Page 39 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 39

Profile’s Stock Exchange Handbook: 2020 – Issue 4 NSX – NHL

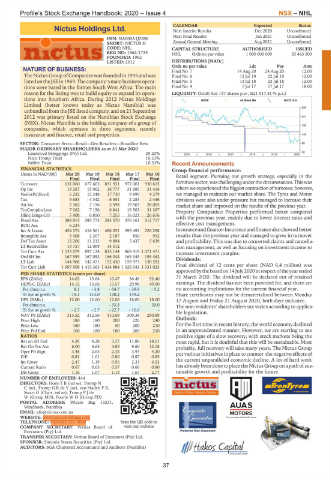

CALENDAR Expected Status

Nictus Holdings Ltd. Next Interim Results Dec 2020 Unconfirmed

NHL Next Final Results Jun 2021 Unconfirmed

ISIN: NA000A1J2SS6

SHORT: NICTUS H Annual General Meeting Aug 2021 Unconfirmed

CODE: NHL CAPITAL STRUCTURE AUTHORISED ISSUED

REG NO: 1962/1735 NHL Ords no par value 1 000 000 000 53 443 500

FOUNDED: 1962

LISTED: 2012 DISTRIBUTIONS [NADc]

Ords no par value Ldt Pay Amt

NATURE OF BUSINESS: Final No 7 14 Aug 20 24 Aug 20 12.00

The Nictus Group of Companies was founded in 1945 and was Final No 6 12 Jul 19 22 Jul 19 12.00

listedontheJSEin1969.Thecompany’smainbusinessopera- Final No 5 13 Jul 18 23 Jul 18 12.00

tions were based in the former South West Africa. The main Final No 4 7 Jul 17 17 Jul 17 18.00

reason for the listing was to build equity to expand its opera- LIQUIDITY: Oct20 Ave 137 shares p.w., R21 917.8(-% p.a.)

tions into Southern Africa. During 2012 Nictus Holdings GERE 40 Week MA NICTUS H

Limited (better known today as Nictus Namibia) was

289

unbundled from the JSE listed company, and on 21 September

2012 was primary listed on the Namibian Stock Exchange 241

(NSX). Nictus Namibia is the holding company of a group of

193

companies, which operates in three segments, namely

insurance and finance, retail and properties. 145

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Broadline Rets 98

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

Landswyd Beleggings (Pty) Ltd. 29.20% 2015 | 2016 | 2017 | 2018 | 2019 | 2020 50

Nico Tromp Trust 10.53%

Saffier Trust 10.53% Recent Announcements

FINANCIAL STATISTICS Group financial performance:

(Amts in NAD’000) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16 Retail segment: Pursuing our growth strategy, especially in the

Final Final Final Final Final

Turnover 631 060 677 603 831 921 972 001 930 615 furnituresector,waschallengingunderthecircumstances.Thiswas

Op Inc 19 267 15 062 16 777 31 685 31 416 where we experienced the biggest contraction of turnover; however,

NetIntPd(Rcvd) 6 222 12 248 17 730 9 899 4 279 we managed to maintain our market share. The Tyres and Motor

Tax 5 683 - 4 342 - 6 551 2 283 2 446 divisions were also under pressure but managed to increase their

Att Inc 7 362 7 156 5 598 19 503 28 005 market share and improved on the results of the previous year.

TotCompIncLoss 7 362 7 156 6 841 19 503 31 397 Property Companies: Properties performed better compared

Hline Erngs-CO 7 408 6 850 7 255 16 021 26 676 with the previous year, mainly due to lower interest rates and

Fixed Ass 389 915 385 773 383 570 376 161 312 717

ROU Ass 6 234 - - - - effective cost management.

Inv & Loans 454 374 416 561 488 051 399 492 226 298 Insuranceandfinance:Insuranceandfinancealsoshowedbetter

Intangible Ass 3 408 2 207 2 187 850 952 results than the previous year and managed to grow in turnover

Def Tax Asset 12 206 11 212 9 894 5 437 5 639 and profitability. This was due to concerted claims and cancella-

LT Receivables 10 757 12 009 14 512 - - tion management, as well as focusing on investment income to

Tot Curr Ass 1 133 079 897 124 835 144 869 419 1 071 471 increase investment margins.

Ord SH Int 167 559 167 052 166 044 165 345 155 462 Dividends:

LT Liab 144 906 142 471 152 430 159 973 130 592

Tot Curr Liab 1 697 508 1 415 363 1 414 884 1 326 041 1 331 023 Final dividend of 12 cents per share (NAD 6,4 million) was

approvedbytheboardon14July2020inrespectoftheyearended

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 14.03 13.64 10.47 36.49 52.40 31 March 2020. The dividend will be declared out of retained

HEPS-C (ZARc) 14.12 13.06 13.57 29.98 49.90 earnings. The dividend has not been provided for, and there are

Pct chng p.a. 8.1 - 3.8 - 54.7 - 39.9 - 5.2 no accounting implications for the current financial year.

Tr 5yr av grwth % - 19.1 113.0 138.2 149.2 - Share certificates may not be dematerialised between Monday

DPS (ZARc) 12.00 12.00 12.00 18.00 18.00 17 August and Friday 21 August 2020, both days inclusive.

Pct chng p.a. - - - 33.3 - 20.0 The non-residents’ shareholders tax varies according to applica-

Tr 5yr av grwth % - 2.7 - 2.7 - 22.7 - 16.0 - ble legislation.

NAV PS (ZARc) 313.52 312.56 310.69 309.38 290.89

Price High 180 180 200 220 240 Outlook:

Price Low 160 180 50 200 210 For the first time in recent history, the world economy declined

Price Prd End 160 180 180 200 210 in an unprecedented manner. However, we are starting to see

RATIOS positive signs of a slow recovery, with stock markets being the

Ret on SH Fnd 4.39 4.28 3.37 11.80 18.01 most rapid, but it is doubtful that this will be sustainable. Most

Ret On Tot Ass 6.00 4.65 4.85 9.60 12.18 probably, full recovery will take many years. The Nictus Group

Oper Pft Mgn 3.48 2.63 2.32 3.93 4.20 put various initiatives in place to counter the negative effects of

D:E 0.81 1.01 0.80 0.87 0.85 the current unparalleled economic decline. A lot of hard work

Int Cover 2.47 1.19 0.95 2.33 4.53

Current Ratio 0.67 0.63 0.57 0.66 0.80 has already been done to place the Nictus Group on a path of sus-

Div Cover 1.16 1.07 1.13 1.67 2.77 tainable growth and profitability for the future.

NUMBER OF EMPLOYEES: 444

DIRECTORS: HornTB(ind ne), Tromp N

C(ne), TrompGRdeV(ne), van Staden F R,

Swart G (Chair, ind ne), TrompPJde

W (Group MD), Fourie W O (Group FD)

POSTAL ADDRESS: Private Bag 13231,

Windhoek, Namibia

EMAIL: cfo@nictus.com.na

WEBSITE: www.nictusholdings.com

TELEPHONE: 0026483-331-3000 Scan the QR code to

COMPANY SECRETARY: Veritas Board of visit our website

Executors (Pty) Ltd.

TRANSFER SECRETARY: Veritas Board of Executors (Pty) Ltd.

SPONSOR: Simonis Storm Securities (Pty) Ltd.

AUDITORS: SGA Chartered Accountants and Auditors (Namibia)

37