Page 40 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 40

NSX – OMJ Profile’s Stock Exchange Handbook: 2020 – Issue 4

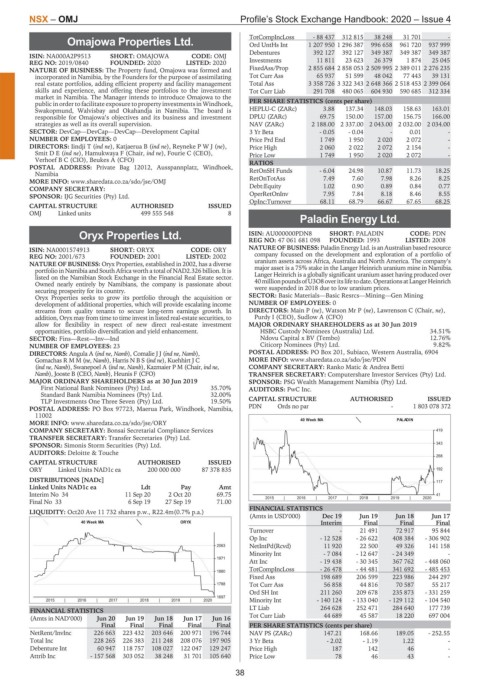

TotCompIncLoss - 88 437 312 815 38 248 31 701 -

Omajowa Properties Ltd. Ord UntHs Int 1 207 950 1 296 387 996 658 961 720 937 999

OMJ Debentures 392 127 392 127 349 387 349 387 349 387

ISIN: NA000A2P9513 SHORT: OMAJOWA CODE: OMJ

REG NO: 2019/0840 FOUNDED: 2020 LISTED: 2020 Investments 11 811 23 623 26 379 1 874 25 045

NATURE OF BUSINESS: The Property fund, Omajowa was formed and FixedAss/Prop 2 855 684 2 858 053 2 509 995 2 389 011 2 276 235

incorporated in Namibia, by the Founders for the purpose of assimilating Tot Curr Ass 65 937 51 599 48 042 77 443 39 131

real estate portfolios, adding efficient property and facility management Total Ass 3 358 726 3 322 343 2 648 366 2 518 453 2 399 064

skills and experience, and offering these portfolios to the investment Tot Curr Liab 291 708 480 065 604 930 590 685 312 334

market in Namibia. The Manager intends to introduce Omajowa to the

public in order to facilitate exposure to property investments in Windhoek, PER SHARE STATISTICS (cents per share)

Swakopmund, Walvisbay and Okahandja in Namibia. The board is HEPLU-C (ZARc) 3.88 137.34 148.03 158.63 163.01

responsible for Omajowa’s objectives and its business and investment DPLU (ZARc) 69.75 150.00 157.00 156.75 166.00

strategies as well as its overall supervision. NAV (ZARc) 2 188.00 2 337.00 2 043.00 2 032.00 2 034.00

SECTOR: DevCap—DevCap—DevCap—Development Capital 3 Yr Beta - 0.05 - 0.04 - 0.01 -

NUMBER OF EMPLOYEES: 0 Price Prd End 1 749 1 950 2 020 2 072 -

DIRECTORS: Iindji T (ind ne), Katjaerua B (ind ne), ReynekePWJ(ne), Price High 2 060 2 022 2 072 2 154 -

SmitDE(ind ne), Hamukwaya F (Chair, ind ne), Fourie C (CEO), Price Low 1 749 1 950 2 020 2 072 -

Verhoef B C (CIO), Beukes A (CFO) RATIOS

POSTAL ADDRESS: Private Bag 12012, Ausspannplatz, Windhoek,

Namibia RetOnSH Funds - 6.04 24.98 10.87 11.73 18.25

MORE INFO: www.sharedata.co.za/sdo/jse/OMJ RetOnTotAss 7.49 7.60 7.98 8.26 8.25

COMPANY SECRETARY: Debt:Equity 1.02 0.90 0.89 0.84 0.77

SPONSOR: IJG Securities (Pty) Ltd. OperRetOnInv 7.95 7.84 8.18 8.46 8.55

OpInc:Turnover 68.11 68.79 66.67 67.65 68.25

CAPITAL STRUCTURE AUTHORISED ISSUED

OMJ Linked units 499 555 548 8

Paladin Energy Ltd.

PDN

Oryx Properties Ltd. ISIN: AU000000PDN8 SHORT: PALADIN CODE: PDN

REG NO: 47 061 681 098 FOUNDED: 1993 LISTED: 2008

ORY

ISIN: NA0001574913 SHORT: ORYX CODE: ORY NATURE OF BUSINESS: Paladin Energy Ltd. is an Australian based resource

REG NO: 2001/673 FOUNDED: 2001 LISTED: 2002 company focussed on the development and exploration of a portfolio of

NATURE OF BUSINESS: Oryx Properties, established in 2002, has a diverse uranium assets across Africa, Australia and North America. The company’s

portfolio in Namibia and South Africa worth a total of NAD2.326 billion. It is major asset is a 75% stake in the Langer Heinrich uranium mine in Namibia.

