd End 99 165 400 350

Tot Curr Ass 9 572 17 775 23 280 49 029 57 545 RATIOS

Ord SH Int - 2 902 6 623 8 118 10 313 22 501 Ret on SH Fnd 3.67 - 21.73 90.16 25.94

Minority Int - - - 114 - - Oper Pft Mgn - 1.43 - 112.52 849.18 105.16

LT Liab 5 981 431 4 031 7 074 8 954 D:E 0.06 0.05 0.27 0.25

Tot Curr Liab 8 903 11 618 12 592 41 398 40 581 Current Ratio 6.51 6.46 3.12 3.00

PER SHARE STATISTICS (cents per share) Div Cover 1.22 - 17.89 66.41 12.95

HEPS-C (ZARc) - 20.60 - 32.80 - 5.00 - 33.40 - 31.60

NAV PS (ZARc) - 5.70 13.59 37.03 47.04 102.40 African Media Entertainment Ltd.

3 Yr Beta - 2.77 1.37 1.71 1.03 - 1.35

AFR

Price High 95 43 85 160 360 ISIN: ZAE000055802 SHORT: AME CODE: AME

Price Low 3 8 15 25 80 REG NO: 1926/008797/06 FOUNDED: 1997 LISTED: 1997

Price Prd End 6 25 20 75 120 NATURE OF BUSINESS: AME is a broadcast company listed in the

RATIOS “Media” sector of the JSE Ltd.

Ret on SH Fnd 356.48 - 141.82 - 33.25 - 118.18 - 30.71 SECTOR: Consumer Srvcs—Media—Media—Broadcasting&Entment

Oper Pft Mgn - 76.01 - 59.11 - 71.55 - 29.90 - 6.53 NUMBER OF EMPLOYEES: 100

D:E - 3.84 1.09 1.04 1.60 0.95 DIRECTORS: Edwards J (ind ne), PrinslooMJ(ind ne), Sooka N (ind ne),

Current Ratio 1.08 1.53 1.85 1.18 1.42 Williams-Thipe K (ind ne), MolusiACG (Chair, ind ne),

Tiltmann D (CEO), Isbister A J (Acting CFO)

African Equity Empowerment MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019 28.80%

Moolman and Coburn Partnership

Investments Ltd. Barwon Investments Ltd. 6.60%

MGM Family Trust 6.20%

AFR

ISIN: ZAE000195731 SHORT: AEEI CODE: AEE POSTAL ADDRESS: PO Box 3014, Houghton, 2041

REG NO: 1996/006093/06 FOUNDED: 1997 LISTED: 1999 MORE INFO: www.sharedata.co.za/sdo/jse/AME

NATURE OF BUSINESS: African Equity Empowerment Investments Ltd. COMPANY SECRETARY: Chrisna Roberts

(“AEEI” or “the company” or “the group”) is a majority black-owned and TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

black controlled investment holding company based in South Africa and is SPONSOR: AcaciaCap Advisors Sponsors (Pty) Ltd.

a subsidiary of Sekunjalo Investment Holdings (Pty) Ltd. AUDITORS: BDO South Africa Inc.

SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance

NUMBER OF EMPLOYEES: 858 CAPITAL STRUCTURE AUTHORISED ISSUED

DIRECTORS: Amod A (ne), Amod I (ind ne), Colbie G (ne), Qama B (ne), AME Ords 100c ea 15 000 000 7 923 126

RaubenheimerWJ(ld ind ne), Dzvova V (CEO), van Wyk J (CFO) DISTRIBUTIONS [ZARc]

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2019 Ords 100c ea Ldt Pay Amt

Sekunjalo Investment Holdings (Pty) Ltd. 61.82% Final No 15 9 Jul 19 15 Jul 19 150.00

Miramare Investments (Pty) Ltd. 9.13% Interim No 14 8 Jan 19 14 Jan 19 80.00

POSTAL ADDRESS: PO Box 181, Cape Town, South Africa, 8000

MORE INFO: www.sharedata.co.za/sdo/jse/AEE LIQUIDITY: Oct20 Ave 28 563 shares p.w., R645 236.7(18.7% p.a.)

COMPANY SECRETARY: Damien Terblanche MEDI 40 Week MA AME

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. 20307

SPONSORS: Merchantec Capital, Vunani Capital (Pty) Ltd.

AUDITORS: Crowe JHB, Thawt Inc 16594

CAPITAL STRUCTURE AUTHORISED ISSUED 12880

AEE B Ords of no par 1 000 000 000 491 022 434

9166

DISTRIBUTIONS [ZARc]

B Ords of no par Ldt Pay Amt 5453

Interim No 10 7 Jul 20 13 Jul 20 10.00

1739

Final No 9 28 Jan 20 3 Feb 20 6.00 2015 | 2016 | 2017 | 2018 | 2019 | 2020

77