Page 41 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 41

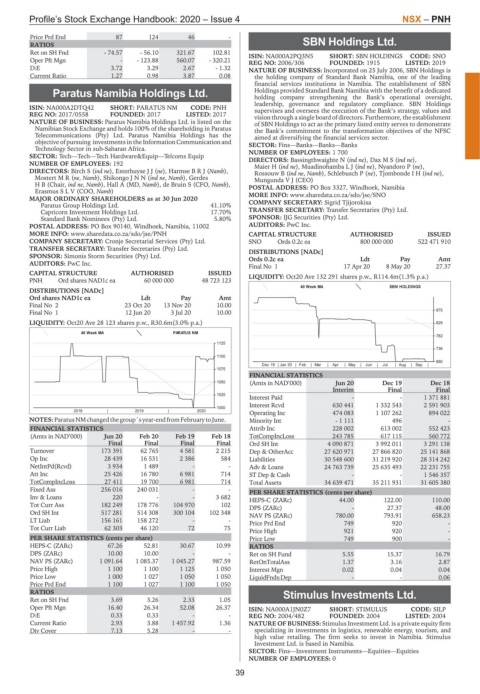

Profile’s Stock Exchange Handbook: 2020 – Issue 4 NSX – PNH

Price Prd End 87 124 46 -

RATIOS SBN Holdings Ltd.

Ret on SH Fnd - 74.57 - 56.10 321.67 102.81 ISIN: NA000A2PQ3N5 SHORT: SBN HOLDINGS CODE: SNO

SNO

Oper Pft Mgn - - 123.88 560.07 - 320.21 REG NO: 2006/306 FOUNDED: 1915 LISTED: 2019

D:E 3.72 3.29 2.67 - 1.32 NATURE OF BUSINESS: Incorporated on 25 July 2006, SBN Holdings is

Current Ratio 1.27 0.98 3.87 0.08 the holding company of Standard Bank Namibia, one of the leading

financial services institutions in Namibia. The establishment of SBN

Paratus Namibia Holdings Ltd. Holdings provided Standard Bank Namibia with the benefit of a dedicated

holding company strengthening the Bank’s operational oversight,

PNH leadership, governance and regulatory compliance. SBN Holdings

ISIN: NA000A2DTQ42 SHORT: PARATUS NM CODE: PNH supervises and oversees the execution of the Bank’s strategy, values and

REG NO: 2017/0558 FOUNDED: 2017 LISTED: 2017 vision through a single board of directors. Furthermore, the establishment

NATURE OF BUSINESS: Paratus Namibia Holdings Ltd. is listed on the of SBN Holdings to act as the primary listed entity serves to demonstrate

Namibian Stock Exchange and holds 100% of the shareholding in Paratus the Bank’s commitment to the transformation objectives of the NFSC

Telecommunications (Pty) Ltd. Paratus Namibia Holdings has the aimed at diversifying the financial services sector.

objective of pursuing investments in the Information Communication and SECTOR: Fins—Banks—Banks—Banks

Technology Sector in sub-Saharan Africa.

SECTOR: Tech—Tech—Tech Hardware&Equip—Telcoms Equip NUMBER OF EMPLOYEES: 1 700

DIRECTORS: Bassingthwaighte N (ind ne), DaxMS(ind ne),

NUMBER OF EMPLOYEES: 192 Maier H (ind ne), MuadinohambaLJ(ind ne), Nyandoro P (ne),

DIRECTORS: Birch S (ind ne), EsterhuyseJJ(ne), HarmseBRJ(Namb), Rossouw B (ind ne, Namb), Schlebusch P (ne), TjombondeIH(ind ne),

MostertMR(ne, Namb), ShikongoJNN(ind ne, Namb), Gerdes Mungunda V J (CEO)

H B (Chair, ind ne, Namb), Hall A (MD, Namb), de Bruin S (CFO, Namb), POSTAL ADDRESS: PO Box 3327, Windhoek, Namibia

ErasmusSLV (COO, Namb) MORE INFO: www.sharedata.co.za/sdo/jse/SNO

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

Paratus Group Holdings Ltd. 41.10% COMPANY SECRETARY: Sigrid Tjijorokisa

Capricorn Investment Holdings Ltd. 17.70% TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

Standard Bank Nominees (Pty) Ltd. 5.80% SPONSOR: IJG Securities (Pty) Ltd.

