Page 38 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 38

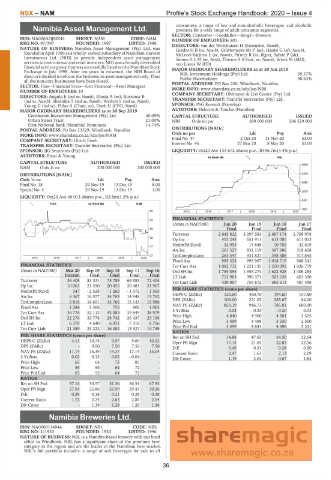

NSX – NAM Profile’s Stock Exchange Handbook: 2020 – Issue 4

consumers; a range of low and non-alcoholic beverages; and alcoholic

Namibia Asset Management Ltd. products for a wide range of adult consumer segments.

NAM SECTOR: Consumer—Food&Bev—Bevgs—Brewers

ISIN: NA000AOJMZ44 SHORT: NAM CODE: NAM NUMBER OF EMPLOYEES: 801

REG NO: 97/397 FOUNDED: 1997 LISTED: 1998 DIRECTORS: van der Westhuizen H (Executive, Namb),

NATURE OF BUSINESS: Namibia Asset Management (Pty) Ltd. was GerdesHB(ne, Namb), Grüttemeyer Mr P (ne), Hanke G (alt, Namb),

founded in April 1996 as a wholly- owned subsidiary of Namibian Harvest McLeod-Katjirua L (ne, Namb), Pirmez R (ne, Blgm), Sabrie P (alt),

Investments Ltd. (NHI) to provide independent asset management SiemerSLM(ne, Neth), Thieme S (Chair, ne, Namb), Wenk M (MD),

services to institutional and retail investors. NHI was a broadly diversified von Lieres W (FD)

financial services group that was successfully listed on the Namibian Stock MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

Exchange in July 1998. After ten years in existence, the NHI Board of NBL Investment Holdings (Pty) Ltd. 59.37%

directors decided to refocus the business on asset management only. Thus Public Shareholders 40.63%

all the non-core businesses have been closed.

SECTOR: Fins—Financial Srvcs—Gen Financial—Asset Managers POSTAL ADDRESS: PO Box 206, Windhoek, Namibia

MORE INFO: www.sharedata.co.za/sdo/jse/NBS

NUMBER OF EMPLOYEES: 10

DIRECTORS: Angula E (ind ne, Namb), Rhoda A (ne), Rossouw B COMPANY SECRETARY: Ohlthaver & List Centre (Pty) Ltd.

(ind ne, Namb), Shaanika T (ind ne, Namb), Walters S (ind ne, Namb), TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

Young G (ind ne), Pillay A (Chair, ne), Eiseb U (CFO, Namb) SPONSOR: PSG Konsult (Namibia)

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2019 AUDITORS: Deloitte & Touche (Namibia)

Coronation Investment Management (Pty) Ltd. 40.05% CAPITAL STRUCTURE AUTHORISED ISSUED

Orban Street Trust 21.00% NBS Ords no par 299 000 000 206 529 000

First National Bank (Namibia) Nominees 14.74%

POSTAL ADDRESS: Po Box 23329, Windhoek, Namibia DISTRIBUTIONS [NADc]

MORE INFO: www.sharedata.co.za/sdo/jse/NAM Ords no par Ldt Pay Amt

COMPANY SECRETARY: Ulrich Eiseb Final No 47 2 Oct 20 13 Nov 20 53.00

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. Interim No 46 27 Mar 20 8 May 20 53.00

SPONSOR: IJG Securities (Pty) Ltd. LIQUIDITY: Oct20 Ave 133 672 shares p.w., R496.7m(3.4% p.a.)

AUDITORS: Ernst & Young 40 Week MA NBL

CAPITAL STRUCTURE AUTHORISED ISSUED

4899

NAM Ords 1c ea 200 000 000 200 000 000

DISTRIBUTIONS [NADc] 4289

Ords 1c ea Ldt Pay Amt

Final No 18 29 Nov 19 13 Dec 19 8.00 3680

Special No 4 29 Nov 19 13 Dec 19 1.00

3070

LIQUIDITY: Oct20 Ave 46 013 shares p.w., R2.8m(1.2% p.a.)