Langer Heinrich is a globally significant uranium asset having produced over

listed on the Namibian Stock Exchange in the Financial Real Estate sector.

Owned nearly entirely by Namibians, the company is passionate about 40millionpoundsofU3O8overitslifetodate.OperationsatLangerHeinrich

securing prosperity for its country. were suspended in 2018 due to low uranium prices.

Oryx Properties seeks to grow its portfolio through the acquisition or SECTOR: Basic Materials—Basic Resrcs—Mining—Gen Mining

development of additional properties, which will provide escalating income NUMBER OF EMPLOYEES: 0

streams from quality tenants to secure long-term earnings growth. In DIRECTORS: Main P (ne), Watson Mr P (ne), Lawrenson C (Chair, ne),

addition, Oryx may from time to time invest in listed real-estate securities, to Purdy I (CEO), Sudlow A (CFO)

allow for flexibility in respect of new direct real-estate investment MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

opportunities, portfolio diversification and yield enhancement. HSBC Custody Nominees (Australia) Ltd. 34.51%

SECTOR: Fins—Rest—Inv—Ind Ndovu Capital x BV (Tembo) 12.76%

NUMBER OF EMPLOYEES: 23 Citicorp Nominees (Pty) Ltd. 9.82%

DIRECTORS: Angula A (ind ne, Namb), ComalieJJ(ind ne, Namb), POSTAL ADDRESS: PO Box 201, Subiaco, Western Australia, 6904

GomachasRMM(ne, Namb), Harris N B S (ind ne), Kuehhirt J C MORE INFO: www.sharedata.co.za/sdo/jse/PDN

(ind ne, Namb), Swanepoel A (ind ne, Namb), Kazmaier P M (Chair, ind ne, COMPANY SECRETARY: Ranko Matic & Andrea Betti

Namb), Jooste B (CEO, Namb), Heunis F (CFO) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 SPONSOR: PSG Wealth Management Namibia (Pty) Ltd.

First National Bank Nominees (Pty) Ltd. 35.70% AUDITORS: PwC Inc.

Standard Bank Namibia Nominees (Pty) Ltd. 32.00%

TLP Investments One Three Seven (Pty) Ltd. 19.50% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 97723, Maerua Park, Windhoek, Namibia, PDN Ords no par - 1 803 078 372

11002

40 Week MA PALADIN

MORE INFO: www.sharedata.co.za/sdo/jse/ORY

COMPANY SECRETARY: Bonsai Secretarial Compliance Services 419

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

SPONSOR: Simonis Storm Securities (Pty) Ltd. 343

AUDITORS: Deloitte & Touche

268

CAPITAL STRUCTURE AUTHORISED ISSUED

ORY Linked Units NAD1c ea 200 000 000 87 378 835 192

DISTRIBUTIONS [NADc] 117

Linked Units NAD1c ea Ldt Pay Amt

Interim No 34 11 Sep 20 2 Oct 20 69.75 41

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Final No 33 6 Sep 19 27 Sep 19 71.00

FINANCIAL STATISTICS

LIQUIDITY: Oct20 Ave 11 732 shares p.w., R22.4m(0.7% p.a.)

(Amts in USD’000) Dec 19 Jun 19 Jun 18 Jun 17

40 Week MA ORYX Interim Final Final Final

Turnover - 21 491 72 917 95 844

Op Inc - 12 528 - 26 622 408 384 - 306 902

2063 NetIntPd(Rcvd) 11 920 22 500 49 326 141 158

Minority Int - 7 084 - 12 647 - 24 349 -

1971

Att Inc - 19 438 - 30 345 367 762 - 448 060

TotCompIncLoss - 26 478 - 44 481 341 692 - 485 453

1880

Fixed Ass 198 689 206 599 223 986 244 297

1788 Tot Curr Ass 56 858 44 816 70 587 55 217

Ord SH Int 211 260 209 678 235 873 - 331 259

1697

2015 | 2016 | 2017 | 2018 | 2019 | 2020 Minority Int - 140 124 - 133 040 - 129 112 - 104 540

FINANCIAL STATISTICS LT Liab 264 628 252 471 284 640 177 739

(Amts in NAD’000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16 Tot Curr Liab 44 689 45 587 18 220 697 004

Final Final Final Final Final PER SHARE STATISTICS (cents per share)

NetRent/InvInc 226 663 223 432 203 646 200 971 196 744 NAV PS (ZARc) 147.21 168.66 189.05 - 252.55

Total Inc 228 265 226 383 211 248 208 076 197 905 3 Yr Beta - 2.02 - 1.19 1.22 -

Debenture Int 60 947 118 757 108 027 122 047 129 247 Price High 187 142 46 -

Attrib Inc - 157 568 303 052 38 248 31 701 105 640 Price Low 78 46 43 -

38