POSTAL ADDRESS: PO Box 90140, Windhoek, Namibia, 11002 AUDITORS: PwC Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/PNH CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: Cronje Secretarial Services (Pty) Ltd. SNO Ords 0.2c ea 800 000 000 522 471 910

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. DISTRIBUTIONS [NADc]

SPONSOR: Simonis Storm Securities (Pty) Ltd. Ords 0.2c ea Ldt Pay Amt

AUDITORS: PwC Inc.

Final No 1 17 Apr 20 8 May 20 27.37

CAPITAL STRUCTURE AUTHORISED ISSUED

PNH Ord shares NAD1c ea 60 000 000 48 723 123 LIQUIDITY: Oct20 Ave 132 291 shares p.w., R114.4m(1.3% p.a.)

40 Week MA SBN HOLDINGS

DISTRIBUTIONS [NADc]

Ord shares NAD1c ea Ldt Pay Amt

Final No 2 23 Oct 20 13 Nov 20 10.00

875

Final No 1 12 Jun 20 3 Jul 20 10.00

LIQUIDITY: Oct20 Ave 28 123 shares p.w., R30.6m(3.0% p.a.) 829

40 Week MA PARATUS NM

782

1125

736

1100

690

Dec 19 | Jan 20 | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep |

1075

FINANCIAL STATISTICS

1050 (Amts in NAD’000) Jun 20 Dec 19 Dec 18

Interim Final Final

1025

Interest Paid - - 1 371 881

Interest Rcvd 630 441 1 332 543 2 591 903

1000

2018 | 2019 | 2020

Operating Inc 474 083 1 107 262 894 022

NOTES:ParatusNMchangedthegroup´syear-endfromFebruarytoJune. Minority Int - 1 111 496 -

FINANCIAL STATISTICS Attrib Inc 228 002 613 002 552 423

(Amts in NAD’000) Jun 20 Feb 20 Feb 19 Feb 18 TotCompIncLoss 243 785 617 115 560 772

Final Final Final Final Ord SH Int 4 090 871 3 992 011 3 291 138

Turnover 173 391 62 765 4 581 2 215 Dep & OtherAcc 27 620 971 27 866 820 25 141 868

Op Inc 28 439 16 531 2 386 584 Liabilities 30 548 600 31 219 920 28 314 242

NetIntPd(Rcvd) 3 934 1 489 - - Adv & Loans 24 763 739 25 635 493 22 231 755

Att Inc 25 426 16 780 6 981 714 ST Dep & Cash - - 1 546 357

TotCompIncLoss 27 411 19 700 6 981 714 Total Assets 34 639 471 35 211 931 31 605 380

Fixed Ass 256 016 240 031 - - PER SHARE STATISTICS (cents per share)

Inv & Loans 220 - - 3 682 HEPS-C (ZARc) 44.00 122.00 110.00

Tot Curr Ass 182 249 178 776 104 970 102 DPS (ZARc) - 27.37 48.00

Ord SH Int 517 281 514 308 300 104 102 348 NAV PS (ZARc) 780.00 793.91 658.23

LT Liab 156 161 158 272 - - Price Prd End 749 920 -

Tot Curr Liab 62 303 46 120 72 75

Price High 921 920 -

PER SHARE STATISTICS (cents per share) Price Low 749 900 -

HEPS-C (ZARc) 67.26 52.81 30.67 10.99 RATIOS

DPS (ZARc) 10.00 10.00 - - Ret on SH Fund 5.55 15.37 16.79

NAV PS (ZARc) 1 091.64 1 085.37 1 045.27 987.59 RetOnTotalAss 1.37 3.16 2.87

Price High 1 100 1 100 1 125 1 050 Interest Mgn 0.02 0.04 0.04

Price Low 1 000 1 027 1 050 1 050 LiquidFnds:Dep - - 0.06

Price Prd End 1 100 1 027 1 100 1 050

RATIOS Stimulus Investments Ltd.

Ret on SH Fnd 3.69 3.26 2.33 1.05

SILP

Oper Pft Mgn 16.40 26.34 52.08 26.37 ISIN: NA000A1JN0Z7 SHORT: STIMULUS CODE: SILP

D:E 0.33 0.33 - - REG NO: 2004/482 FOUNDED: 2004 LISTED: 2004

Current Ratio 2.93 3.88 1 457.92 1.36 NATURE OF BUSINESS: Stimulus Investment Ltd. is a private equity firm

Div Cover 7.13 5.28 - - specializing in investments in logistics, renewable energy, tourism, and

high value retailing. The firm seeks to invest in Namibia. Stimulus

Investment Ltd. is based in Namibia.

SECTOR: Fins—Investment Instruments—Equities—Equities

NUMBER OF EMPLOYEES: 0

39