2461

FINA 40 Week MA NAM

1851

85 2015 | 2016 | 2017 | 2018 | 2019 | 2020

FINANCIAL STATISTICS

75

(Amts in NAD’000) Jun 20 Jun 19 Jun 18 Jun 17

66 Final Final Final Final

Turnover 2 645 832 3 097 583 2 687 174 2 708 978

56

Op Inc 453 243 651 911 613 085 611 013

NetIntPd(Rcvd) 32 953 15 848 10 702 32 619

47

Att Inc 261 327 931 119 397 686 318 428

37 TotCompIncLoss 263 547 931 827 398 388 317 845

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Fixed Ass 985 323 995 967 1 018 719 988 241

FINANCIAL STATISTICS Tot Curr Ass 1 082 732 1 221 135 1 250 092 1 026 779

(Amts in NAD’000) Mar 20 Sep 19 Sep 18 Sep 17 Sep 16 Ord SH Int 1 755 895 1 955 274 1 622 928 1 406 285

Interim Final Final Final Final LT Liab 712 983 390 373 502 638 601 390

Turnover 36 408 83 331 75 789 69 583 72 404 Tot Curr Liab 439 007 759 872 585 613 487 498

Op Inc 10 063 21 550 20 455 20 481 21 907

NetIntPd(Rcvd) 347 - 2 528 - 1 265 - 1 572 - 1 565 PER SHARE STATISTICS (cents per share)

Att Inc 6 367 16 577 14 763 14 948 15 762 HEPS-C (ZARc) 125.60 450.70 194.60 157.80

TotCompIncLoss 5 818 16 691 14 766 15 143 15 986 DPS (ZARc) 106.00 221.05 285.67 84.00

Fixed Ass 1 284 1 366 755 906 1 003 NAV PS (ZARc) 850.19 946.73 785.81 680.90

Tot Curr Ass 36 776 52 113 43 083 39 849 38 979 3 Yr Beta 0.08 - 0.23 - 0.20 0.03

Ord SH Int 22 276 32 778 28 742 26 437 23 198 Price High 4 840 4 900 4 501 3 525

LT Liab 6 379 4 640 6 031 7 318 8 756 Price Low 3 499 4 498 3 330 2 550

Tot Curr Liab 21 389 23 222 16 382 13 927 14 749 Price Prd End 3 499 4 841 4 498 3 331

RATIOS

PER SHARE STATISTICS (cents per share)

Ret on SH Fnd 14.88 47.62 24.50 22.64

HEPS-C (ZARc) 4.13 10.75 9.57 9.69 10.22 Oper Pft Mgn 17.13 21.05 22.82 22.56

DPS (ZARc) - 9.00 7.50 7.50 7.50 D:E 0.49 0.31 0.38 0.50

NAV PS (ZARc) 11.14 16.39 14.37 17.14 15.04 Current Ratio 2.47 1.61 2.13 2.09

3 Yr Beta 0.02 0.13 0.02 - 0.04 - Div Cover 1.19 2.04 0.67 1.84

Price High 65 64 72 85 -

Price Low 55 55 64 72 -

Price Prd End 65 55 64 72 -

RATIOS

Ret on SH Fnd 57.16 50.57 51.36 56.54 67.95

Oper Pft Mgn 27.64 25.86 26.99 29.43 30.26

D:E 0.29 0.14 0.21 0.28 0.38

Current Ratio 1.72 2.24 2.63 2.86 2.64

Div Cover - 1.19 1.28 1.29 1.36

Namibia Breweries Ltd.

NBS

ISIN: NA0009114944 SHORT: NBL CODE: NBS

REG NO: 2/1920 FOUNDED: 1920 LISTED: 1996

NATURE OF BUSINESS: NBL is a Namibia-based brewery with our head

office in Windhoek. NBL has a significant share of the premium beer

category in the region and are the leader in the Namibian beer market.

NBL’s full portfolio includes: a range of soft beverages for sale to all

36